Employment growth has varied significantly over time across Colorado, New Mexico and Wyoming and also has varied significantly within each state. In particular, metropolitan areas have performed quite differently from non-metropolitan areas since the start of the Great Recession. Each region’s industry mix is crucial to explaining variations in employment growth. This issue of the Rocky Mountain Economist looks at differences in employment growth between metropolitan and non-metropolitan areas of the Rocky Mountain States and examines the industries that have contributed to their performance.

Employment Growth since the Great Recession

Since the start of the Great Recession in December 2007, economic conditions across the United States have differed significantly. In particular, employment in the United States was 4.9 percent higher in November 2016 than December 2007, while employment was up 21.7 percent in North Dakota and down 5.1 percent in Wyoming over the same period. Conditions also varied widely over that period in the other two Rocky Mountain States with employment up 11.5 percent in Colorado and down 2.7 percent in New Mexico.

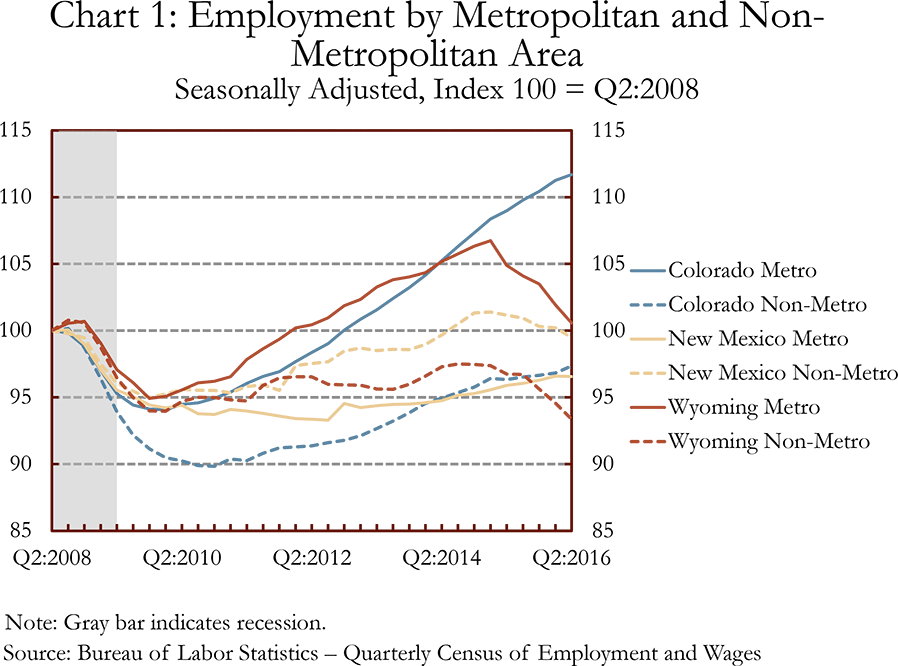

Focusing on changes in state-level employment masks some of the variation within each state. In particular, metropolitan and non-metropolitan areas have experienced significantly different changes in employment from the second quarter of 2008 to the second quarter of 2016 (Chart 1).i Among the Rocky Mountain States, the biggest difference has been in Colorado where employment was up 11.7 percent in metropolitan areas and down 2.7 percent in non-metropolitan areas.ii Similarly, metropolitan areas grew faster than non-metropolitan areas in Wyoming during this period. In contrast, non-metropolitan areas performed better than metropolitan areas in New Mexico, although employment remains below mid-2008 levels in both geographies.

