The need for farm lending remained high in the second quarter of 2016, driven by ongoing demand for operating loans. The prolonged environment of robust lending activity, amid persistently weak profits in the farm sector, has led to slight reductions in the performance of agricultural loans at commercial banks. Alongside increased risk in the sector due to reduced cash flow, interest rates and maturities for agricultural loans both edged up. Despite the slight declines in loan performance and heightened risk, however, profitability at agricultural banks generally has remained strong.

Section A – Second Quarter Survey of Terms of Bank Lending to Farmers

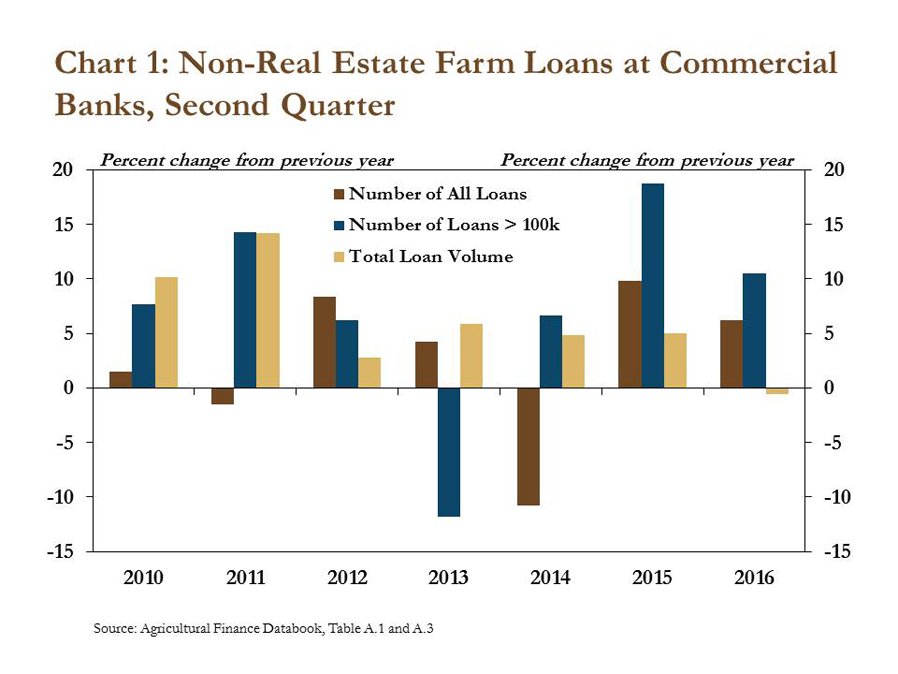

The pace of agricultural lending in the second quarter remained strong. Respondents to the Survey of Terms and Bank Lending to Farmers indicated the total number of non-real estate loans made to farmers in the second quarter increased 6 percent from a year ago (Chart 1). Moreover, the number of non-real estate loans larger than $100,000 made to farmers climbed 11 percent, continuing the trend of recent years.

