Growth in farm lending activity slowed in the third quarter of 2019. Following nine consecutive quarters of year-over-year growth and a particularly notable increase a year ago, the volume of total non-real estate farm debt declined nearer to the historical third-quarter average. The primary contributor to the slowdown from sharp increases a year ago was a decline in the average size of farm operating loans.

Section A – Third Quarter National Farm Loan Data

Demand for farm loans remained strong, but slowed in the third quarter, according to the National Survey of Terms of Lending to Farmers. A significant increase in the volume of non-real estate loans in the third quarter of 2018 was offset by a decline of similar magnitude in the third quarter of 2019. However, on a rolling four-quarter basis, non-real estate lending only was about 2 percent lower than a year ago (Chart 1). Furthermore, the average volume of non-real estate loans over the past four quarters remained nearly 10 percent above the recent historical average.

A decrease in the volume of farm operating loans drove the slowdown in non-real estate lending relative to a year ago. Following sharp increases in 2018, loans used to finance current operating expenses declined in the third quarter, returning to the prior 20-year average (Chart 2). Feeder livestock and farm machinery loans also were lower and made up the remaining share of the decline in non-real estate lending, while loans for other livestock increased.

A decline in average loan size contributed to the drop in operating loan volumes. The average size of operating loans continued to follow a long-term trend of increases, but the pace of increase slowed (Chart 3). Similar to total non-real estate debt, the average size of operating loans declined from a year ago, offsetting a large increase in the third quarter of 2018. On a rolling four-quarter basis, the size of operating loans remained well above the trend level of growth. Also contributing to a decrease in loan volume, the number of operating loans declined in the third quarter and kept pace with the long-term trend.

Interest rates on new non-real estate farm loans increased modestly. The average rate charged on all loan categories except feeder livestock rose slightly in the third quarter (Chart 4). The increase was largest for operating loans, which rose about 60 basis points from a year ago. Despite steady increases in recent years, interest rates on farm loans have remained well below historical averages.

Section B – Second Quarter Call Report Data

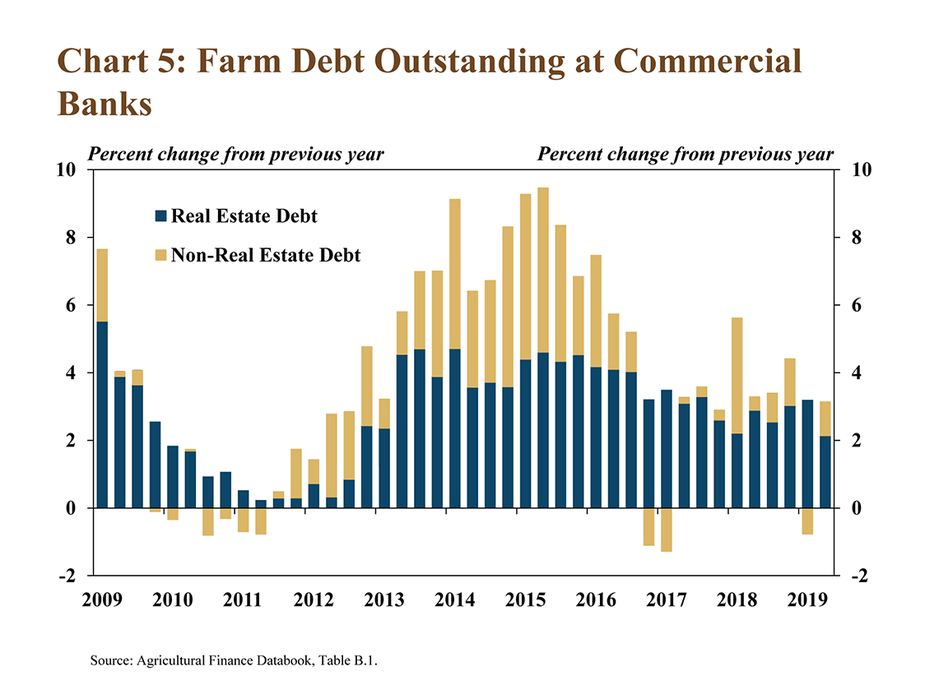

According to Call Report data, total farm debt outstanding at commercial banks continued to increase at a modest pace in the second quarter. Total farm debt increased 3 percent, as levels of real estate and non-real estate debt rose (Chart 5). The overall pace of growth was slightly higher than in the first quarter but similar to second-quarter growth in 2017 and 2018. Since 2016, loans for farm real estate have been the primary contributor of growth in farm debt. Continuing that trend, farm real estate debt accounted for a majority of the growth in total farm debt at commercial banks in the second quarter.