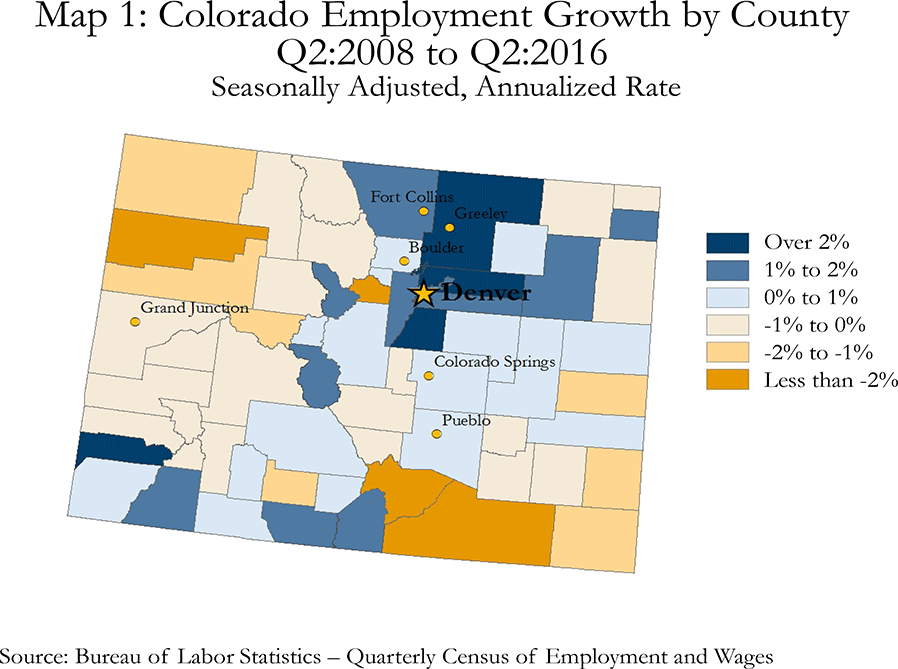

In Colorado, employment levels troughed in the first quarter of 2010 in metropolitan areas, while job losses continued in non-metropolitan areas through the fourth quarter of 2010. Since then, employment has been expanding in both areas, albeit at a faster pace in metropolitan areas. The fastest-growing metropolitan area in Colorado between the second quarters of 2008 and 2016 was Greeley, followed by Fort Collins and Denver. In general, the Front Range and mountain areas of Colorado tended to experience faster growth in employment than other parts of the state since mid-2008 (Map 1). Across Colorado’s metropolitan areas, gains in employment have been particularly strong in healthcare, leisure and hospitality and professional and business services. Each of these industries also makes up more than 10 percent of the Colorado workforce, making strength in these areas a driver of overall growth. Construction employment has also been important to metropolitan area growth, increasing more than 45 percent since early 2010 after declining sharply during the recent recession. In Greeley, employment gains were broad based across industries, but the energy sector and its impact on related industries such as transportation, manufacturing, professional and business services and construction were significant drivers of growth during the recovery. More recently, however, the energy sector has struggled since a sharp drop in oil prices in mid-2014, and employment in that sector has fallen sharply in Greeley and across Colorado.

Manufacturing and wholesale trade have helped spur growth in Colorado’s non-metropolitan areas, with employment in these sectors growing faster in non-metropolitan areas than metropolitan areas. However, these sectors are relatively small, representing a combined 6.5 percent of the non-metropolitan workforce. Employment also has increased in both professional and business services and health care in Colorado’s non-metropolitan areas, but at a slower pace than in metropolitan areas. In addition, the professional and business services industry represents about 9 percent of the workforce in non-metropolitan areas versus a much larger 17 percent in metropolitan areas. In contrast to Colorado’s metropolitan areas, employment declined in the leisure and hospitality and the construction sectors between the second quarters of 2008 and 2016. These two sectors have expanded in Colorado’s non-metropolitan areas since late 2010, but have not recovered all the jobs lost during the recession.