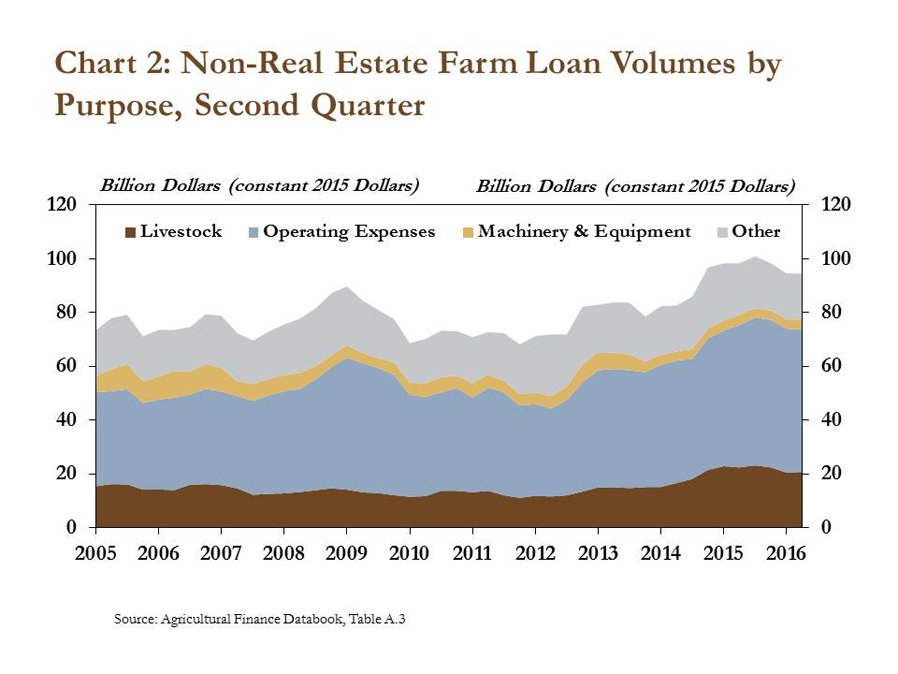

The volume of lending in the farm sector also remained high despite a modest decline in loans used for operating expenses. Non-real estate loan volumes in the quarter decreased about 1 percent from a year ago, but remained well above the average of the past 10 years (Chart 2). The reduction in non-real estate farm loan volumes at commercial banks primarily was driven by a 3 percent decline in lending associated with operating expenses, which include spending on items related to crop production and the care and feeding of livestock. The volume of loans used to finance these expenses, however, also remained more than 50 percent above the 10 year average from 2005 to 2014.

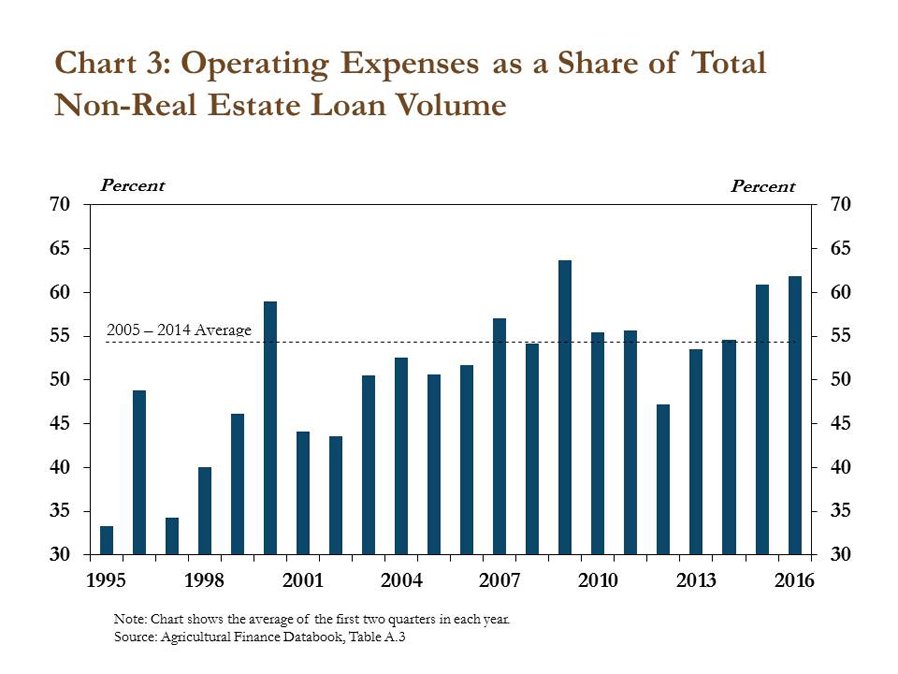

Trends in non-real estate lending activity at commercial banks increasingly have been driven by changes in the short-term financing needs associated with agricultural production. The share of non-real estate loan volumes categorized as current operating expenses gradually has drifted higher since the 1990s, but especially over the past five years (Chart 3). In the first two quarters of 2016, operating expenses accounted for 62 percent of total non-real estate loan volumes, according to the survey. Since the survey began in 1978, operating expenses as a share of the total have eclipsed 60 percent in the first half of the year just once (2009) prior to 2015, but have remained above 60 percent each of the past two years. The gradual increase over the past five years highlights the persistently weak cash flow that has driven demand for agricultural credit.

