Farm income remained suppressed in the first quarter of 2016, keeping farm lending activity high. Although non-real estate farm loan volumes declined modestly from a year ago, the number of loans originated increased slightly and the volume of loans remained near record highs. Large loans used to finance operating expenses remained the primary driver of demand for non-real estate loans. Although returns at agricultural banks generally remained strong, delinquency rates on farm loans ticked up, and loan repayment rates dipped, as persistently weak profit margins in the farm sector continued to intensify the challenge of maintaining adequate cash flow.

Section A – First Quarter Survey of Terms of Bank Lending to Farmers

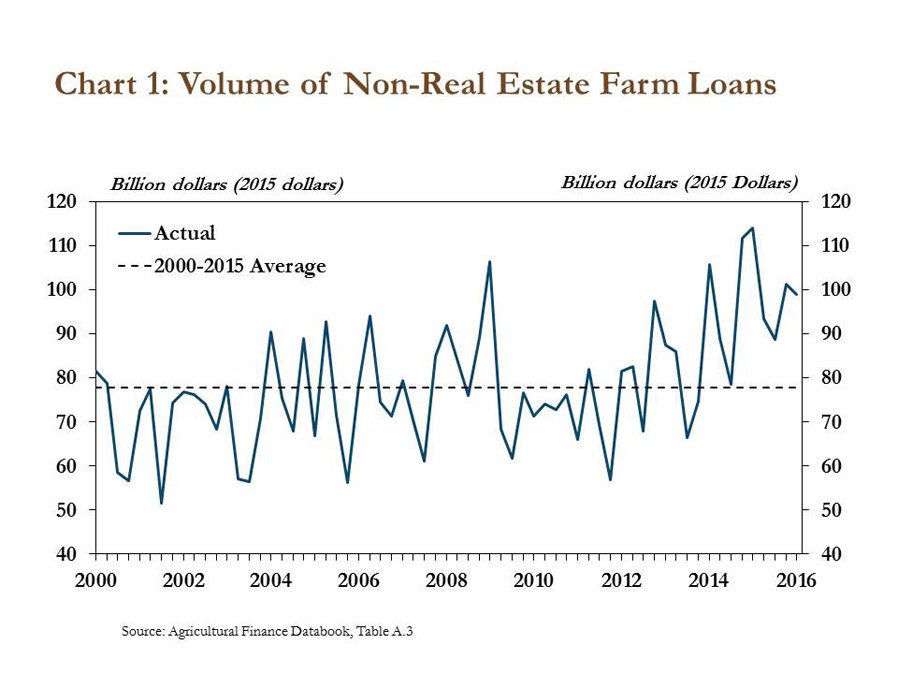

Agricultural lending activity remained strong in the first quarter of 2016. The national Survey of Terms of Bank Lending to Farmers, conducted the first full week of February, indicated the total volume of non-real estate farm loans originated in the quarter declined 13 percent from a year ago. However, the total volume of lending in the first quarter was the sixth highest since 2000, and more than 20 percent higher than the average of the past 15 years (Chart 1). Moreover, despite a modest decline in the volume of farm loans, the number of farm loans originated for non-real estate purposes increased 4 percent from a year ago.

