Agricultural lending at commercial banks was steady in the second quarter, but risks in the farm sector continued to weigh on loan growth and credit conditions. The volume of non-real estate farm loans increased only slightly from a year ago as interest rates continued to trend up at a modest pace and maturities continued to lengthen. The rate of farm loan delinquencies edged higher, but the performance of agricultural banks generally remained strong, even as farmland values in most areas continued to decline.

Section A – Second Quarter Survey of Terms of Bank Lending to Farmers

The pace of farm lending at commercial banks remained relatively steady in the second quarter of 2017. The survey of Terms of Bank Lending to Farmers shows the volume of non-real estate farm loans originated in the second quarter increased less than 4 percent. Farm loan volumes at commercial banks with a sizable farm loan portfolio rose about 7 percent from the previous year, accounting for the slight overall increase.1 The volume of new farm loans in banks with a smaller farm loan portfolio continued a recent trend of decline from a year ago.

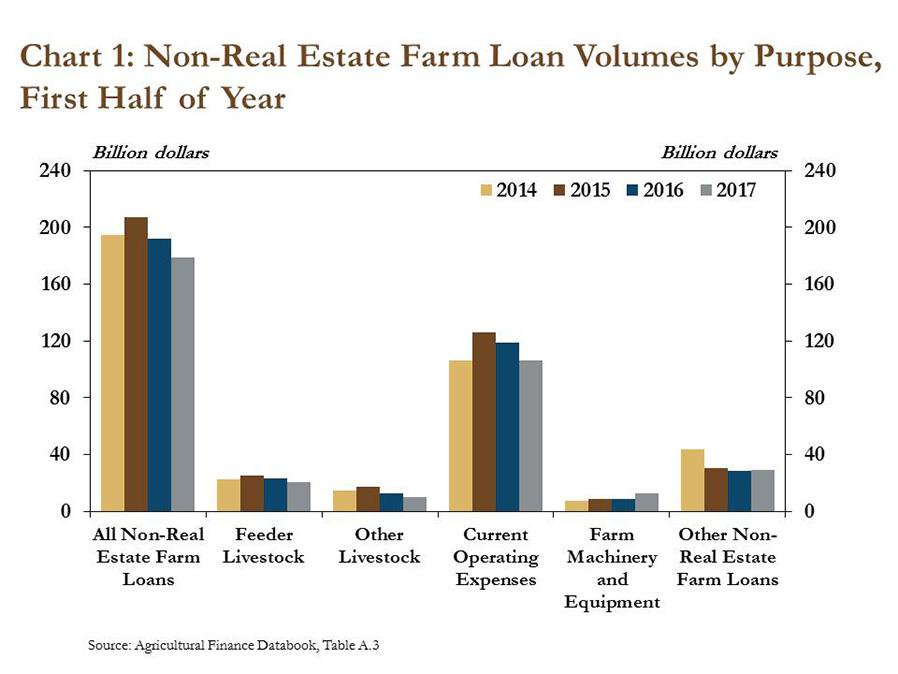

Despite the slight uptick in the second quarter, the total volume of new farm loans in the first half of 2017 remained subdued. The total volume of farm loans originated in that time was 7 percent less than the first half of 2016 (Chart 1). Although farm lending at commercial banks appears to have slowed over the past year, some of the sluggishness in the first half of 2017 may have been due to a prolonged renewal season. Amid a recent decline in working capital and a slight increase in risk associated with agricultural lending, some bankers and borrowers have taken more time to reaffirm financials, expenditures and loan terms from one year to the next.