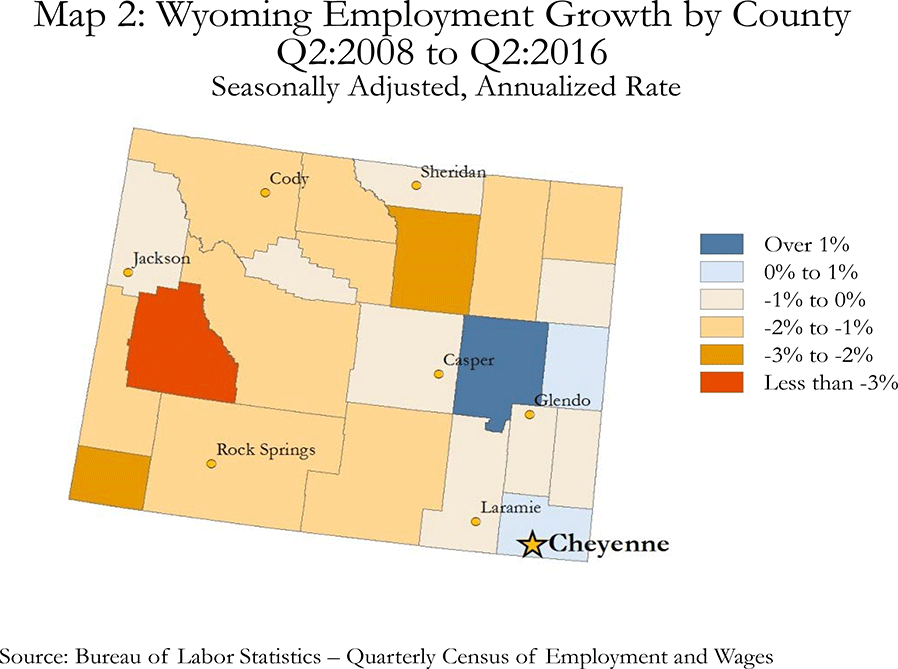

Similar to Colorado, employment growth was stronger in Wyoming’s metropolitan areas than the state’s non-metropolitan areas between mid-2008 and mid-2016. After falling during the Great Recession, employment in Wyoming started to increase by early 2010 in both metropolitan and non-metropolitan areas. However, as the energy sector weakened, employment in recent years has declined. Over the entire period from mid-2008 through mid-2016, employment increased 0.6 percent in Wyoming’s metropolitan areas and declined 6.6 percent in the non-metropolitan areas. Other than in southeast Wyoming, employment levels in most counties in mid-2016 generally were below mid-2008 levels (Map 2).

Both Cheyenne and Casper experienced strong growth in employment in the years following the recent recession. Between the fourth quarter of 2009, which was the trough for Wyoming’s metropolitan employment during the recession, and the first quarter of 2015, employment increased 9.7 percent in metropolitan areas, led by strong gains in the energy, transportation and warehousing and leisure and hospitality sectors. Since the first quarter of 2015, however, economic performance has differed significantly in Cheyenne and Casper. Employment levels have declined moderately in Cheyenne, but remain 3.7 percent above their levels in mid-2008. However, employment has declined more than 10 percent in Casper since early 2015, and employment levels are now almost 3 percent below mid-2008 levels. The divergence in performance between Casper and Cheyenne has been driven primarily by differences in industry composition and industry performance. Casper is much more reliant on the energy sector and related industries, and these industries have struggled in recent years. In contrast, Cheyenne has benefited in recent years from having a smaller share of its workforce tied to the energy sector, and having a larger share of employment in the retail trade and government sectors, which have grown since early 2015. In addition, Cheyenne has benefited from strong gains in recent years in the retail trade and professional and business services sectors.

Employment has struggled to recover from the Great Recession in Wyoming’s non-metropolitan areas, as the energy sector has weighed heavily on growth. Energy employment has dropped more than 36 percent since mid-2008, and its share of non-metropolitan employment has fallen from about 12 percent in 2008 to 8 percent in 2016. The construction sector has been particularly weak in Wyoming’s non-metropolitan areas. Despite slight gains since early 2010, construction employment remains almost 30 percent below mid-2008 levels. On the positive side, several industries have performed well since early 2010, including strong gains in employment in manufacturing, professional and business services and leisure and hospitality. Gains in the leisure and hospitality sector have been particularly important as the industry makes up almost 14 percent of jobs in Wyoming’s non-metropolitan areas.

