Lending at agricultural banks appeared to stabilize in the third quarter of 2017, but risks in the sector have remained alongside a persistently weak agricultural economy. After declining in the winter months, the volume of loans used to finance non-real estate farm purchases rebounded in the third quarter to a level similar to a year ago. Despite the rebound in lending activity, however, risk ratings on new farm loans have increased somewhat, interest rates have edged higher and loan-to-deposit ratios—a key measure of bank liquidity—also have increased.

Section A: Third-Quarter Survey of Terms of Bank Lending to Farmers

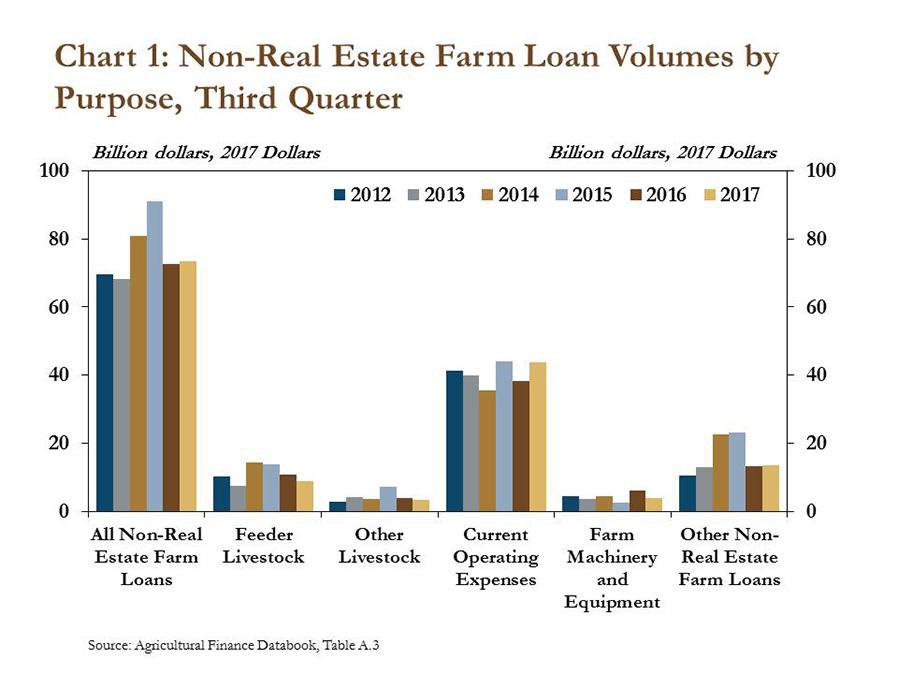

The pace of farm lending at commercial banks in the third quarter largely was unchanged from a year ago. Survey data indicate the volume of non-real estate farm loans originated in the third quarter increased about 2 percent from the previous year (Chart 1). The slight increase followed a similar year-over-year increase in the second quarter after sharp declines in lending activity the previous two quarters.