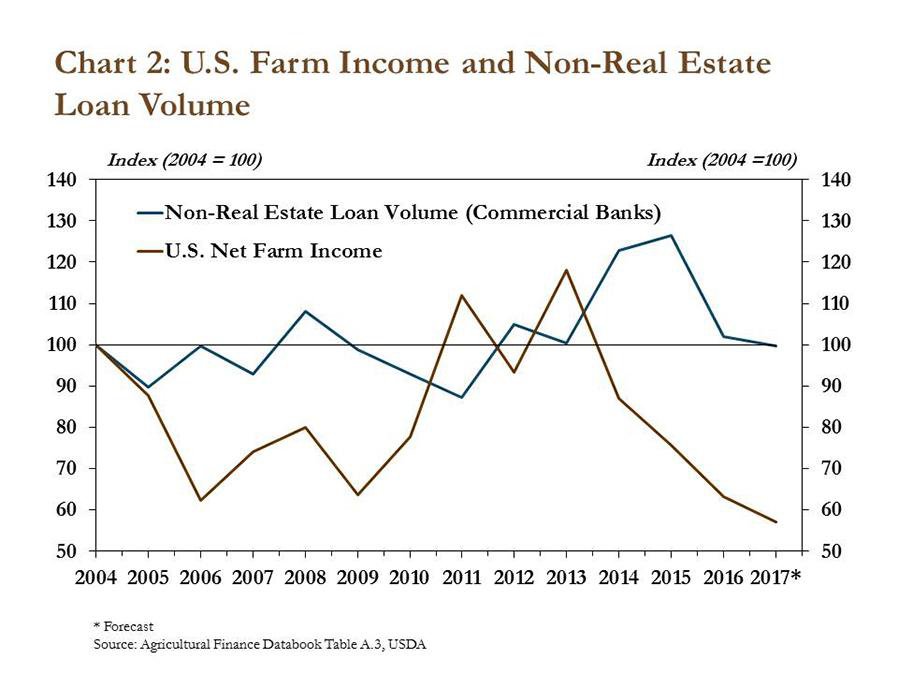

Persistent declines in farm income have likely slowed the volume of new non-real estate loans as bankers and borrowers have sought to manage risk. The U.S. Department of Agriculture’s most recent forecast shows net farm income in 2017 is expected to be about 10 percent less than a year ago and more than 50 percent below the recent peak in 2013 (Chart 2). After rising until 2015, non-real estate farm lending has slowed alongside the declines in farm income.

