Labor markets have shown significant signs of fundamental improvement and recovery over the past year. In 2014, U.S. employment levels surpassed pre-recession peaks, unemployment rates fell sharply and labor force participation rates stabilized. The Mountain States have also experienced a recent strengthening in their labor markets. However, despite improvement in many labor market indicators, areas of concern remain. In particular, wage growth has been sluggish throughout the recovery. Furthermore, employment shares have shifted across industries, with lower-paying industries expanding at a slightly faster pace than higher-paying industries. This issue of The Rocky Mountain Economist examines the industry mix before and after the recent recession and wage growth over this period.

Employment and Wages in the United States before and after the Recession

After more than four years of job gains, total employment in the United States surpassed its pre-recession peak in the second quarter of 2014. During the recent recession and recovery, employment growth has varied across industries, leading to a shift in the share of employment by industry. Average wages vary substantially in each of these industries, and although real wage growth has been fairly sluggish in recent years, there has been some variance across industries.[1] Differences in wages and wage growth across industries combined with a shift in employment shares have affected wages since the recession started. Increases in each industry's average wage resulted in higher total average wages. In addition, a rise in the employment shares of industries that pay more on average than the total average wage may have put upward pressure on total average wages in the U.S. economy. By contrast, a rise in the employment shares of industries that pay less than the U.S. average may have dampened wage growth. Analyzing these two sources of wage change—industry composition and wage growth—provides further insight into the forces behind total average wage growth.

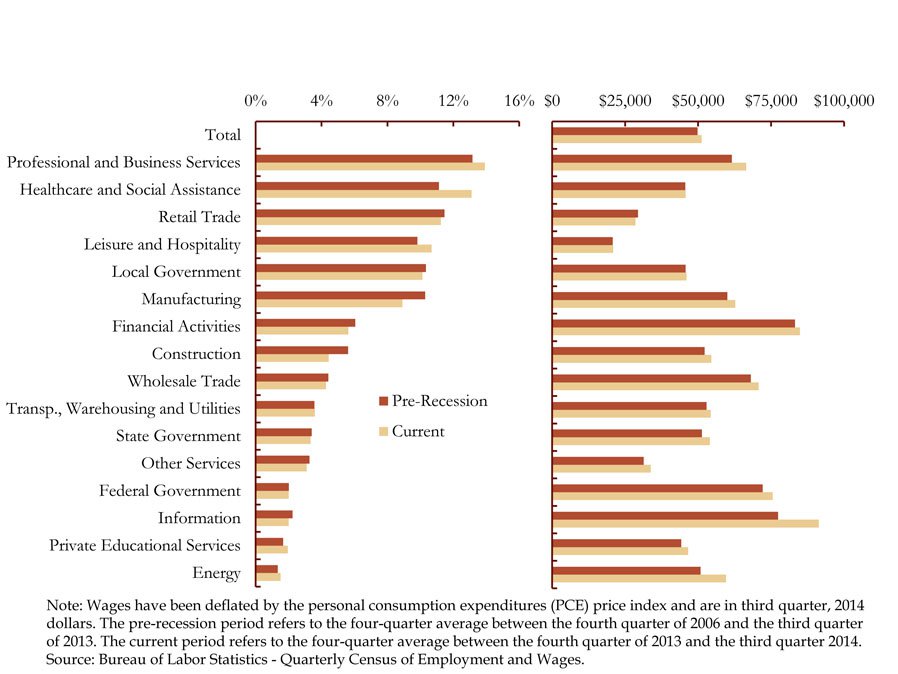

Chart 1 shows the share of total U.S. employment by industry as well as each industry’s average wage. Pre-recession values are shown in the red bar, and the most current data are shown in the yellow bar.[2] Between these two time periods, the average real wage in the United States grew 0.39 percent per year on average to $51,215. Total U.S. employment increased just 0.6 percent over this seven-year period after accounting for both the sharp decline in employment during the recession and the increase in employment over the past five years.

The healthcare industry experienced the fastest increase in employment share over the past seven years, rising from 11.1 percent of total employment before the recession started to more than 13.1 percent today. Real wages remained roughly flat and below the U.S. average in the healthcare sector during this period, with average real wages of $45,749 in the most recent data. Employment shares also increased notably in the private educational services, energy, leisure and hospitality and professional and business services sectors. The energy and private education services sectors are both relatively small sectors of the U.S. economy, and after strong gains in recent years, make up 1.5 percent and 2.0 percent, respectively, of total employment. However, the energy sector did experience one of the sharpest increases in real average wages, rising 1.7 percent on average to $59,554, well above the U.S. average.