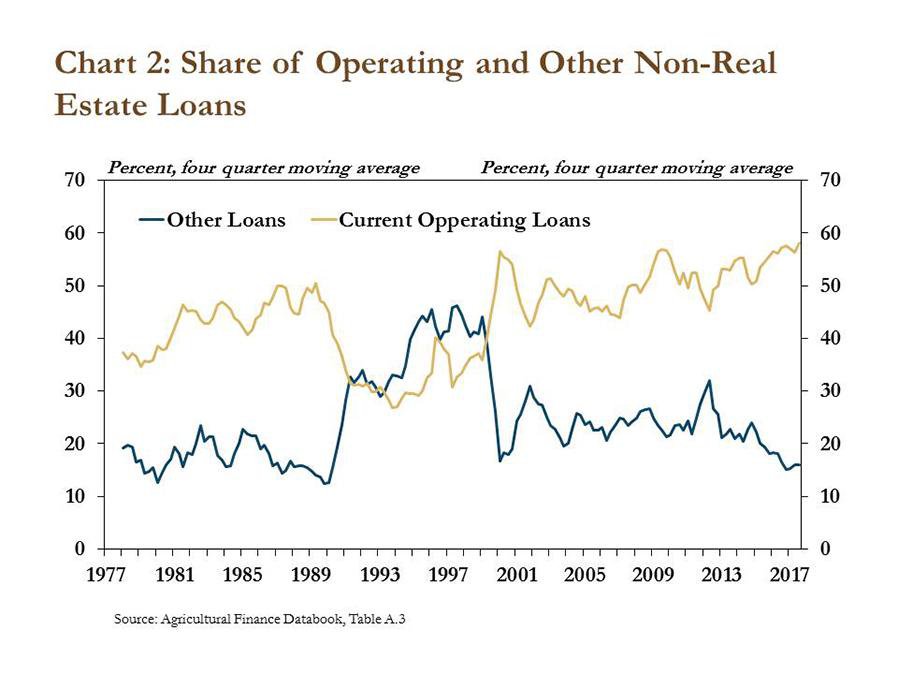

Demand for loans to finance operating expenses was the primary driver of non-real estate farm lending in the third quarter. The volume of loans used to pay for current operating expenses increased 15 percent from the previous year, whereas the volume of loans used to finance livestock and equipment purchases declined. Operating loans have continued to account for a rising share of commercial banks’ farm loan portfolio in recent years. In fact, operating loans have accounted for nearly 60 percent of the total volume of non-real estate farm loans over the past four quarters, the highest in the 40-year survey history (Chart 2). Conversely, the share of other loans has fallen to levels last seen in the early 1990s.

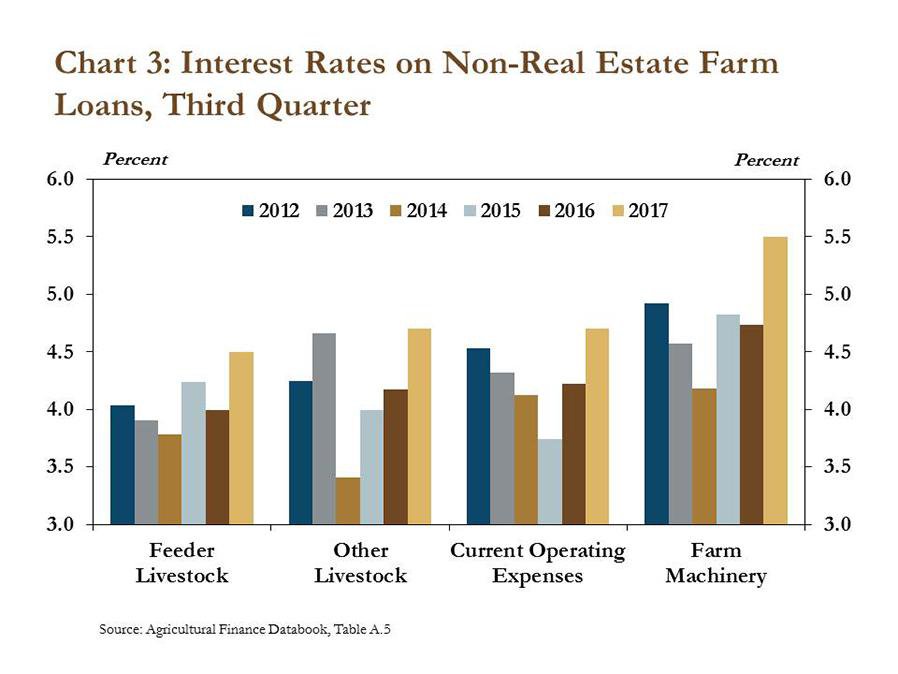

Alongside persistently low profit margins in large segments of the farm economy, bankers have continued to gradually raise interest rates. Interest rates on loans used to finance operating expenses, farm machinery, feeder livestock and other livestock have increased about 50 to 75 basis points from the previous year (Chart 3). Although current rates remain historically low, interest rates on operating loans have increased about a full percentage point since the lows observed in 2015.