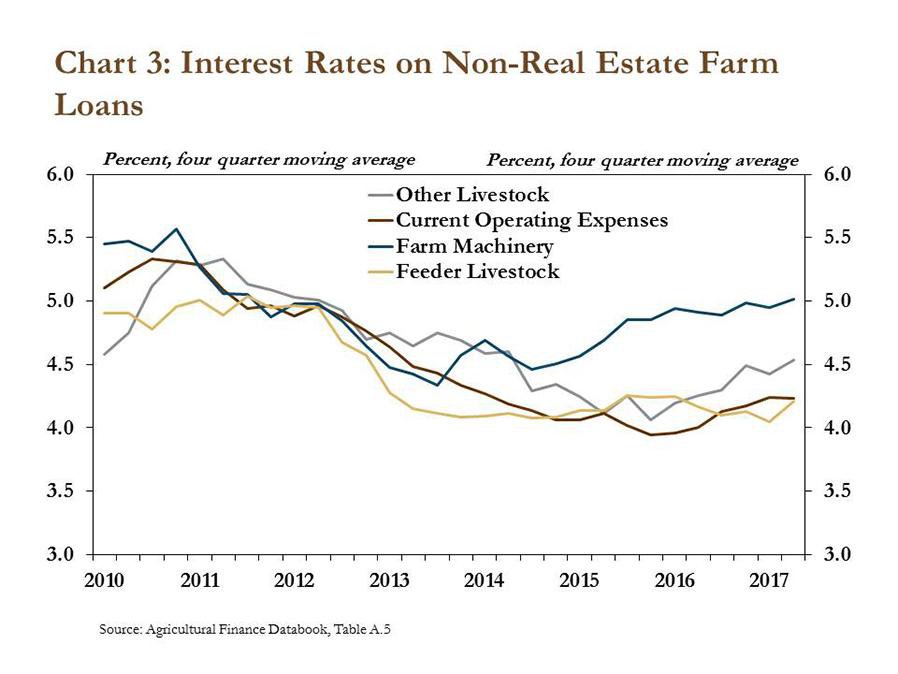

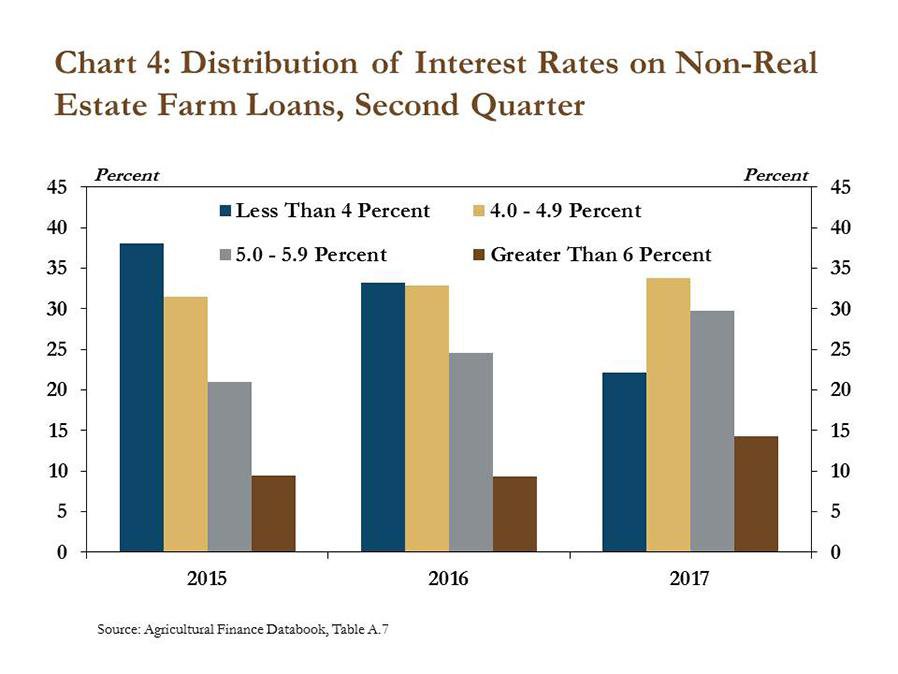

Interest rates on farm loans have continued to inch higher as risk in the sector has increased. Specifically, interest rates on loans for operating expenses, farm machinery and other livestock have increased about 25 to 50 basis points from a year ago (Chart 3). Moreover, in the second quarter of 2017, fewer loans were made at an interest rate of less than 4 percent. In 2015, nearly 40 percent of loans carried an interest rate below 4 percent and only 9 percent carried an interest rate above 6 percent (Chart 4). In 2017, however, only 22 percent of loans carried an interest rate below 4 percent and 14 percent carried an interest rate above 6 percent.