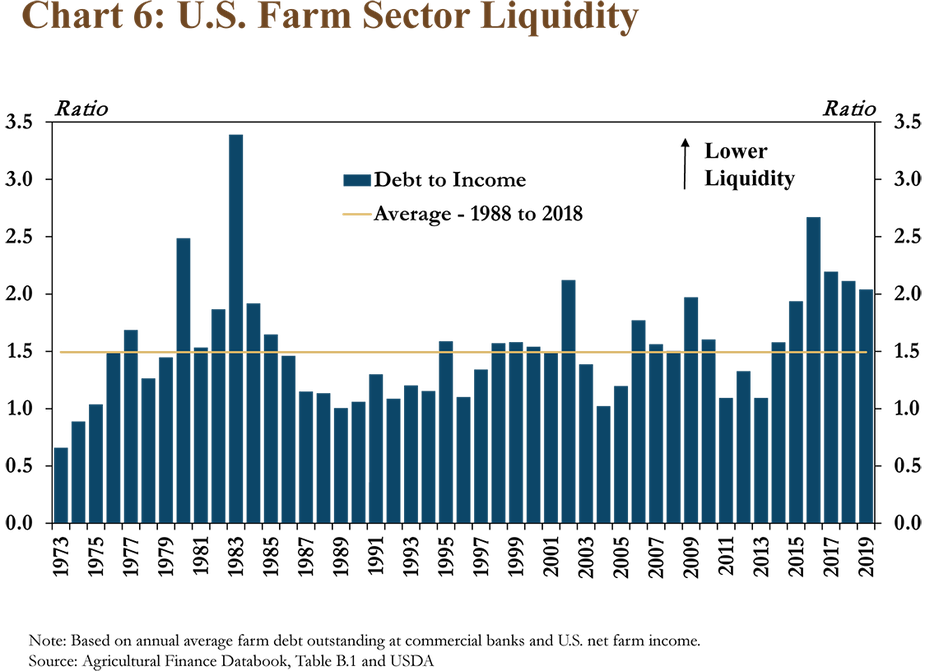

Farm sector debt continued to increase as liquidity in the sector generally has remained low. Debt-to-income ratios have declined slightly from historically high levels in 2016. However, in the third quarter, outstanding debt in the farm sector was more than twice as large as farm income and remained above a historical average (Chart 6). Although the USDA forecasted a slight increase in farm income in 2019, liquidity could remain weak, due, in part, to continued growth in farm debt.

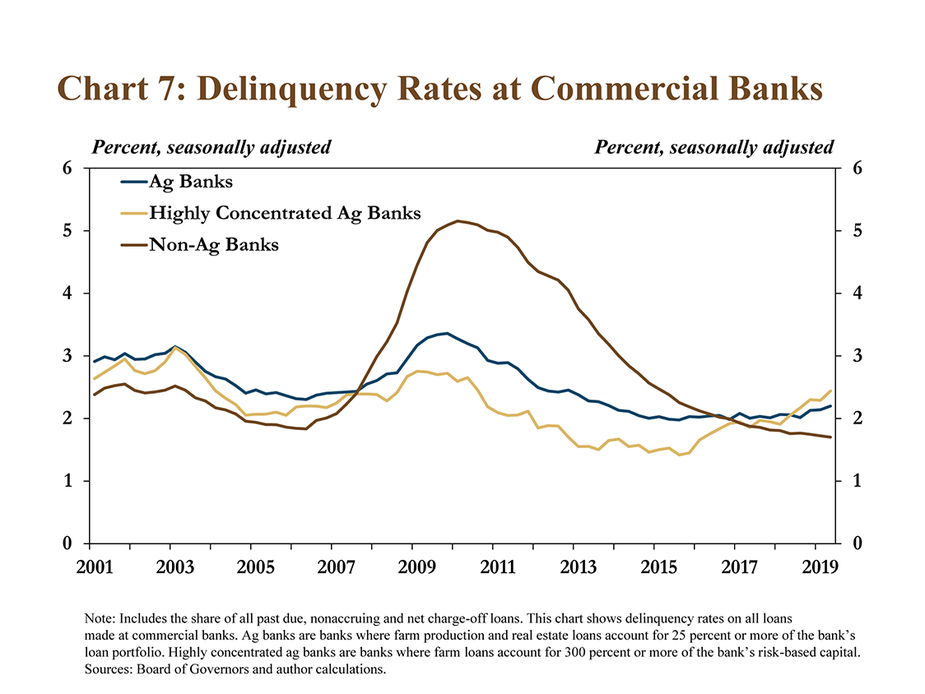

Alongside historically low levels of liquidity, loan performance at agricultural banks and highly concentrated agricultural banks has declined. Delinquent loans at agricultural banks have eclipsed loan delinquencies at all other commercial banks (Chart 7). In fact, in 2018, delinquency rates at highly concentrated agricultural banks surpassed delinquency rates at agricultural banks for the first time since 2003. Despite some signs of weakness at agricultural banks, delinquency rates remained low by historical standards.