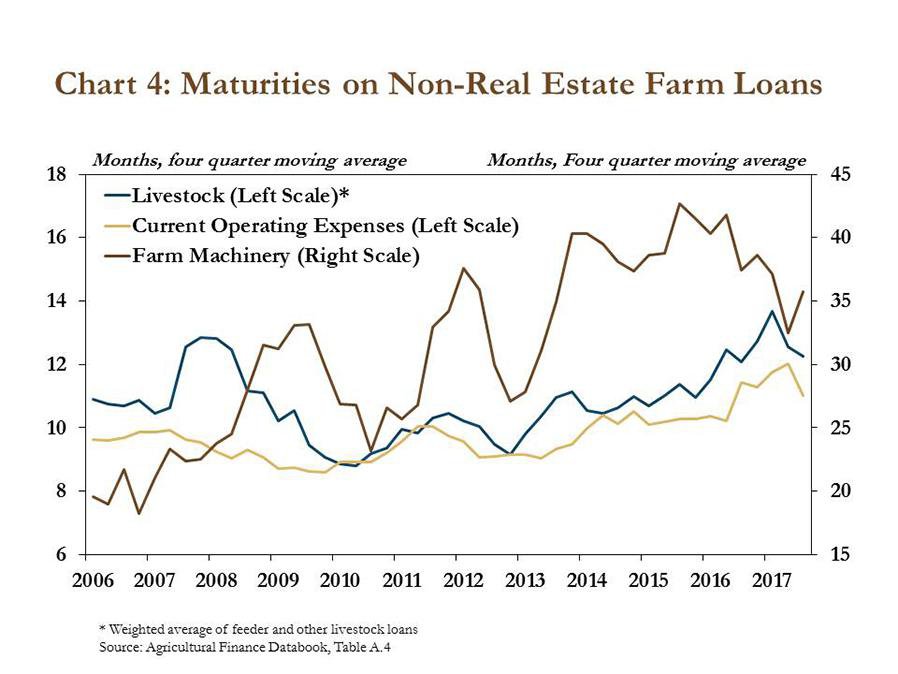

Loan maturities also have remained elevated amid persistently low profit margins in the farm sector. Although the average maturity on loans used for operating expenses over the past four quarters has declined 4 percent from the previous year, the duration has remained one of the highest in survey history at 12 months (Chart 4). Similarly, maturities for livestock and farm machinery loans have declined in recent quarters; despite the decline, maturities were both higher than the previous year and historically high.