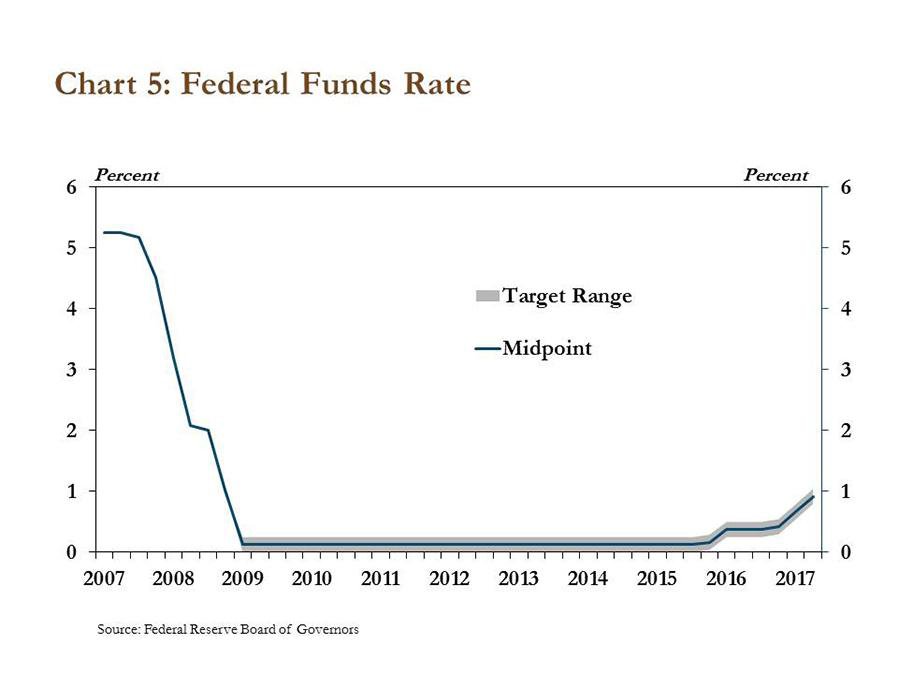

Some of the recent increase in interest rates on farm loans also could be due to increases in other benchmark interest rates. After several consecutive years of being near zero, the federal funds rate has increased to a midpoint of 1 percent in the second quarter (Chart 5).

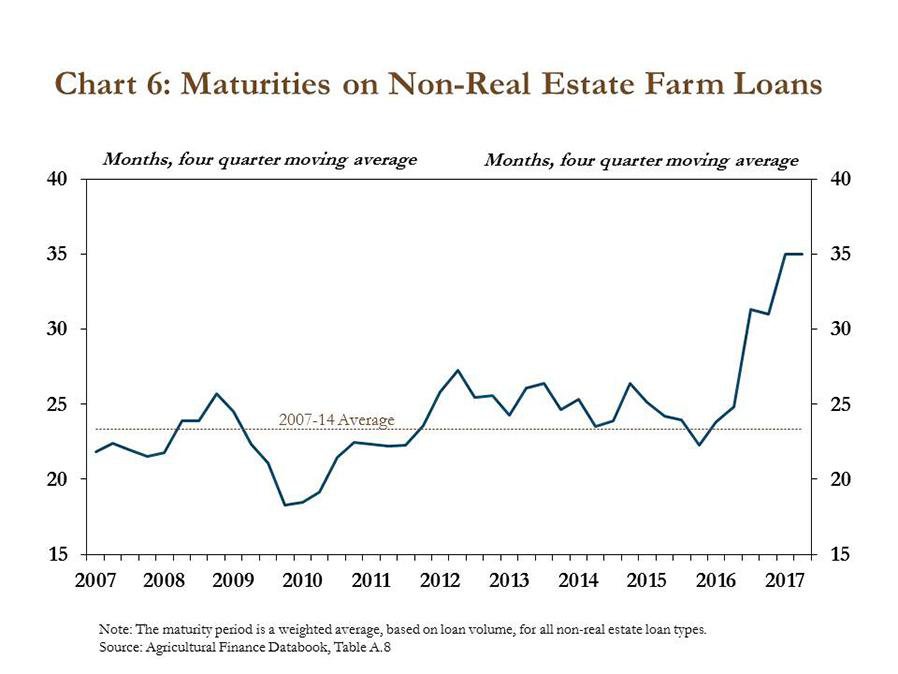

Bankers also have lengthened maturity periods as an additional risk management strategy. The average maturity for non-real estate farm loans, for example, has increased sharply since 2015 (Chart 6). After averaging about 23 months from 2007 to 2014, maturities as of the second quarter of 2017 have jumped to 35 months. Bankers likely have increased maturities to improve cash flow and financial flexibility in the near term.