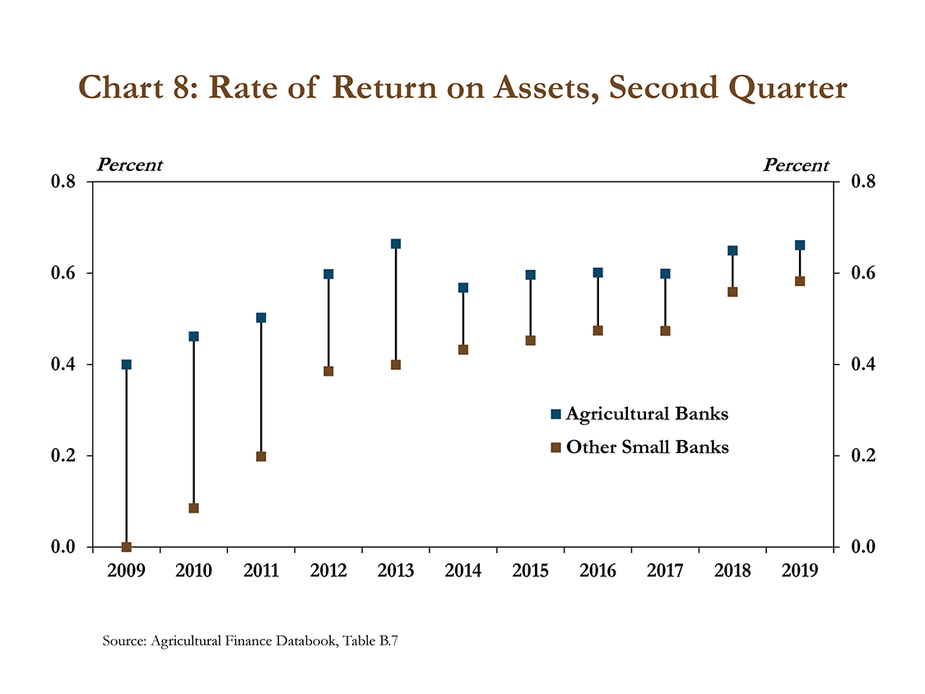

Despite some deterioration in agricultural credit conditions, financial performance at agricultural banks remained sound. For example, the rate of return on assets at agricultural banks increased slightly in the second quarter of 2019 (Chart 8). Since 2014, the pace of growth in returns at agricultural banks and other small banks has slowed somewhat but remained on an upward trend in the second quarter. Additionally, although returns at agricultural banks remained higher than returns at other small banks, the margin continued to narrow.