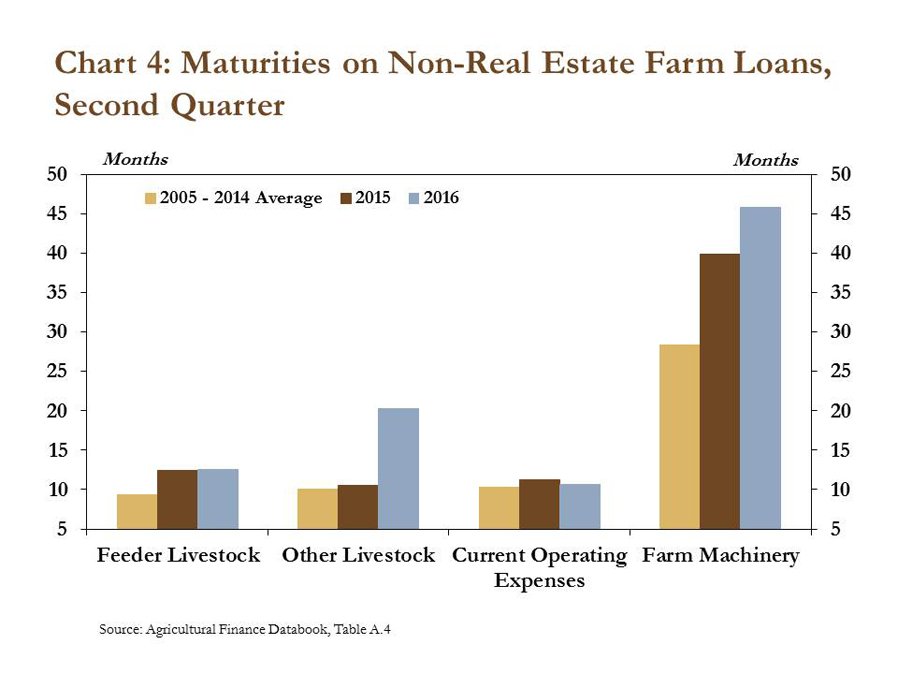

Reduced cash flow also has led to extended maturities for many loan categories to help reduce annual debt payments. Loans used to finance machinery and equipment were extended to an average of 46 months in the second quarter from an average of 28 from 2005 to 2014 (Chart 4). Maturities on loans used to finance livestock operations, excluding the purchase of feeder livestock, increased to a record 20 months. In fact, since 2005, maturities on each of the loan types tracked in the survey has increased, but most significantly in the machinery category.