Section B – First Quarter Call Report Data

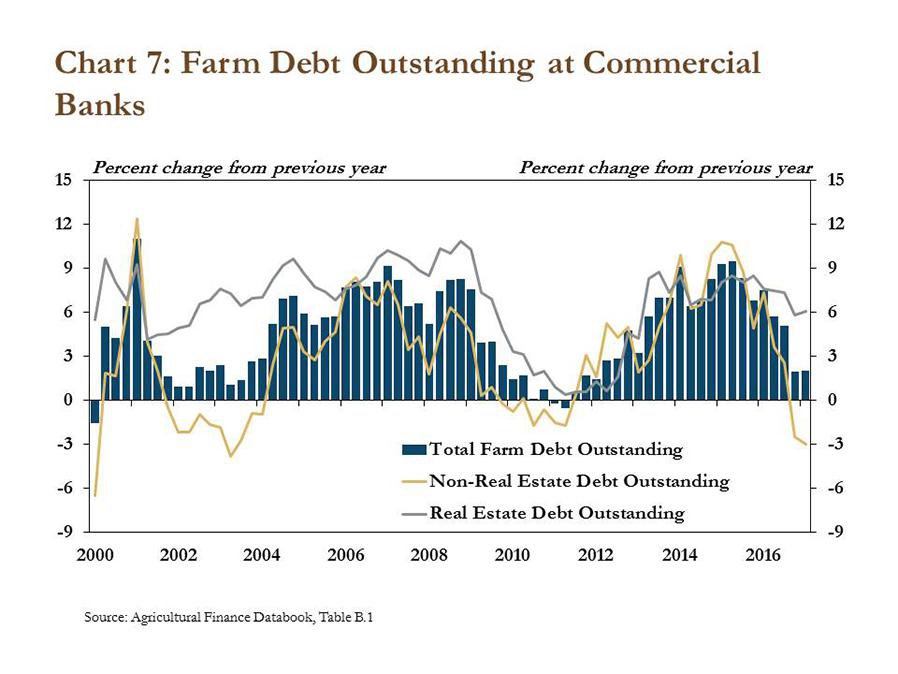

Similar to recent trends in farm loan originations, farm debt outstanding at commercial banks remained stable in the first quarter. Data aggregated from Call Reports indicated that total farm debt increased only 2 percent from a year ago (Chart 7). Gains in farm real estate debt continued to drive the increase as non-real estate debt declined for a second consecutive quarter.

Consistent with the past two quarters, real estate lending over the last 20 years has been stronger and more stable, particularly during downturns in the farm economy. For example, from 2001 to 2002, farm income declined nearly 30 percent and from 2008 to 2009 decreased 21 percent alongside a drop in commodity prices. However, in both time periods, and the years immediately following, farm real estate lending continued to rise while non-real estate lending declined. As in the past, borrowers appear to be responding to reduced farm income by making significant cuts to production expenses and restructuring some non-real estate debt onto longer-term real estate loans.