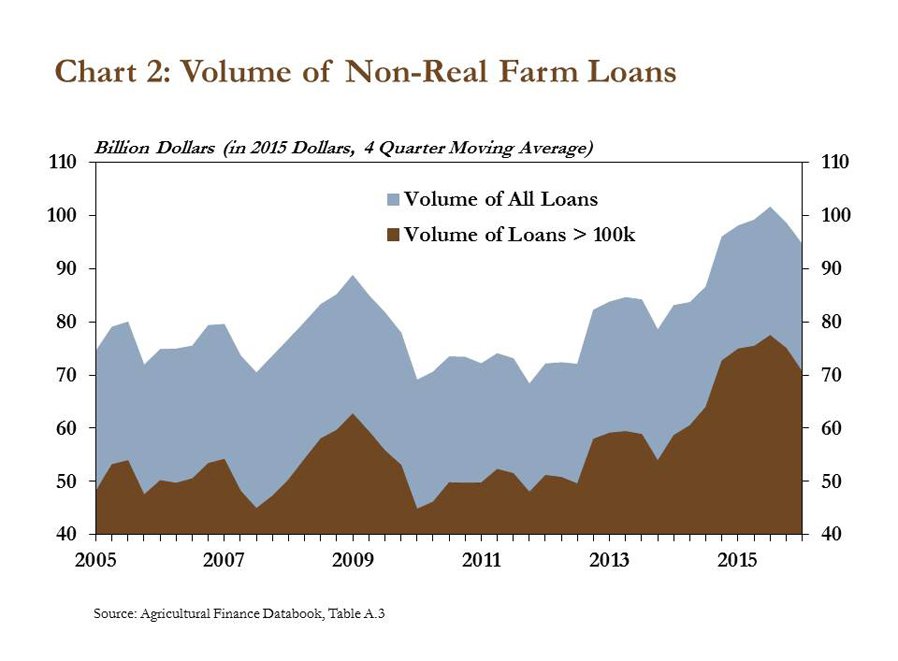

The volume of large non-real estate farm loans continued to have a significant effect on changes in farm lending. In the first quarter, loans larger than $100,000 accounted for 77 percent of the total volume of non-real estate farm loans, up from 72 percent in 2011 and 67 percent in 2006 (Chart 2). The increasing share of large loans could be due to persistently high input costs or farm expansion, but may also indicate producers have become increasingly dependent on financing amid tighter profit margins in the farm sector.

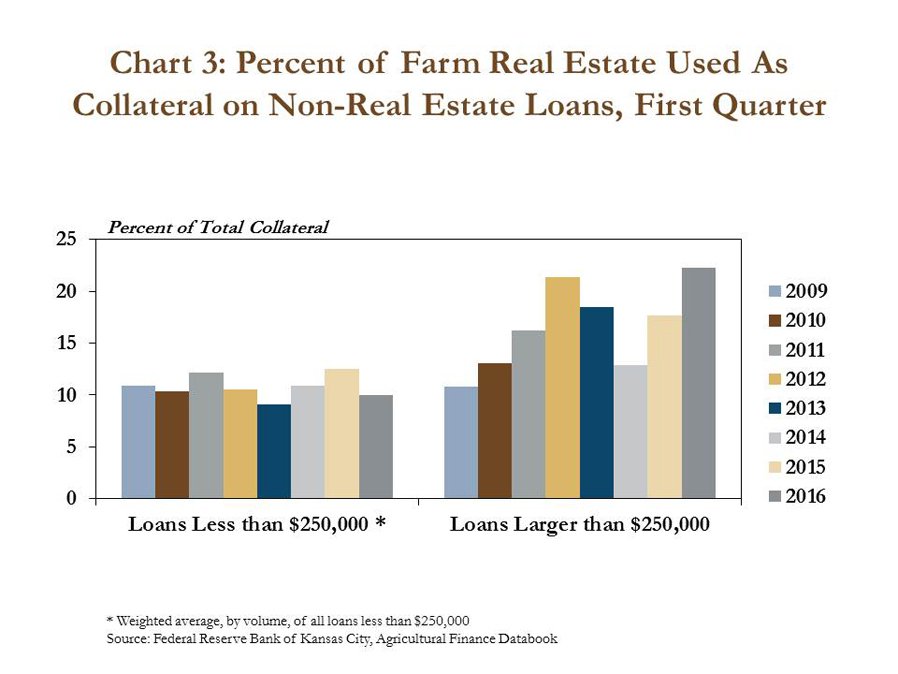

Alongside a rising share of large farm loans and weaker farm income, the composition of collateral tied to large farm loans also has shifted somewhat. In the first quarter, farm real estate accounted for 22 percent of collateral on non-real estate loans larger than $250,000, up from 13 percent two years ago (Chart 3). In contrast, farm real estate used as collateral on loans less than $250,000 consistently has hovered near 10 percent. As farm incomes have softened, the increasing use of farm real estate as collateral may indicate that bankers have sought to improve their borrowing base and exposure to risk from reduced cash flow.