The leisure and hospitality sector and the professional and business services sector are large industries in the U.S. economy. After moderate increases in recent years, the leisure and hospitality sector makes up 10.7 percent of total employment and the professional and business services sector makes up 13.9 percent. The leisure and hospitality sector is the lowest-paying sector on average, and experienced minimal wage gains over the past seven years—averaging just 0.1 percent growth per year. In contrast, the average wage of professional and business services jobs at $66,483 is well above the total U.S. average wage, and real wages in this sector increased 1.1 percent per year on average since the recession started.

As some industries saw employment shares increase, others experienced a decline. The construction industry, one of the industries hardest hit during the recent recession, experienced the largest decrease, falling from 5.6 percent to 4.4 percent of total employment. Despite a decline in employment share, construction wages increased slightly over the past seven years and remained above the U.S. average. The manufacturing and finance industries, both with average wages well above the U.S. average, also experienced sizable declines in employment shares.

Over the past seven years, average wages increased in every industry except retail trade, helping to contribute to higher average wages in the United States. The shift in industry composition had a modest effect on wage gains over this period. If employment shares by industry had remained constant, average wage gains would have averaged 0.56 percent per year on average—slightly higher than the actual gains. This indicates that over the past seven years a shift in employment share to lower-paying industries put some downward pressure on overall wage increases.

Chart 1: United States' Employment Shares and Real Wages by Industry

Employment and Wages in the Mountain States

Similar to the United States, labor markets have strengthened in the Mountain States in recent years, but employment growth and wage gains have not been uniform across industries. This section looks at the shift in employment shares across industries and differences in wage gains since the recession started, and examines the effect of shifts in industry composition on overall wage growth in the Mountain States.

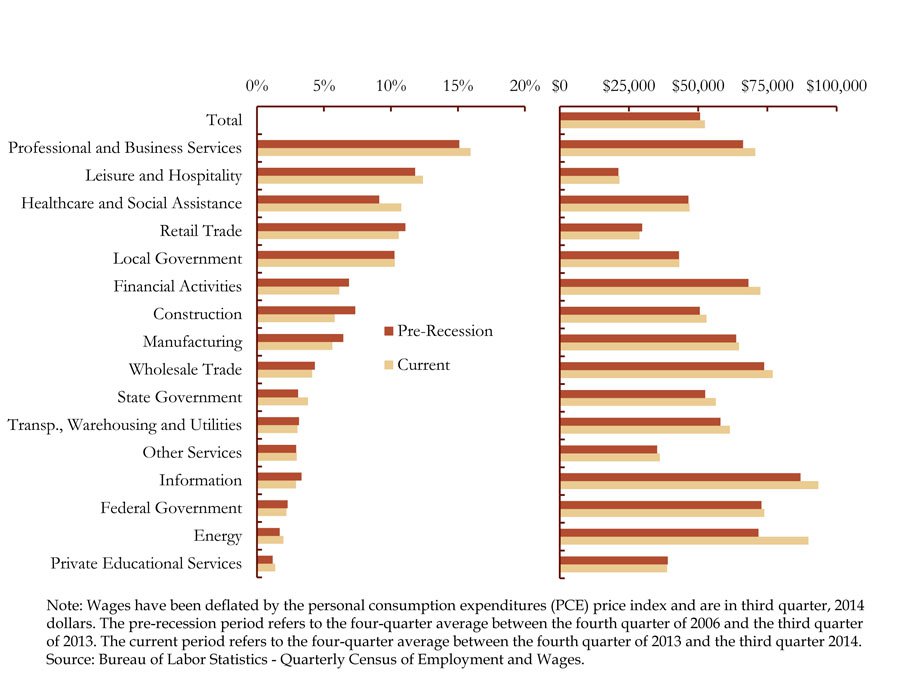

Colorado has experienced a stronger recovery than the U.S. in recent years, leading to a faster pace of employment growth and wage gains. Employment in Colorado has increased 5.1 percent over the past seven years, while wages have risen 0.49 percent per year on average. Many of the sectors that increased their employment share at the national level also rose in Colorado. Employment shares increased notably in the healthcare, private educational services, energy, state government, professional and business services and leisure and hospitality sectors (Chart 2).

Healthcare, professional and business services and leisure and hospitality services are the largest sectors in the Colorado economy. Healthcare’s share of employment increased from 9.1 percent to 10.8 percent over the past seven years, while professional and business services and leisure and hospitality rose 0.8 and 0.7 percentage point, respectively. The healthcare and leisure industries both pay less than the Colorado average wage and experienced modest wage gains in recent years. The professional and business services sector pays well above the Colorado average at $70,656, and saw stronger wage gains over the past seven years—rising 0.9 percent per year on average.

The energy sector remains a relatively small share of employment in Colorado, but the industry experienced strong employment growth and wage gains over the past seven years. Wages in the energy sector grew faster than any other industry in the state, increasing 3.3 percent per year on average, reaching an average wage of $89,869.