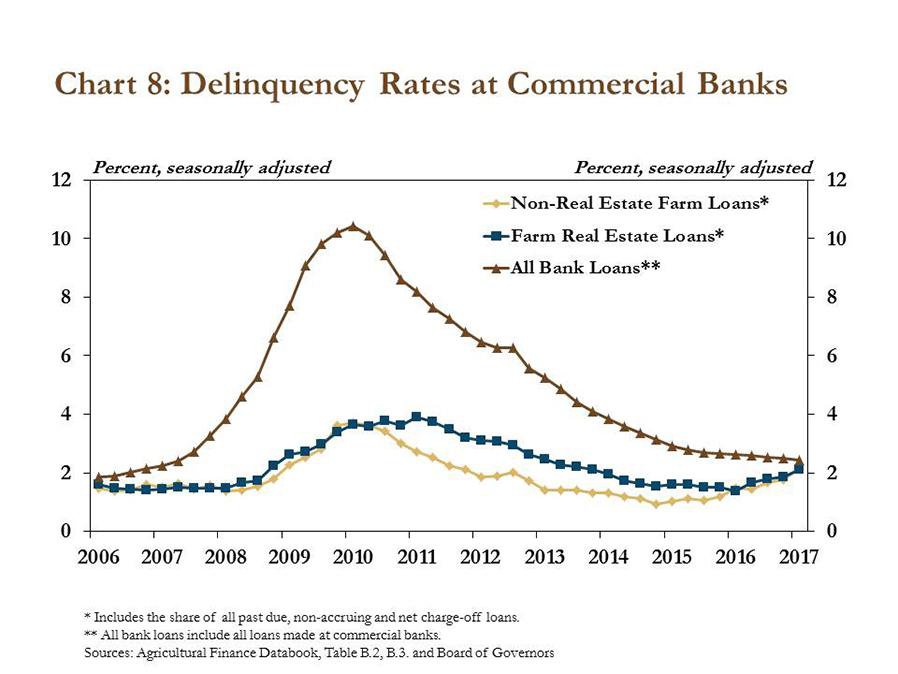

Farm loan delinquency rates increased slightly in the first quarter, but remained historically low. Delinquency rates for both farm real estate and non-real estate farm loans edged above 2 percent (Chart 8). Total delinquencies for farm real estate and non-real estate loans had not been above 2 percent since 2013 and 2012, respectively, but both have trended higher in recent quarters. However, delinquency rates have remained near their 10-year averages and less than the average rate for all bank loans.

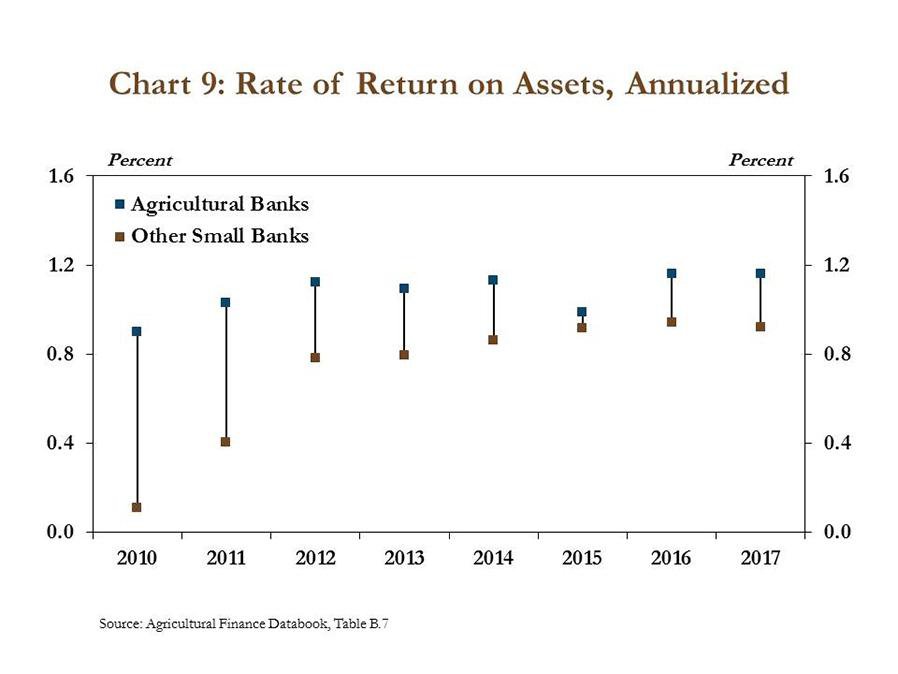

Despite the upward trend in farm loan delinquency rates, the performance of agricultural banks has remained steady. Notably, the rate of return on assets has remained slightly above the five-year average of 1.1 percent (Chart 9). Likewise, the rate of return on assets at agricultural banks has remained above the rate of return at other small banks.