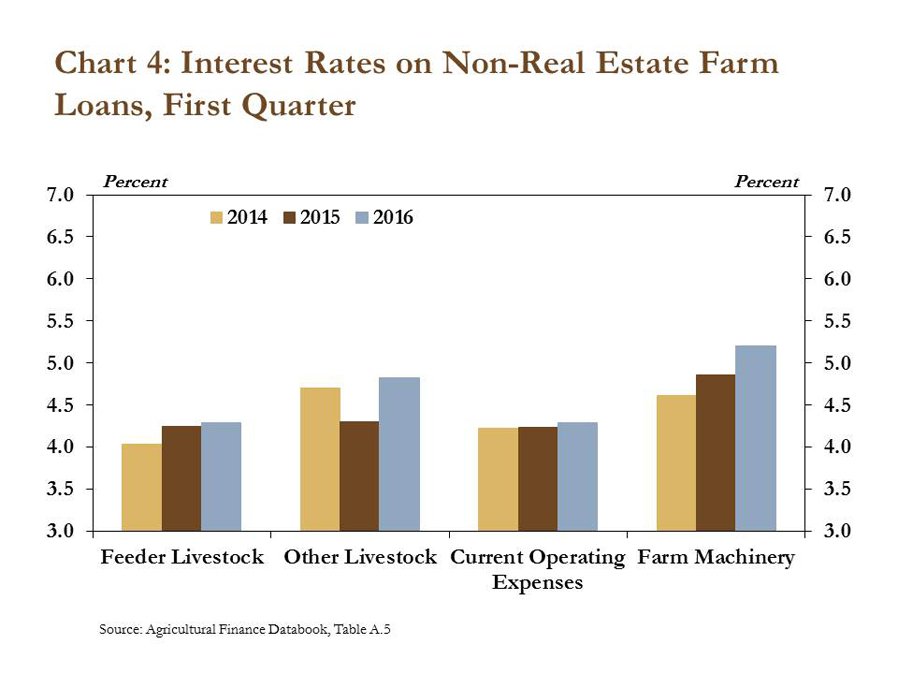

Interest rates on non-real estate farm loans also inched up in the first quarter. Interest rates for operating expenses and feeder livestock, which accounted for nearly 75 percent of non-real estate loan volume, increased slightly, but were similar to previous years (Chart 4). Interest rates for other livestock and farm machinery increased 52 and 34 basis points, respectively. Some of the increase in interest rates can be attributed to the high percentage of variable interest rate loans (nearly 68 percent) reacting to minor market movements. However, some of the increase also may be attributed to banks’ risk pricing methods on loans for depreciable intermediate assets in a lean farm economy.

Section B - Fourth Quarter Call Report

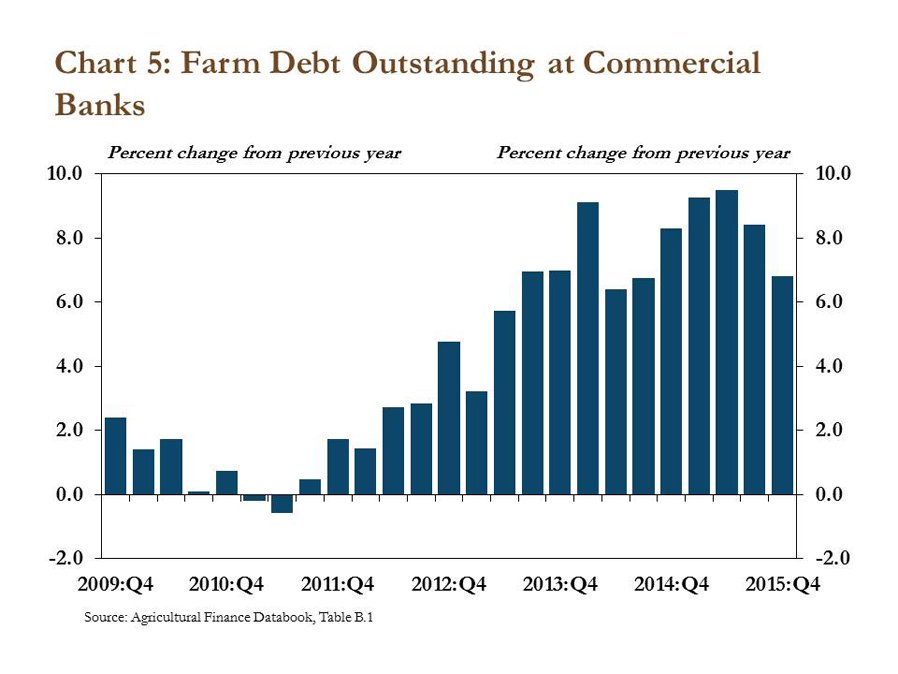

In the fourth quarter of 2015, total farm debt at commercial banks continued to rise, but at a somewhat slower pace. Specifically, the level of outstanding debt in the farm sector increased about 7 percent from the previous year, marking the 18th consecutive quarter of increased farm debt financed by commercial banks (Chart 5). However, the year-over-year increase in the fourth quarter was smaller than in the prior four quarters.