Employment shares declined significantly in the construction, manufacturing, information and finance industries. The construction sector witnessed the largest decrease in employment share, falling from 7.3 percent of jobs before the recession started to 5.8 percent in the most recent data. Despite the decline in employment shares over the past seven years, all of these sectors experienced wage gains in recent years and all pay higher wages on average than the Colorado average. In particular, the information sector is the highest-paying industry in Colorado, and the finance sector is the third highest paying industry in the state.

Overall, real wages increased 0.49 percent per year on average over the past seven years in Colorado, and gains would have been slightly higher at 0.58 percent per year if the industry composition had remained the same.

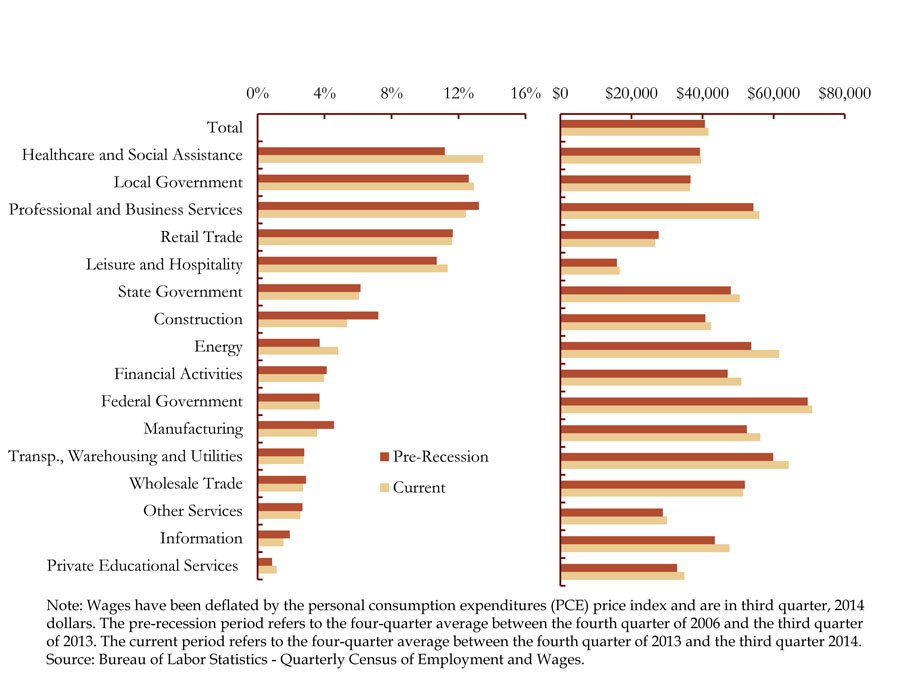

New Mexico has struggled to recover from the recent recession, and in contrast to the United States and the other Mountain States, total employment in New Mexico declined 2.9 percent over the past seven years. Real wages, however, increased by 0.34 percent per year on average to an average wage of $41,681. Over this period, employment shares increased considerably in the private educational services, energy, healthcare and leisure sectors (Chart 3).

Chart 2: Colorado's Employment Shares and Real Wages by Industry

Chart 3: New Mexico's Employment Shares and Real Wages by Industry

Similar to the U.S. share, New Mexico healthcare’s employment share increased from 11.2 percent of employment to 13.4 percent. Wages also increased modestly in the healthcare, leisure and private educational services industries in New Mexico, although these industries continue to pay less than the New Mexico average wage. The energy sector represents a much larger share of employment in New Mexico at 4.8 percent compared to the nation, and is also one of the highest paying sectors in the state with average wages of $61,568. Real wages in the energy sector grew faster than any other industry in the state over the past seven years.

The professional and business services sector was the largest industry in New Mexico prior to the recession, making up 13.2 percent of total employment. However, employment fell 8.6 percent in that industry over the past seven years, reducing its share to 12.4 percent. Employment shares in the construction, manufacturing, information and wholesale trade sectors also fell notably during this period. Average wages in these five industries are all above the New Mexico average, and smaller employment shares in these industries limited wage gains in the state. Real wages grew 0.34 percent per year on average in New Mexico over the past seven years, but there would have been slightly more growth of 0.47 percent per year if the industry composition had remained the same.