Section C – Second Quarter Regional Agricultural Data

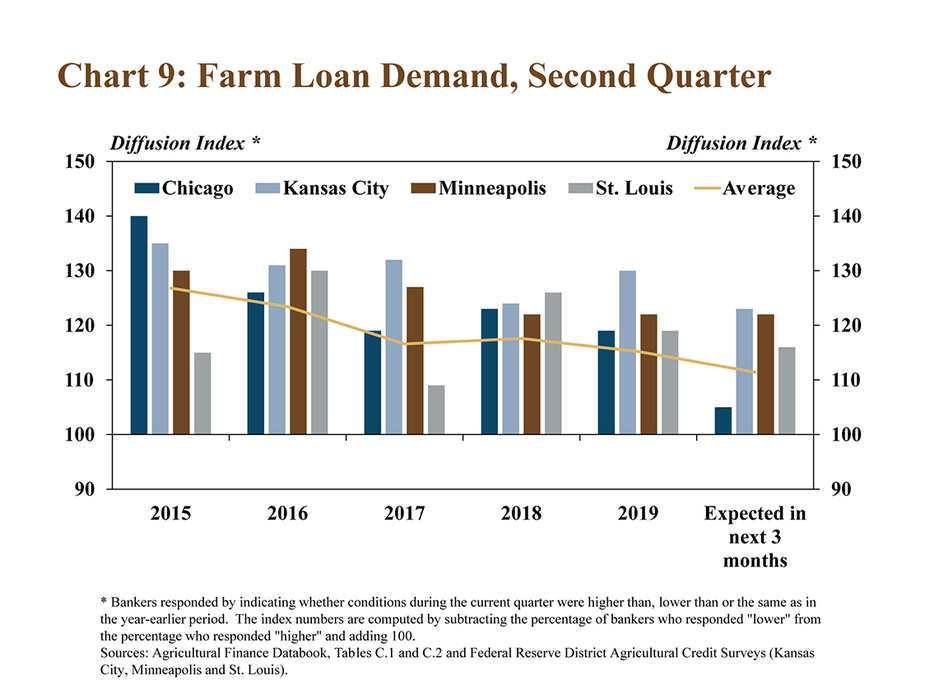

Similar to Call Report data, Regional Federal Reserve surveys also showed that demand for farm loans continued to trend higher in the second quarter. For the fifth year, a majority of bankers in several Districts reported that loan demand was higher than the previous year (Chart 9). The pace of growth in farm loan demand rose somewhat in the Kansas City District but declined in the Chicago and St. Louis Districts. In addition, respondents in the Chicago, Kansas City and St. Louis Districts expected growth in loan demand to slow in coming months.

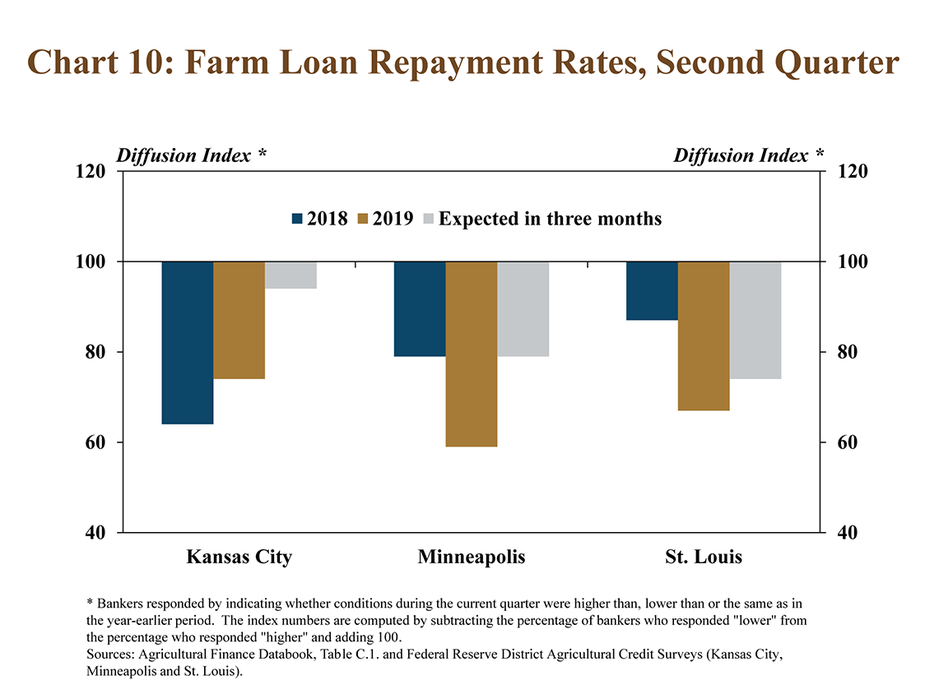

Alongside strong demand for farm loans, the rate of repayment on agricultural loans continued to decline at a modest pace. Farm loan repayment rates declined at a faster pace in the Minneapolis and St. Louis Districts in the second quarter of 2019 (Chart 10). In the Kansas City region, the rate of loan repayment continued to decline in 2019 but at a slower pace. Although a majority of bankers indicated they expect repayment rates on farm loans to continue to decline in the third quarter, the pace of decline was expected to be slower in all Districts.