Section C – First Quarter Regional Agricultural Data

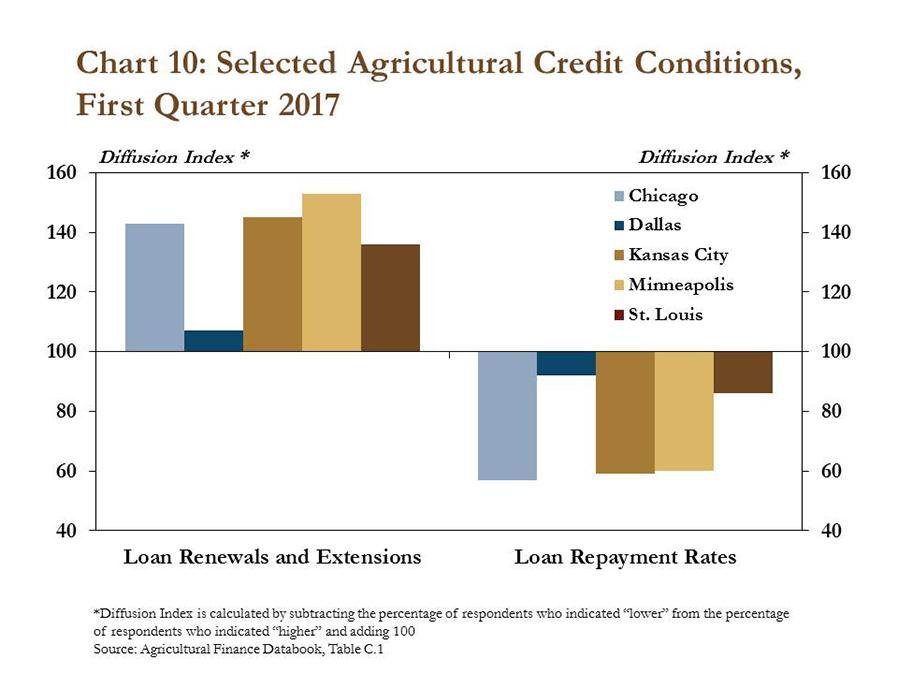

Despite recent signs of reduced lending activity, regional Federal Reserve surveys indicated that borrowers’ demand for financing generally remained strong. Demand for farm loan renewals and extensions remained elevated in each Federal Reserve district, marking the ninth consecutive quarter that each district has reported an increase (Chart 10). In a similar vein, each district also reported a decline in the rate of loan repayments for a ninth consecutive quarter.