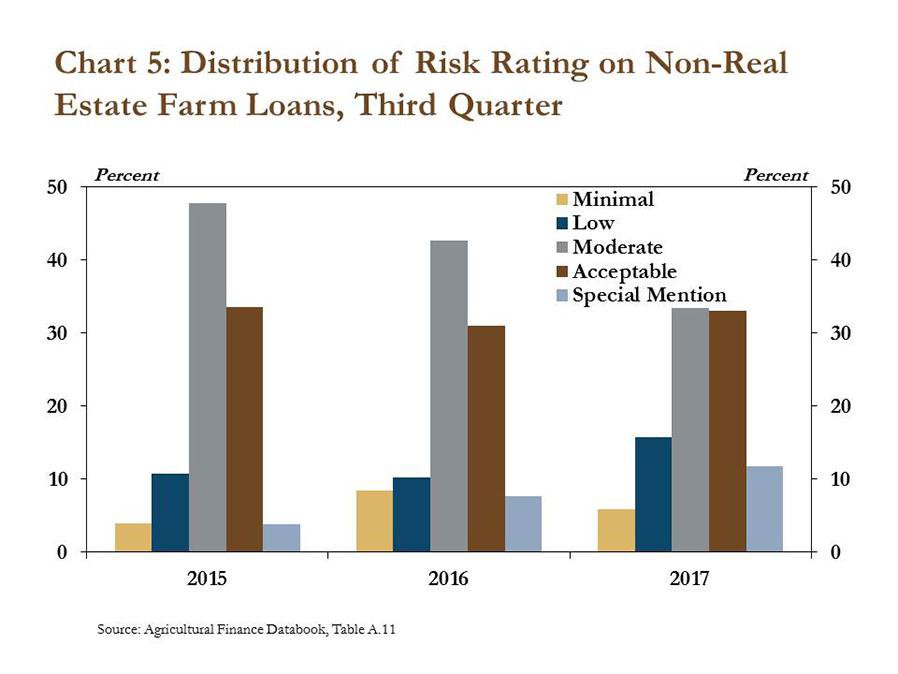

As risk in the farm sector has remained elevated, bankers have raised the risk ratings slightly on new non-real estate farm loans. In the third quarter, the share of non-real estate farm loans classified as special mention increased 4 percent from the previous year and the share of loans classified as minimal risk declined 2 percent (Chart 5). Although the share of loans classified as special mention continued to increase, nearly 90 percent of farm loans still were assigned a rating of “acceptable” or better in the third quarter, suggesting that financial conditions have only deteriorated modestly.

Section B: Second Quarter Call Report Data

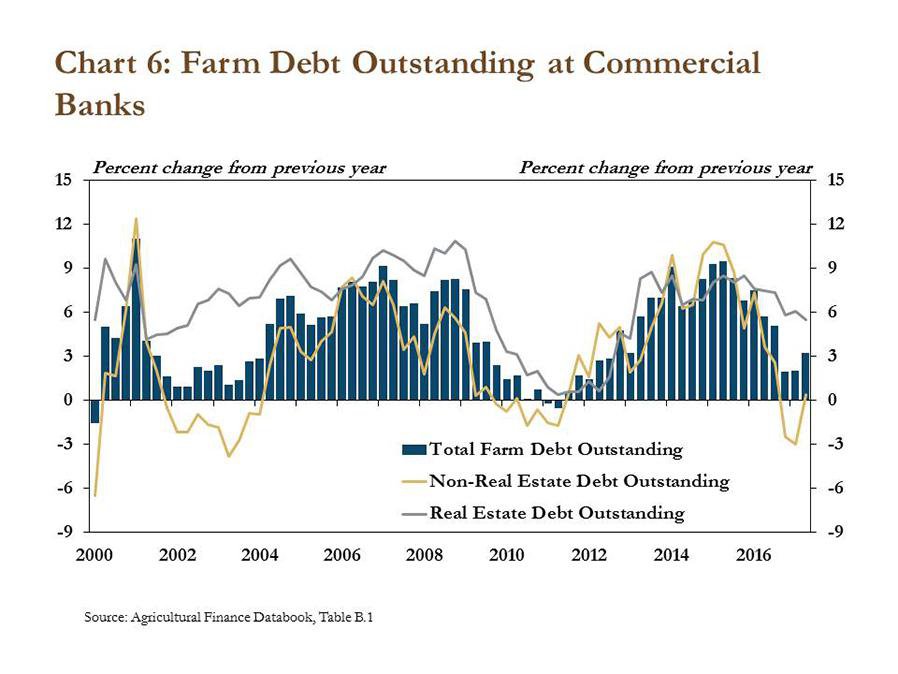

Farm debt outstanding at commercial banks continued to build in the second quarter, but only at a modest pace. Data from commercial bank Call Reports indicate total farm debt outstanding grew slightly more than 3 percent in the second quarter (Chart 6). Although loan growth was slightly higher than the previous two quarters, the increase in farm debt in the second quarter trailed the five-year average of nearly 6 percent. In addition, the increase in both real estate and non-real estate farm debt was slower in the second quarter than in each of the previous four years.