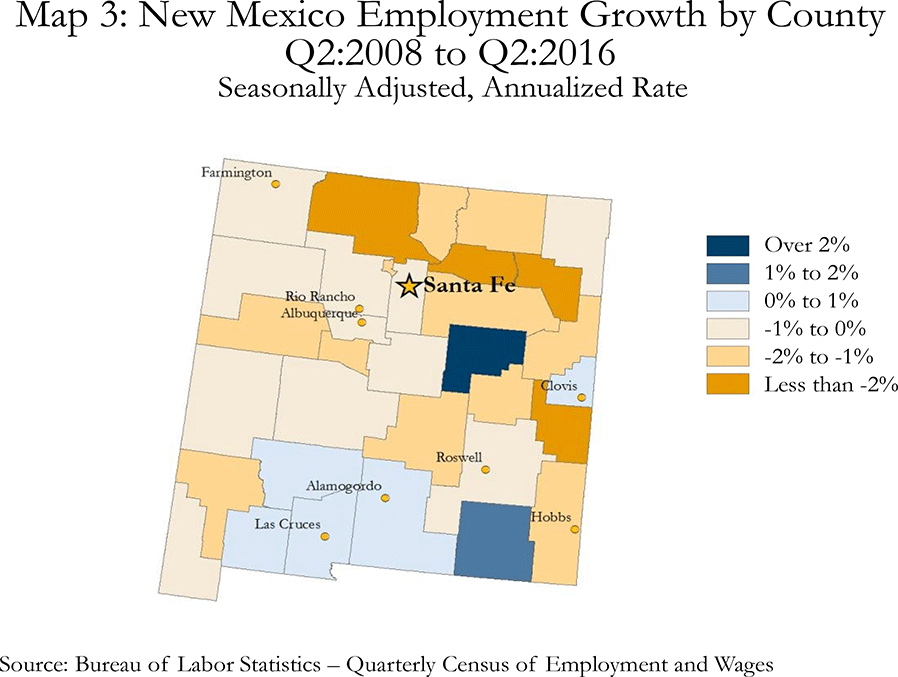

New Mexico differs from Colorado and Wyoming in that employment growth in its non-metropolitan counties has outpaced metropolitan counties over the last eight years. However, the economy has been fairly weak in both areas, with employment levels down 0.5 percent in non-metropolitan areas and 3.4 percent in metropolitan areas between the second quarters of 2008 and 2016 (Map 3). New Mexico’s non-metropolitan counties have fared better than the metropolitan counties in part because the downturn they experienced in construction and manufacturing was not as large. In addition, non-metropolitan areas saw an increase in jobs in professional and business services, transportation and warehousing and energy even as metropolitan areas experienced large declines. The leisure and hospitality sector in New Mexico has made strong contributions to employment growth in both non-metropolitan and metropolitan areas.

The economy in New Mexico’s metropolitan areas has been particularly weak since mid-2008, and employment did not reach trough levels until the third quarter of 2012. Contributing to the weakness have been large job losses in construction, manufacturing, and professional and business services. Other sectors with employment levels that remain below mid-2008 levels include energy, wholesale trade, retail trade, transportation, information, financial activities and government. The key bright spots for New Mexico’s metropolitan areas have been healthcare and leisure and hospitality. Employment conditions have improved significantly since the third quarter of 2012, and employment since then is up 3.5 percent. Among metropolitan areas in New Mexico, Las Cruces is a notable outlier in that employment growth there has outpaced growth in New Mexico’s non-metropolitan counties, and also was above its mid-2008 employment level. The biggest industry contributing to growth in Las Cruces was healthcare and social assistance, which also has the largest share of total employment.