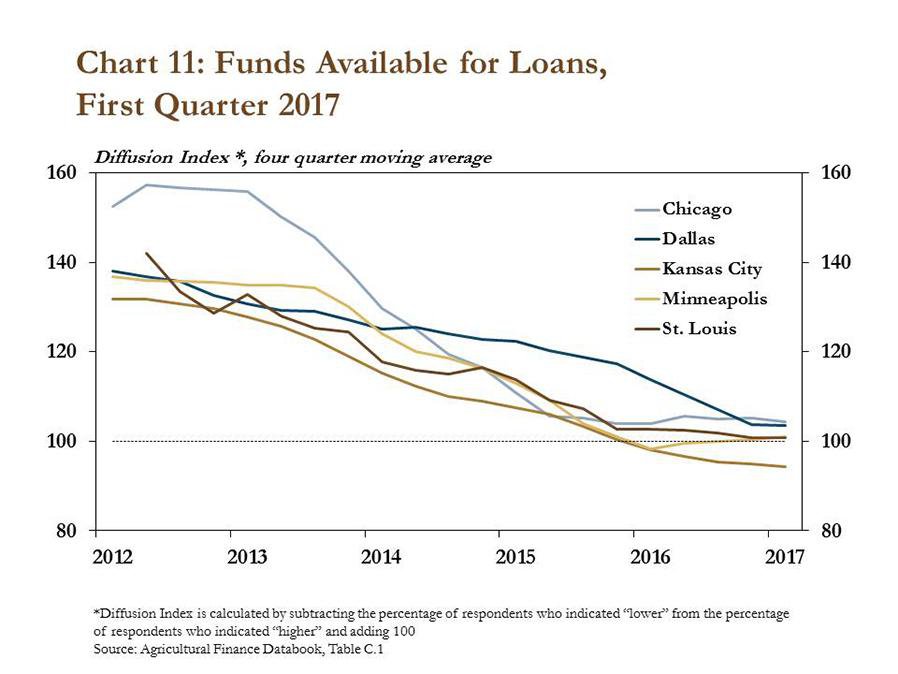

Weaker repayment rates and strong loan demand has slowed the growth of funds available for agricultural loans. For example, in 2012 and 2013, funds available for financing grew sharply in most districts (Chart 11). However, by the first quarter of 2017, available funds declined in the Kansas City District from the previous year, and were flat in the Minneapolis and St. Louis Districts. Credit availability increased modestly in the Chicago and Dallas Districts, but at a slower pace than previous years.

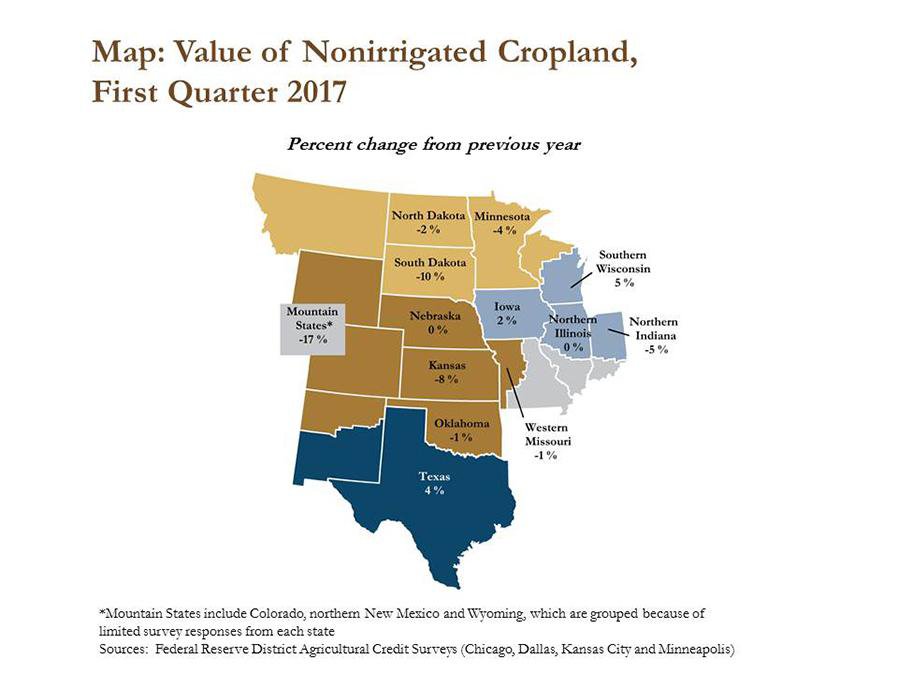

Farmland values continued to decline amid slightly weaker credit conditions and a sluggish farm economy. Bankers in states with a heavy reliance on income from wheat and cattle, such as the Mountain States, South Dakota and Kansas, reported relatively large declines in farmland values from the previous year (Map). Bankers in Texas, southern Wisconsin and Iowa reported slight increases, likely due to strong demand for farmland and limited sales. Farmland values in most other states remained flat from the previous year.

Conclusion

Lending in the farm sector generally remained stable, even as farm loan delinquency rates continued to trend up. Farmland markets have remained relatively strong, despite ongoing declines in most areas, and lending connected to farm real estate has continued to rise at a steady pace. However, producers still appear to be cautious in financing non-real estate purchases as income in the farm sector has remained suppressed. If farm income remains low, agricultural lenders may need to adjust to an environment of persistently sluggish loan growth and heightened risk in their farm loan portfolio.

____________________________________________

1Banks with a portfolio of more than $25 million in farm loans.