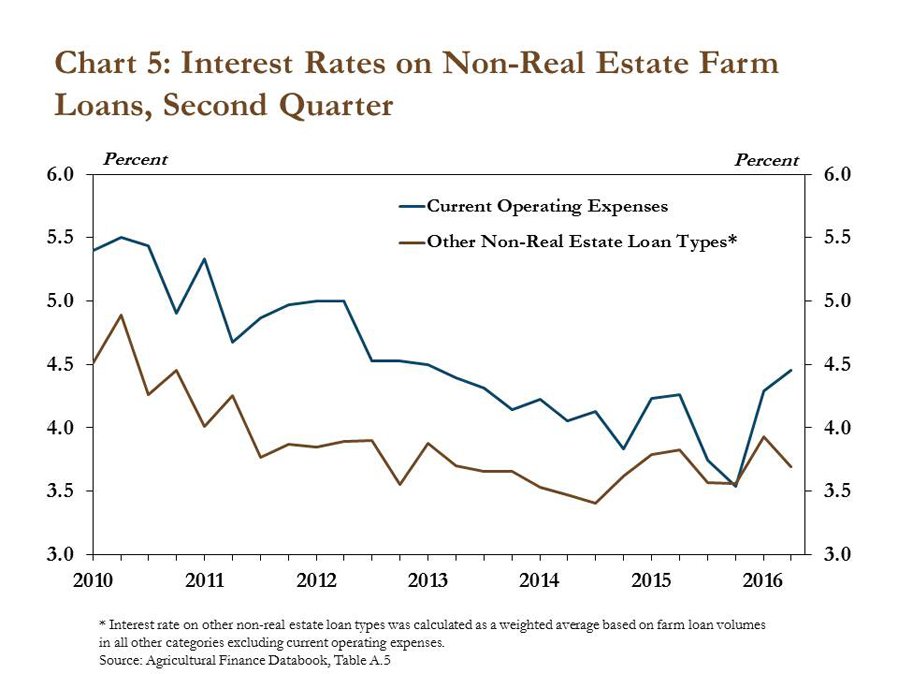

Reflecting some increased risk associated with agricultural lending, interest rates on operating loans increased to their highest level since 2013. The average interest rate on loans used to finance operating expenses increased to 4.5 percent in the second quarter, after increasing about 75 basis points from the fourth quarter of 2015 to the first quarter of 2016 (Chart 5). Although rates on loans used for other purposes generally have edged higher since 2014, average interest rates declined in the second quarter for most other loan categories and generally have remained low in recent quarters.

Section B – First Quarter Call Report

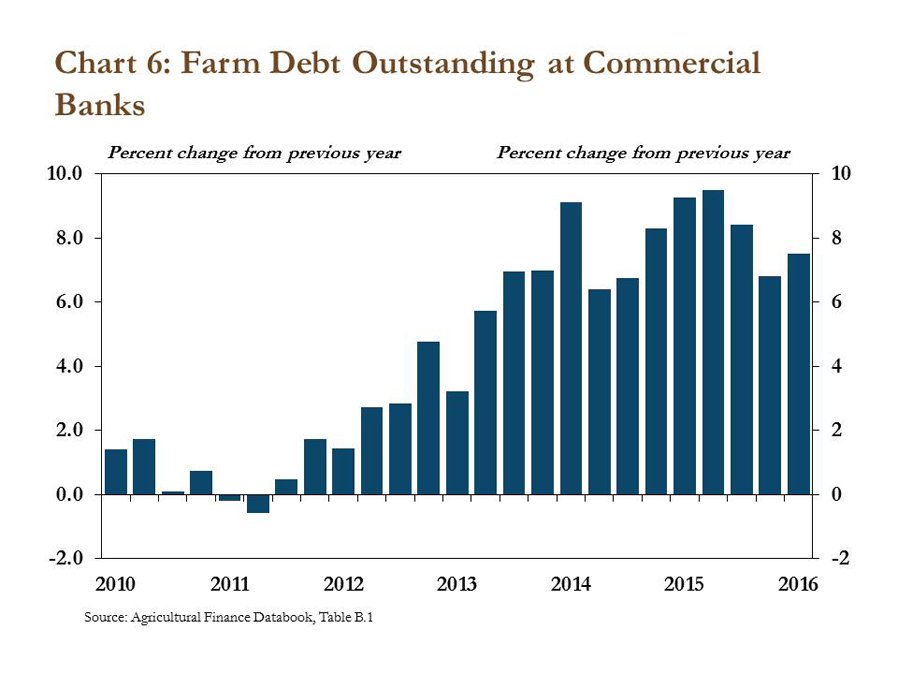

In the first quarter of 2016, commercial bank Call Report data indicate total farm debt outstanding expanded almost 8 percent from a year ago. The increase was the 19th consecutive quarter in which total farm debt expanded from the previous year (Chart 6). This increase marks the second longest streak of increasing farm debt since 1988, accounting for inflation, exceeded only by the period from 2003 to 2009 (25 quarters). The current growth in farm debt began during a period of improving farm sector profitability, but has more recently occurred during an era of reduced farm income.