Farm lending trended higher during years of strong farm income, but lending also has increased in recent years as income has softened. For example, farm debt rose nearly 15 percent from the first quarter of 2012 to the fourth quarter of 2013 when farm income was near historical highs. Nevertheless, farm debt since the first quarter of 2014 has expanded about 20 percent even as income has dropped sharply. The increase in debt in both environments suggests the current amount of outstanding farm debt at commercial banks represents both capital purchases made during periods of optimistic growth and, more recently, debt to cover short-term financing needs as profit margins have narrowed.

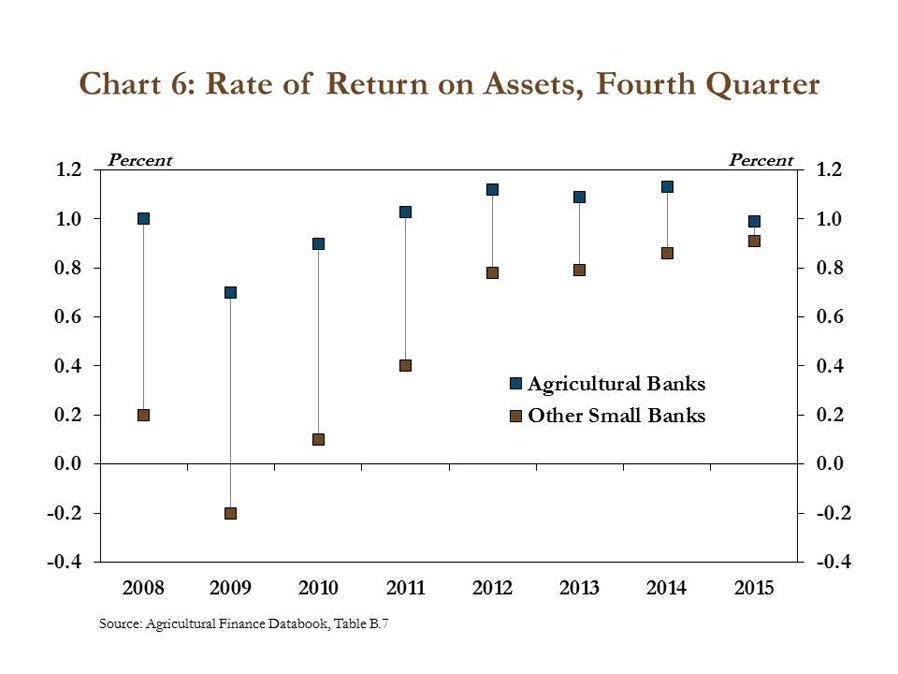

Despite the increased lending activity, the performance of agricultural banks softened in the fourth quarter even as other small banks became slightly more profitable. Returns on assets, a typical bank performance measure, dipped below 1 percent at agricultural banks for the first time since 2010. Additionally, the difference between return on assets at agricultural banks and the same measure at other small banks has narrowed significantly (Chart 6).