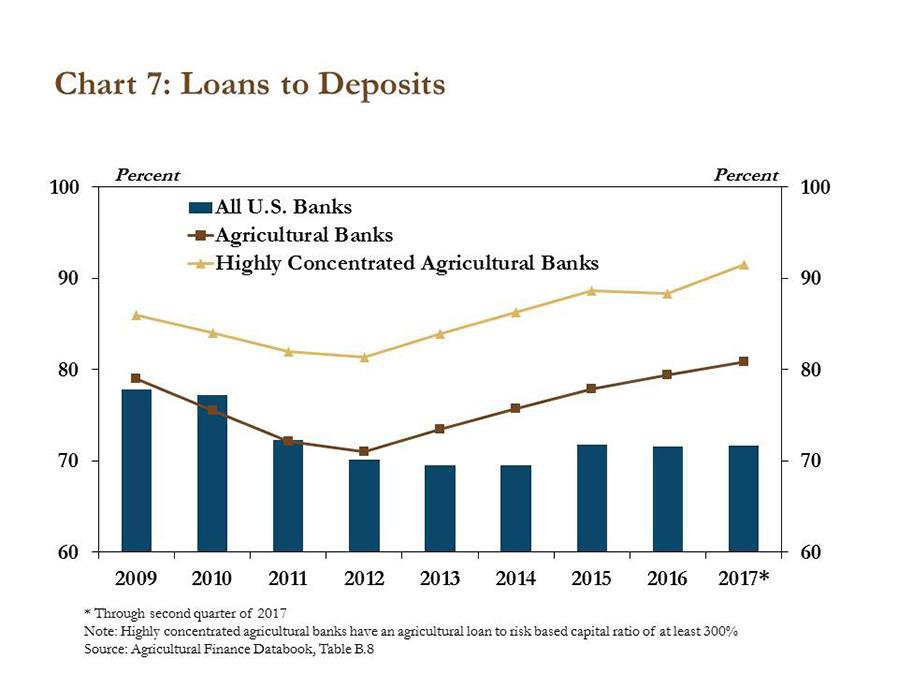

Despite the modest pace of growth in farm debt, liquidity at agricultural banks has continued to decline at a gradual pace. The average loan-to-deposit ratio at agricultural banks has increased from 71 percent in 2012 to 81 percent in 2017 (Chart 7). Loan-to-deposit ratios at highly concentrated agricultural banks (those with a ratio of agricultural loans to risk-based capital of at least 300 percent), have increased to more than 90 percent.