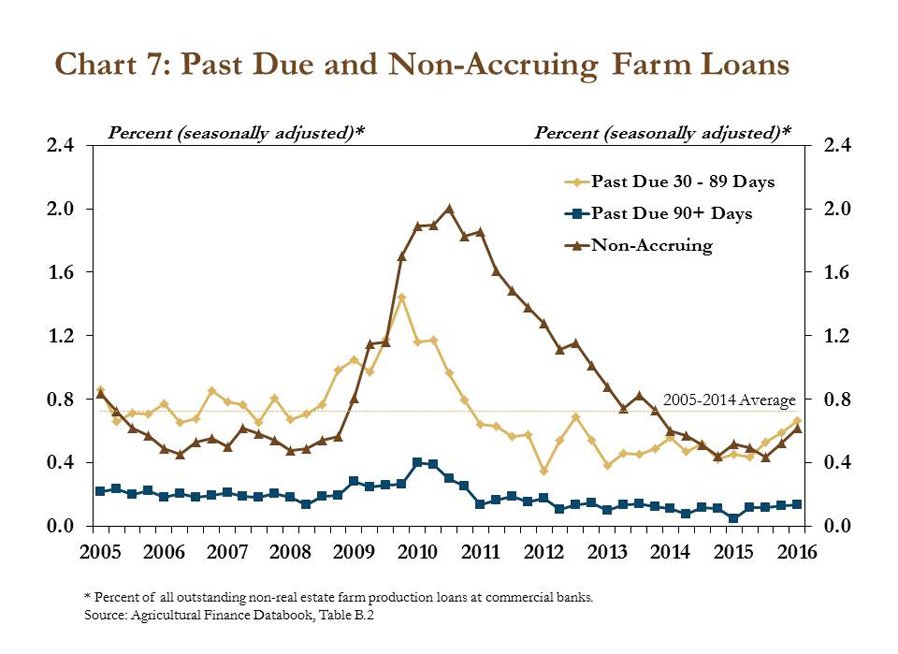

The growth in farm debt during a time of weakening profit margins has led to a modest increase in past due and non-performing loans. Specifically, the share of outstanding loans for farm production that were 30 to 89 days past due in the first quarter crept closer to the 10 year average from 2005 to 2014 (Chart 7). The share of non-accruing loans also has edged up the past two quarters, while loans 90 days or more past due remained relatively steady. Although the share of troubled loans has remained low from a historical perspective, the increase in loans 30 to 89 days past due could be an early indication that borrowers are struggling to repay loans in a time of tight profit margins.