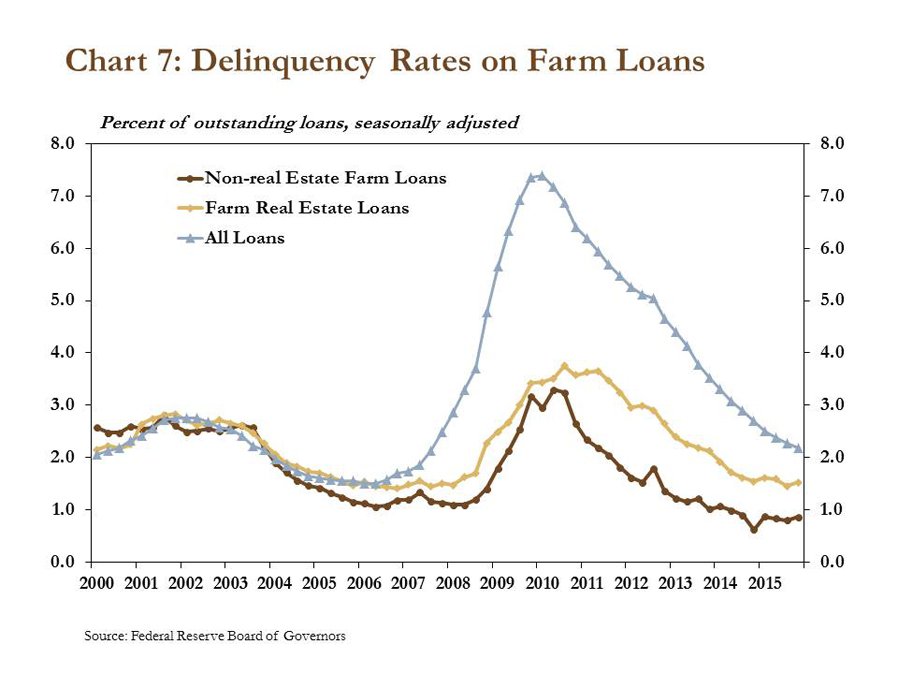

The narrower gap between returns at agricultural banks and other small banks was consistent with recent trends in delinquency rates on farm loans. In the fourth quarter, delinquency rates on both farm real estate loans and farm non-real estate loans edged up whereas delinquency rates on all loans, agricultural loans included, trended lower (Chart 7). Despite the recent uptick in delinquencies on farm loans, delinquency rates remained well below the average of the past 15 years. Nevertheless, a persistently weak farm economy may force a greater number of highly leveraged producers into default, putting further pressure on profits for banks with a portfolio concentrated in agriculture.

Section C – Fourth Quarter Regional Agricultural Data

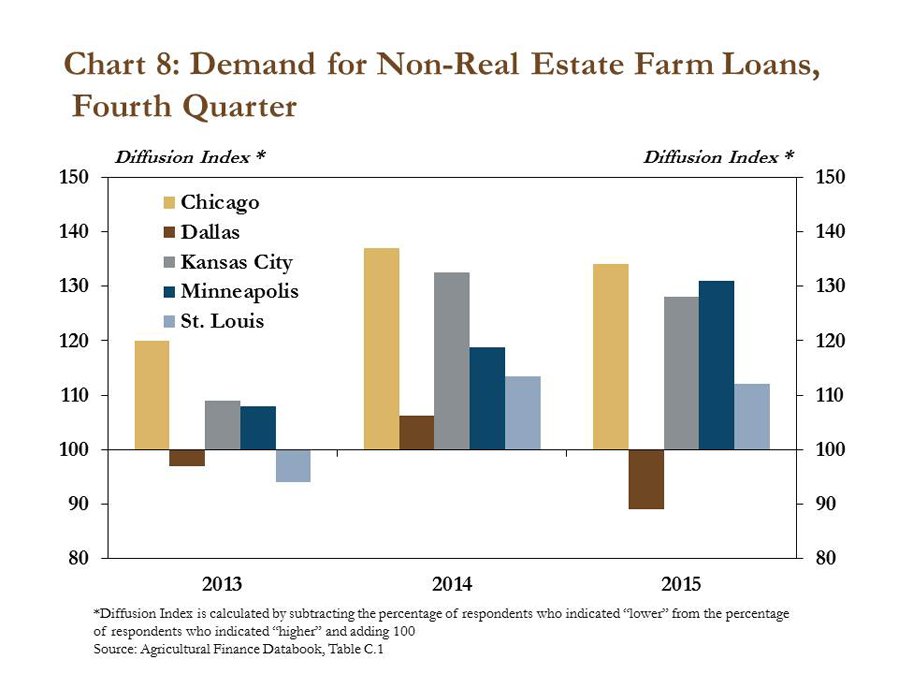

Consistent with fourth quarter call report data, Federal Reserve surveys of agricultural credit conditions generally pointed to strong demand for non-real estate farm loans. Of the surveys conducted in districts with prominent agricultural sectors, only the Dallas district reported a decrease in demand for non-real estate farm loans in the fourth quarter (Chart 8). The Minneapolis and Chicago districts, which generally have higher shares of crop production relative to livestock production, recorded the highest and second highest increases in fourth quarter loan demand since 1991. Similarly, loan demand in the Kansas City district increased for the 10th consecutive quarter and in 11 of the last 15 quarters in the St. Louis district.