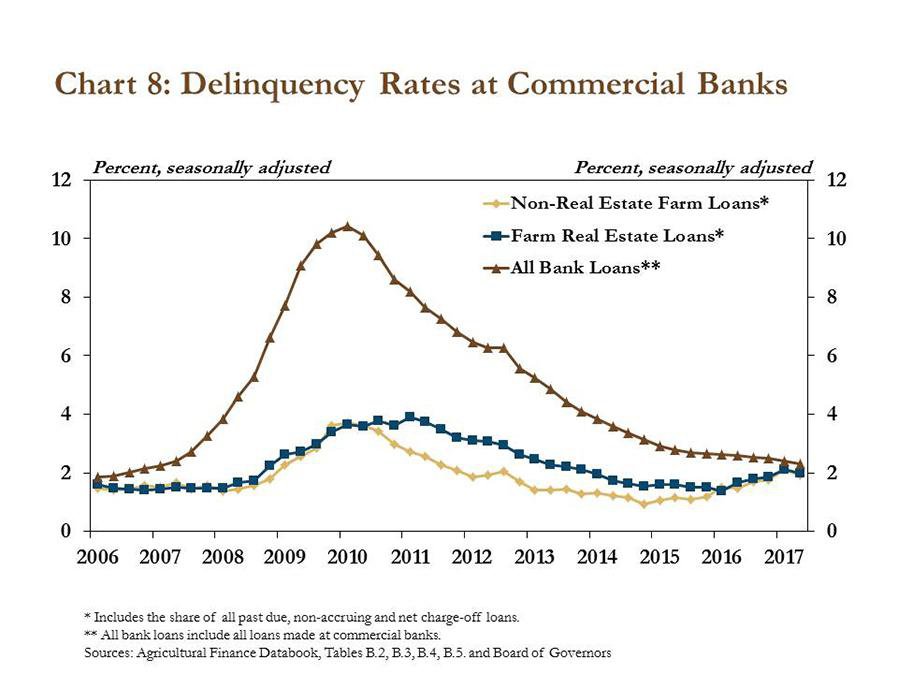

Delinquency rates at commercial banks also were up from a year ago, but down slightly from the first quarter. In the second quarter, delinquency rates for both real estate and non-real estate farm loans hovered near 2 percent, but remained less than those of all other bank loans (Chart 8). Moreover, despite the slight uptick in delinquency rates on farm loans from a year ago, less than 3 percent of agricultural banks had a portfolio with more than 5 percent of loans considered nonperforming.

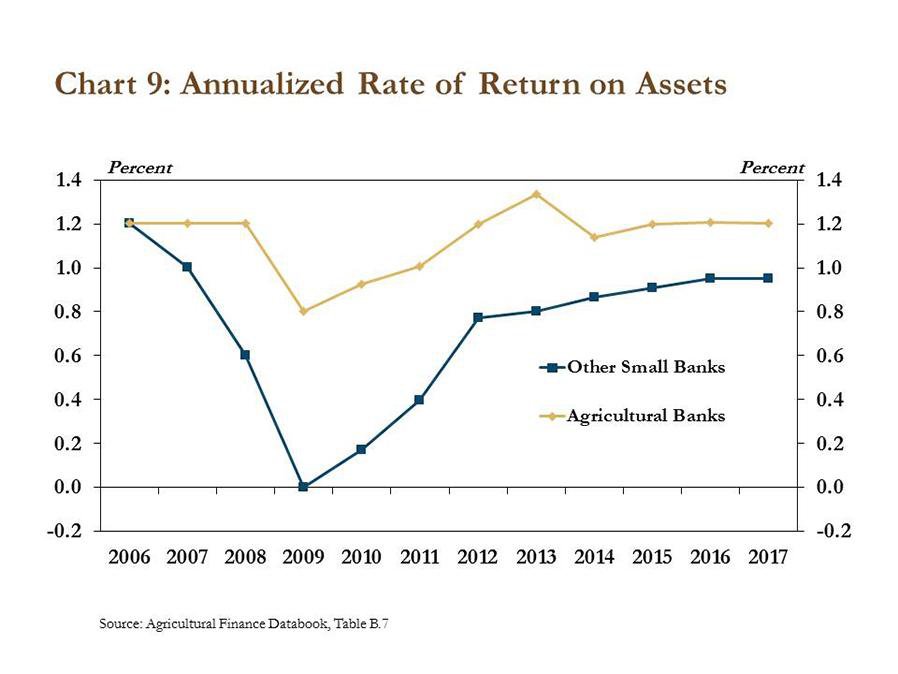

Despite some concerns about liquidity at agricultural banks and the performance of farm loan portfolios, profitability at agricultural banks has remained steady. In the second quarter, the rate of return on assets was unchanged from the previous quarter and slightly above the average of the past five years (Chart 9). Agricultural banks also continued to outperform small nonagricultural banks.