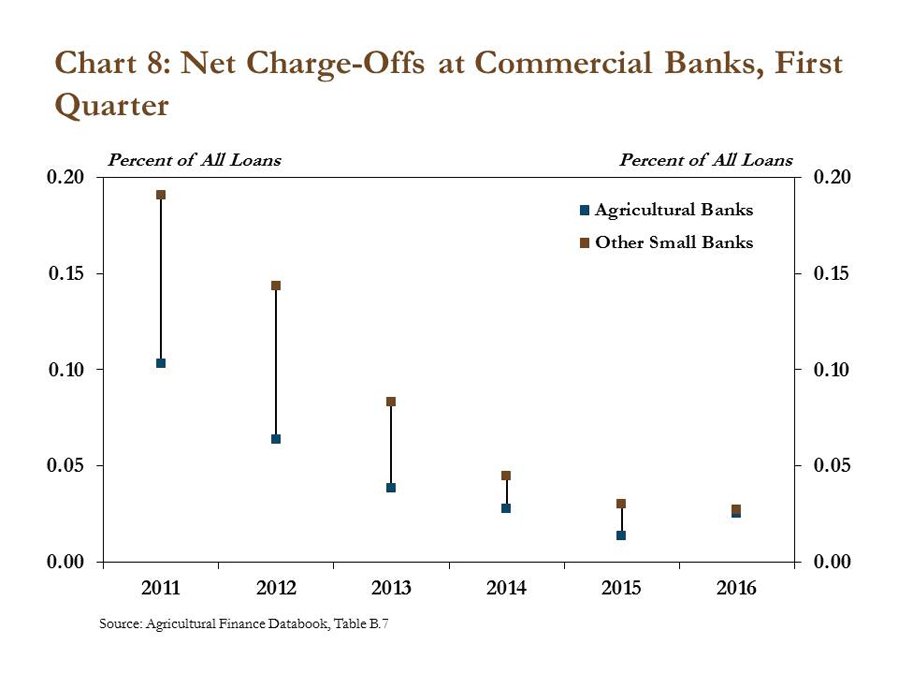

In addition to increases in loans past due, the share of net charge-offs at agricultural banks also edged up. In the first quarter, net charge-offs as a share of total loans increased from .01 percent to .03 percent, in contrast to further declines at small non-agricultural banks (Chart 8). Moreover, the first quarter was the first in recent years in which the share of net charge-offs at agricultural banks was roughly equal to that of its non-agricultural peer group.

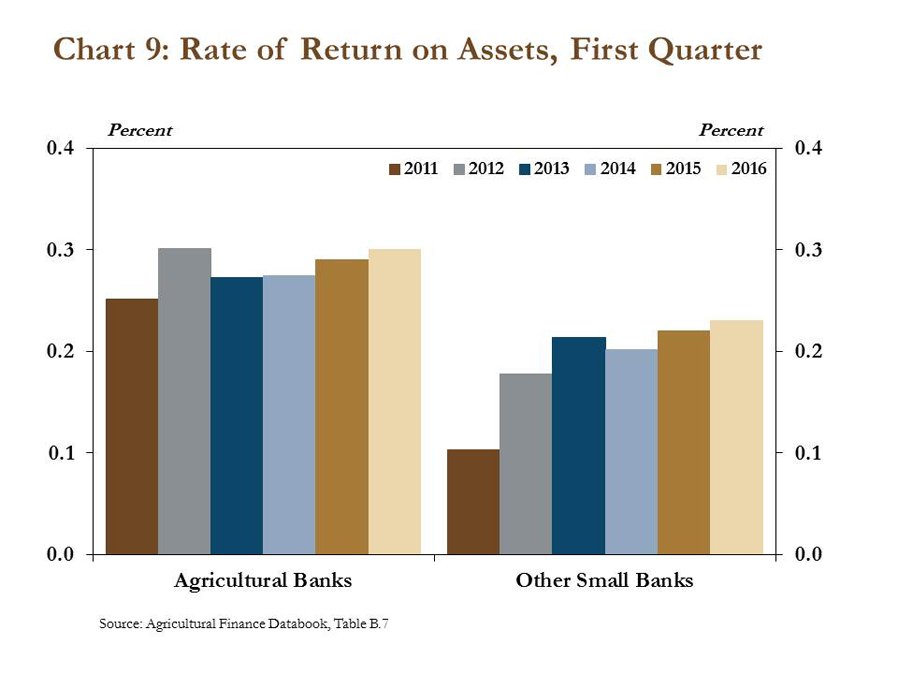

Despite slight increases in loans past due and net charge-offs, returns at agricultural banks remained strong. Returns on assets, a typical measure of bank performance, increased in the first quarter from a year ago for the fourth consecutive year; other small banks also showed further increases (Chart 9).