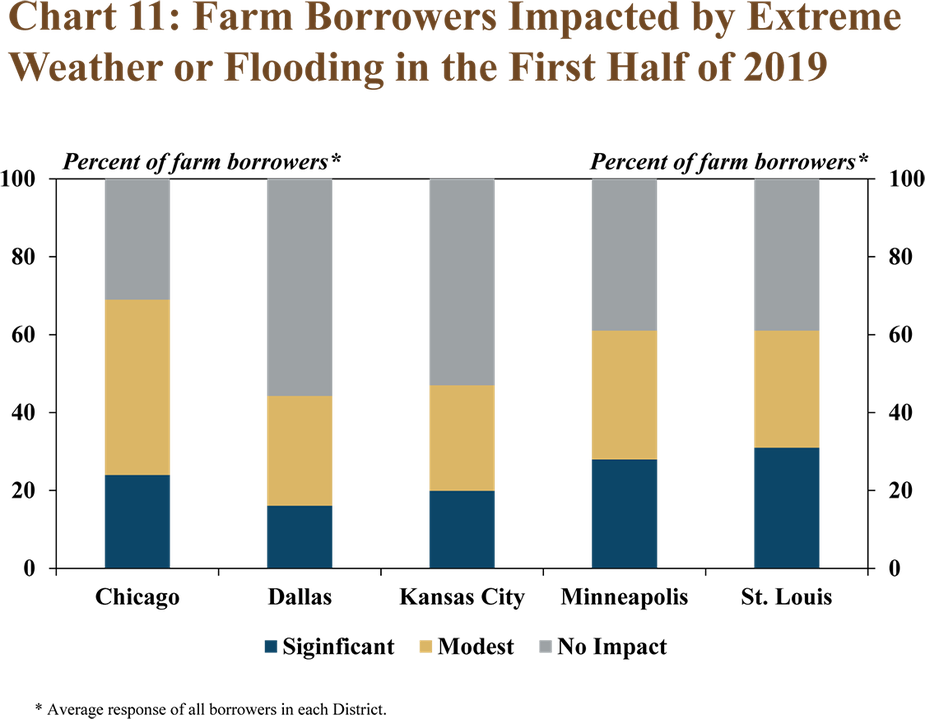

Abnormal weather conditions may have contributed to the outlook for weaker credit conditions in the second quarter. In many regions, agricultural borrowers were impacted by flooding or other extreme weather events during the first half of the year. Impacts appeared to be the most severe in the Chicago, Minneapolis and St. Louis Districts, where some form of extreme weather affected more than 50 percent of farm borrowers (Chart 11). The effects of weather in the first half of the year could continue to weigh on production prospects, yields and credit conditions throughout 2019.

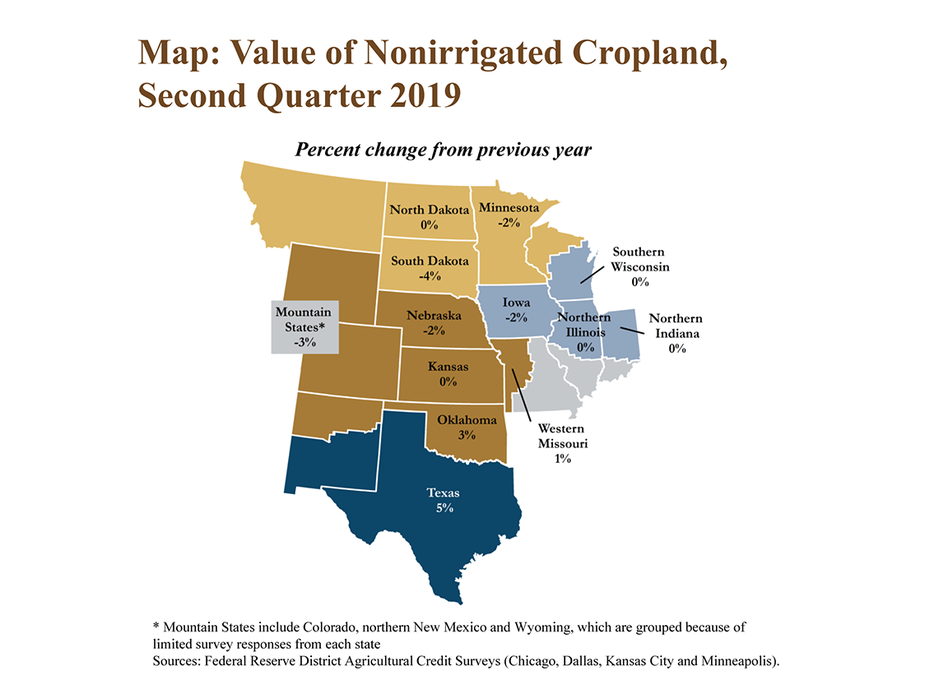

Despite further deterioration in agricultural credit conditions and weather constraints, farmland values remained relatively stable. In most states across the upper Plains, Midwest and Corn Belt, farmland values declined slightly or remained unchanged (Map). Conversely, agricultural lenders in Oklahoma and Texas reported slight increases in farm real estate values.

Conclusion

Despite reduced agricultural lending activity at commercial banks in the third quarter, loan volumes in the farm sector remained elevated. Alongside elevated lending levels, credit quality has deteriorated slightly in recent years at agricultural banks. In general, agricultural lenders reported that the pace of weakening in credit conditions has slowed. However, adverse weather conditions and elevated levels of debt relative to income could continue to weigh on the outlook for agricultural lending conditions in 2019.