Section C: Second Quarter Regional Agricultural Data

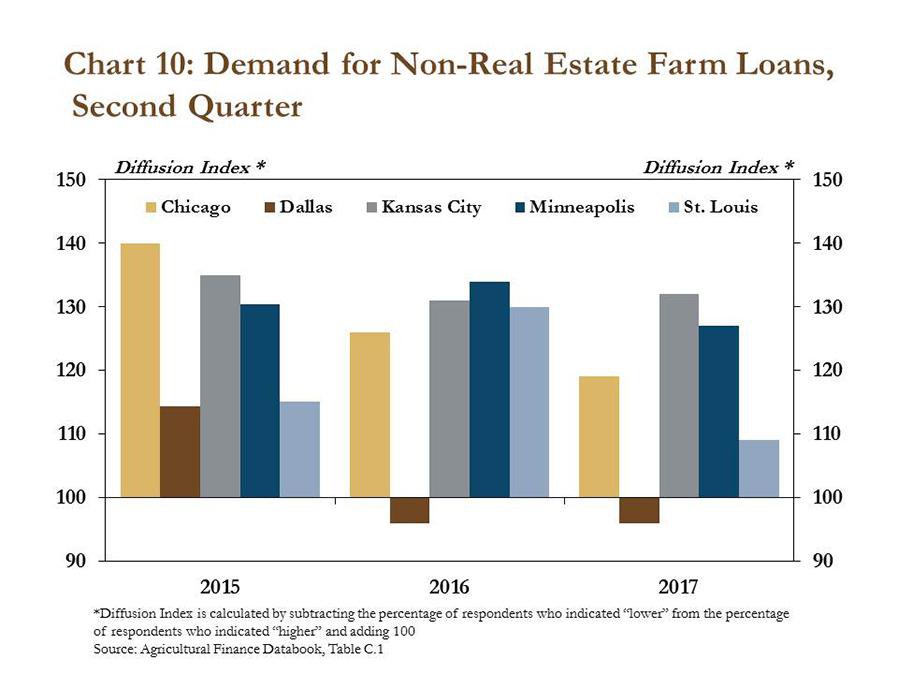

Similar to survey data of commercial banks and Call Report data, recent data collected from regional Federal Reserve surveys of credit conditions also suggested that increases in demand for agricultural loans have continued to soften. In the Chicago, Minneapolis and St. Louis Districts, demand for non-real estate farm loans increased, but at a slower pace than the previous year (Chart 10). Demand for financing in the Kansas City District held steady and demand continued to decline in the Dallas District.