Section C – First Quarter Regional Agricultural Data

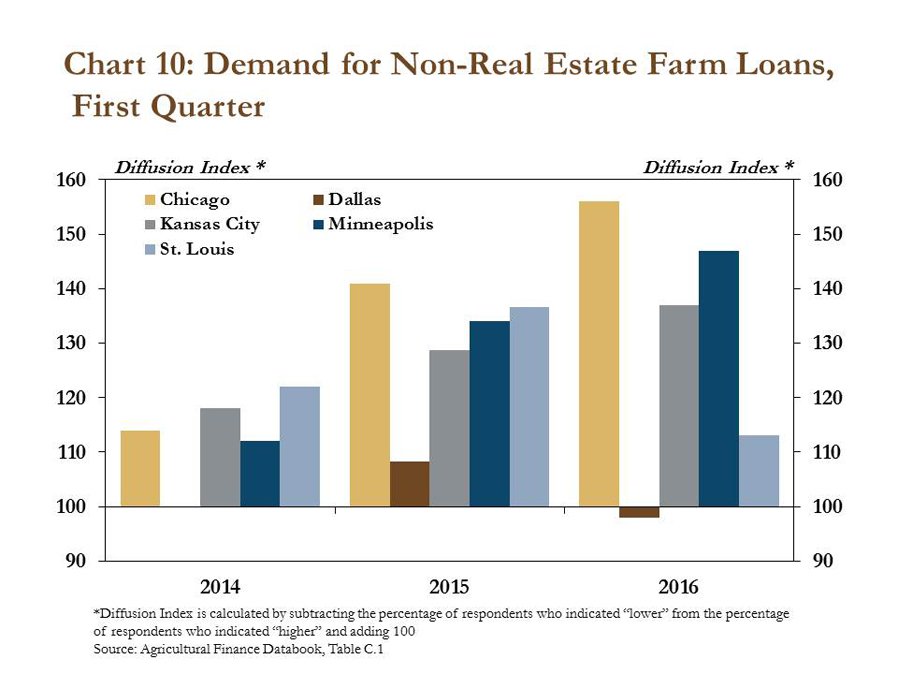

Consistent with recent trends, respondents to regional agricultural credit surveys reported further increases in demand for non-real estate farm loans. The Federal Reserve Districts of Chicago, Kansas City, Minneapolis and St. Louis all recorded increased loan demand in the first quarter from a year ago (Chart 10). Moreover, similar to developments at commercial banks nationally, the first quarter increase marked a third consecutive year of increasing demand for non-real estate farm loans in each of these districts.