Historical Employment Growth

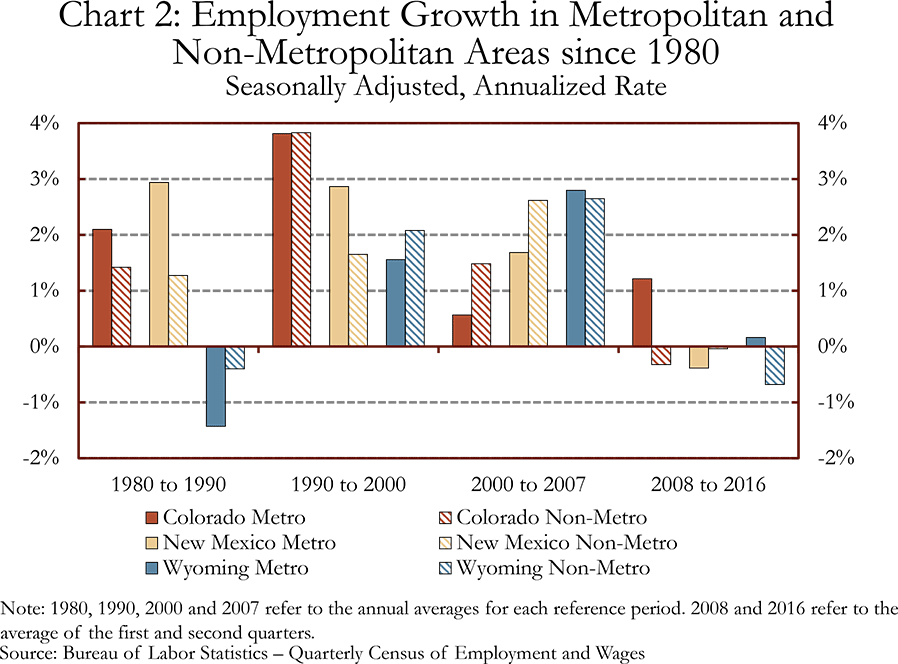

Employment trends in metropolitan and non-metropolitan areas have varied since 1980, with metropolitan growth exceeding non-metropolitan growth about half of the time (Chart 2). For example, employment in Colorado’s metropolitan areas has expanded faster than in non-metropolitan areas from 1980 to 1990 and 2008 to 2016. From 1990 to 2000, both geographies experienced similar, robust growth in employment. However, the opposite was true between 2000 and 2007 due, in part, to the effects felt after the “tech bubble” burst, which had a larger impact in the metropolitan areas. In particular, Colorado’s metropolitan areas experienced large declines in information sector employment, which consists of companies related to internet and software development, as well as the loss of jobs in manufacturing. These sectors continued to expand in non-metropolitan areas between 2000 and 2007; employment also increased significantly in the construction, professional and business services and local government sectors.

Similar to Colorado, employment growth in New Mexico’s metropolitan areas outpaced growth in non-metropolitan areas from 1980 to 1990 and from 1990 to 2000. However, employment gains in non-metropolitan areas started to outpace growth in metropolitan areas in 2000. Between 1990 and 2000, the metropolitan areas experienced broad-based employment growth across industries, with particularly strong growth in the professional and business services, healthcare and retail sectors. Although these sectors also expanded in the non-metropolitan areas, it was at a slower pace. Additionally, the manufacturing sector declined in the non-metropolitan areas but expanded in the metropolitan areas. Between 2000 and 2007, the professional and business services and healthcare and social assistance sectors were the primary drivers of faster growth in employment in the non-metropolitan areas. In addition, weakness since 2008 in the construction and professional and business services sectors in New Mexico’s metropolitan areas contributed to slower growth in the metropolitan areas.

In Wyoming, non-metropolitan areas outperformed metropolitan areas from 1980 to 2000. Since 2000, however, metropolitan areas have experienced stronger growth in employment. Both geographies in Wyoming lost jobs in the 1980s, primarily because of a sharp downturn in the energy sector. Between 1990 and 2000, although employment expanded in both geographies, the non-metropolitan areas expanded slightly faster due to growth in the construction, leisure and hospitality and professional and business services sectors. For metropolitan areas, growth in these sectors between 1990 and 2000 occurred at a slightly slower pace. Industries that made the largest contributions to growth in metropolitan areas during the early 2000s were state government and healthcare and social assistance, although all sectors expanded with the exception of information and local government. Since 2008, employment growth has slowed sharply in both metropolitan and non-metropolitan areas, but has been particularly weak in non-metropolitan areas due to the energy and construction sectors.

Conclusion

Growth in employment has differed significantly between metropolitan and non-metropolitan areas since the Great Recession. In particular, employment growth has been stronger in metropolitan areas of Colorado and Wyoming since mid-2008, while in New Mexico, non-metropolitan areas have fared better. However, these trends have shifted over time and regional economic growth has been closely tied to industry composition and performance. One example is the close tie between the performance of the energy sector and employment growth in Casper and non-metropolitan areas of New Mexico and Wyoming. Specifically, booms in the energy sector are linked to strong gains in employment and busts are tied to significant job losses in these areas.

Endnotes

-

1

i Metropolitan Statistical Area (MSA) refers to the definition provided by the Office of Management and Budget (OMB), found here: External Linkhttps://www.whitehouse.gov/omb/inforeg_statpolicy. For this article, metropolitan areas include the counties within a metropolitan area as defined by the OMB in July 15, 2015. This list is provided by the Bureau of Economic Analysis here: External Linkhttp://www.bea.gov/regional/docs/msalist.cfm#D.

ii Metropolitan areas within Colorado include Denver, Boulder, Colorado Springs, Fort Collins, Grand Junction, Greeley and Pueblo. Metropolitan areas within New Mexico include Albuquerque, Las Cruces, Farmington and Santa Fe. Metropolitan areas within Wyoming include Cheyenne and Casper.