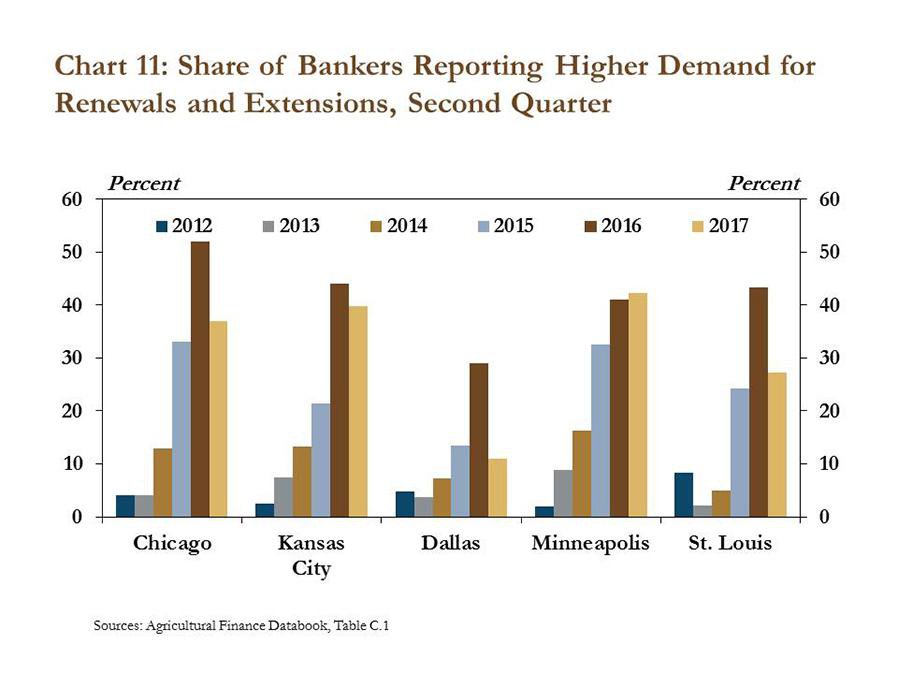

In addition, the pace of increased demand for loan renewals and extensions has steadied somewhat over the past several quarters. For instance, the share of bankers reporting increased demand for renewals and extensions declined in the second quarter in most Districts with a significant agricultural concentration (Chart 11). Only the Minneapolis District reported a very minor increase.

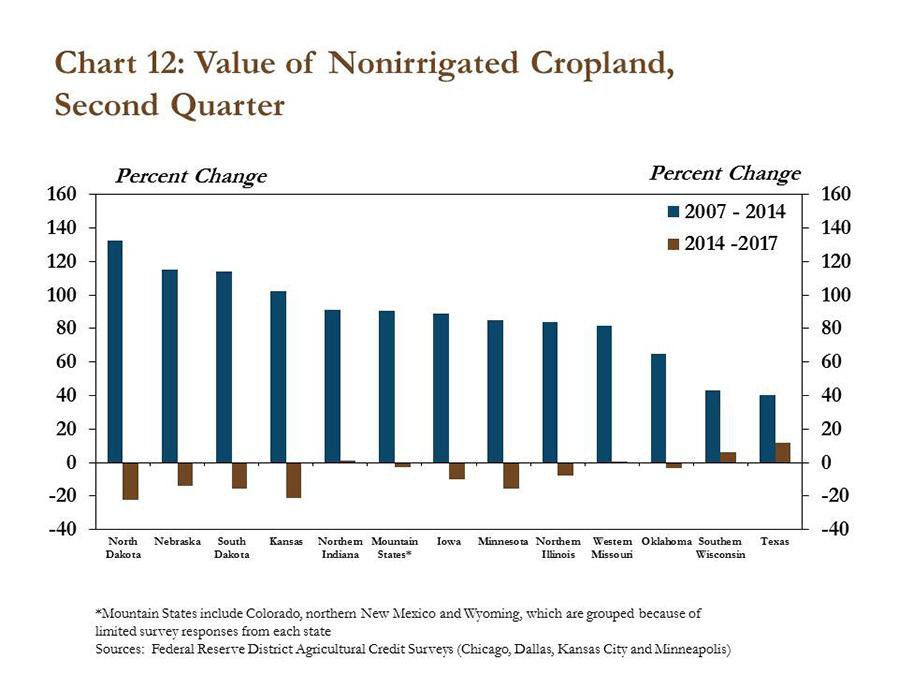

As farm debt has continued to increase, albeit at a more modest pace, the value of farmland has remained a crucial component to farm-sector balance sheets and financial stress. Although farmland values have continued to moderate in most areas, values have stabilized in some states, and generally have remained strong overall. In Iowa, southern Wisconsin and Texas, the value of farmland increased slightly from the previous year. Farmland values in other parts of the Corn Belt, such as Illinois, Indiana and Missouri, continued to decline modestly, but remained well above values of a decade ago (Chart 12).

Conclusion

After dipping three quarters ago, farm lending activity picked up in the third quarter to a level similar to a year ago. The recent stabilization in lending activity may suggest that borrowers and lenders have made some adjustments alongside reduced profit margins and spending that have persisted for several years. Although farm lending appeared to stabilize in the third quarter, liquidity remains a concern for some borrowers and also for some lenders. Some borrowers may find it increasingly difficult to obtain credit amid low profits. Meanwhile, rising loan-to-deposit ratios at many agricultural banks also may induce more caution in the months ahead.