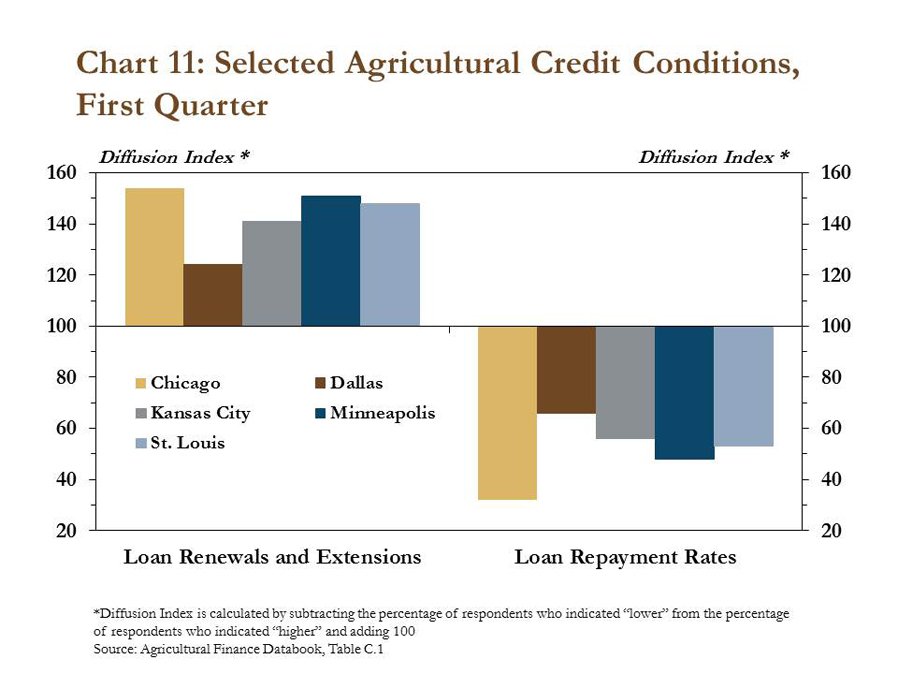

Similar to the trends in demand for non-real estate farm loans, demand for loan renewals and extensions also continued to rise. Each of the Federal Reserve Districts that track farm loan renewals and extensions reported year-over-year increases in the first quarter (Chart 11). Conversely, as short-time financing needs have increased, the rate of loan repayments has continued to decline. Similar to the persistent increases in loan demand and renewals and extensions, each of the five districts reported a fifth consecutive quarter of softer repayment rates.

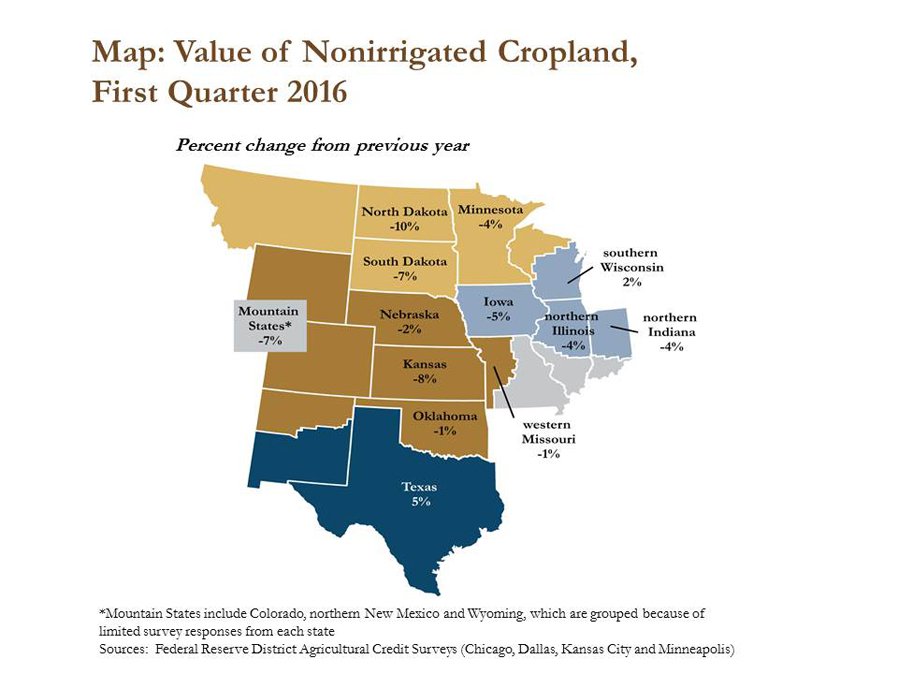

Persistently low profit margins, increased financing needs for operating expenses and a general softening in the farm economy have continued to place downward pressure on farmland values. The value of nonirrigated, good-quality cropland declined modestly in almost all states in the western Corn Belt (Map). Cropland values in North Dakota dropped 10 percent from a year ago, possibly due to some spillover from the prolonged weakness in the energy sector. However, major corn-producing states, including Iowa, Illinois, Nebraska and Indiana, also posted modest declines in the first quarter alongside weakened credit conditions.

Conclusion

The lending environment in the farm sector has remained active despite ongoing indicators of growing risk. Demand for short-term financing has continued to increase during a period of persistently weak profit margins while past dues have crept higher in recent quarters. Banks appear to have taken some measures to manage potential risk of further pressure on farm finances; however, a protracted period of high loan demand and weakening credit conditions could intensify the challenges in the farm sector and at agricultural banks.