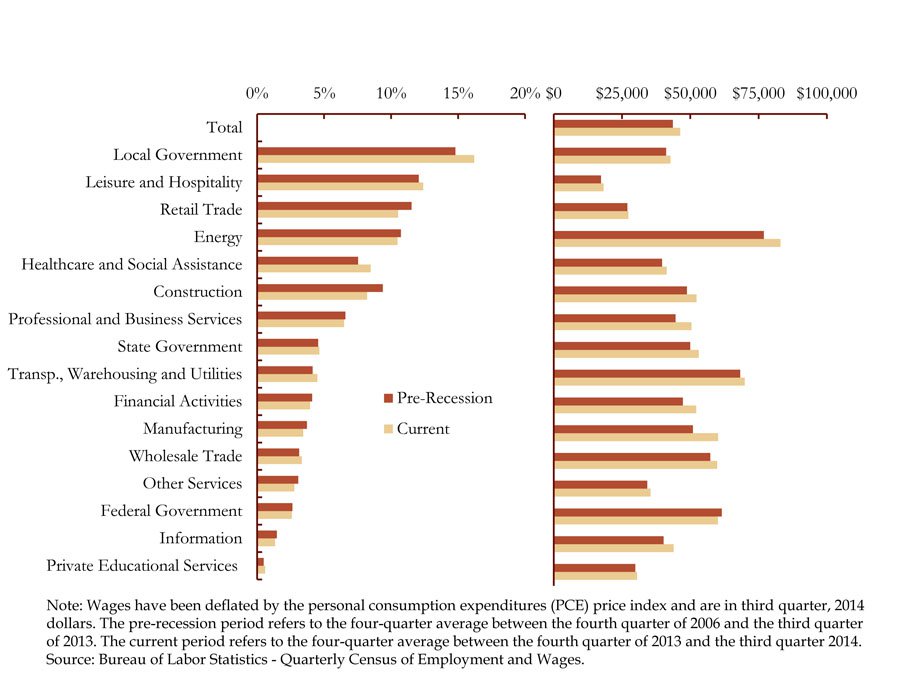

Wyoming experienced the sharpest wage growth compared to the other Mountain States and United States, with wages growing 0.85 percent per year on average to $46,309. Total employment in Wyoming grew 2.9 percent over the period shown.

Wyoming’s largest industries, local government and leisure and hospitality, increased their employment shares over the past seven years, and contributed 16.2 and 12.4 percent, respectively, of total employment in the most recent data (Chart 4). Employment shares also increased significantly in private educational services, healthcare, transportation and wholesale trade. Although local government, leisure, healthcare and private educational services all pay less than the state average, the transportation and wholesale trade sectors pay considerably higher wages.

Chart 4: Wyoming's Employment Shares and Real Wages by Industry

Similar to the United States and the other Mountain States, construction’s share of total employment experienced the biggest decrease, falling from 9.3 percent to 8.2 percent. Employment shares also declined notably in the manufacturing, retail trade, information and finance industries. In Wyoming, the manufacturing, construction and finance industries pay well above the state average, while the retail trade and information sectors pay less than average. Real wages increased in every industry except the federal government sector in Wyoming over the past seven years, contributing to overall real wage growth of 0.85 percent per year on average. Unlike other regions, the change in industry mix did not significantly affect wage growth in Wyoming.

The recent resurgence of energy activity is most evident when looking at the rapid increase of energy production, specifically in crude oil and natural gas. Crude oil production in the last 10 years has experienced rapid growth in the Mountain States and the U.S. From September 2004 to September 2014, U.S. crude oil production grew 69 percent, reaching 273.3 million barrels per month, almost surpassing its February 1986 peak of 276.1 million barrels a month. The Mountain States also experienced rapid growth over the last decade, and, as of September 2014, New Mexico was producing 9.9 million barrels per month and Colorado and Wyoming each were producing more than 6 million barrels per month. Colorado has had the most notable growth in crude oil production, rising 263.6 percent from September 2004 to September 2014.

Conclusion

Uneven job losses and job gains during the recent recession and recovery led to a change in industry composition in the Mountain States and the United States. Despite varying industry compositions across the Mountain States and the nation, a few similar themes stand out. Employment shares increased in the healthcare, leisure and private education services sector in the Mountain States and the United States. In addition, energy’s share of employment increased in the United States, Colorado and New Mexico. Several industries were particularly hard hit during the recent recession, and employment shares declined significantly in the construction, manufacturing, finance and information industries in the nation and in the Mountain States.

Overall, the shift in industry composition led to a slightly higher proportion of jobs in lower-paying industries such as healthcare, leisure and hospitality and private educational services and a slightly lower proportion of jobs in higher-paying industries such as finance, information and manufacturing. The shift in jobs from higher-paying industries to lower-paying industries put some downward pressure on average wages. If industry shares of total employment had remained at pre-recession levels, wage growth over the past seven years would have been slightly higher in the Mountain States and the United States. This has been just one contributing factor to sluggish wage growth in recent years. Weak wage growth across most sectors has also led to slow overall wage growth, and demographic factors may have also played a role.

End notes

[1] All references to wages throughout this article refer to an inflation-adjusted wage, also known as the real wage.

[2] The pre-recession period refers to the four-quarter average between the fourth quarter of 2006 and the third quarter of 2013. The current period refers to the four-quarter average between the fourth quarter of 2013 and the third quarter of 2014.