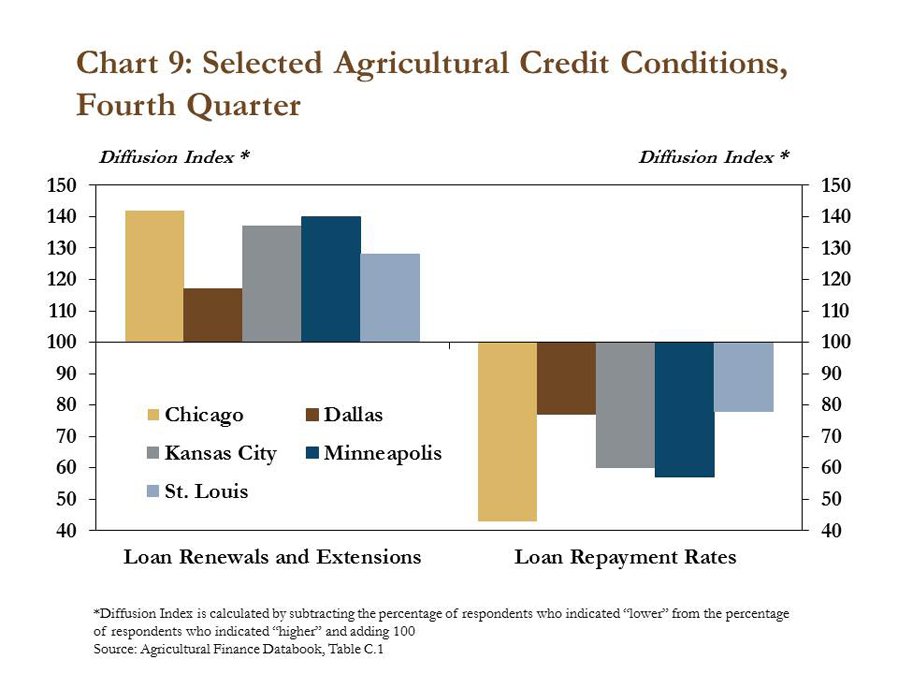

Demand for loan renewals and extensions also increased in the fourth quarter. The surveys of each reporting district showed sharp increases in demand for loan renewals and extensions, while repayment rates continued to weaken (Chart 9). The increase in loan renewals and extensions, and softer repayment rates, most likely were due to reduced cash flow and short-term liquidity as some borrowers also sought to restructure existing loans.

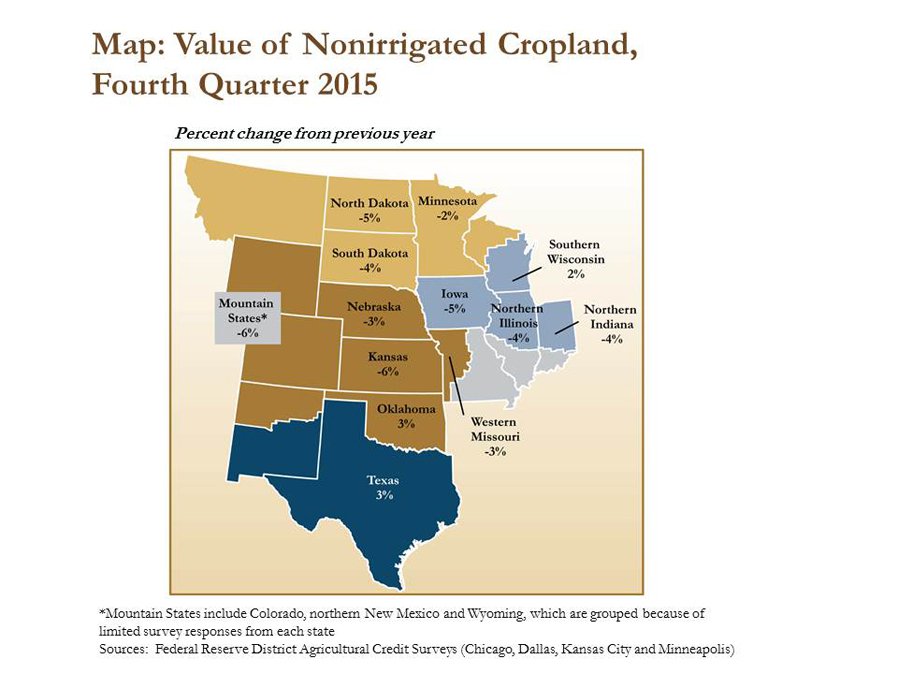

The weakening farm economy continued to weigh on farmland values and cash rents in the fourth quarter. The value of nonirrigated cropland in most states within the Federal Reserve districts of Chicago, Dallas, Kansas City and Minneapolis declined slightly (Map). However, nonirrigated cropland values in Oklahoma, Texas and southern Wisconsin increased, but only slightly. Cash rental rates for farmland also declined in the Dallas, Kansas City and Minneapolis districts as profit margins remained weak.

Conclusion

The pace of farm lending in the first quarter remained relatively brisk. Agricultural credit conditions deteriorated somewhat as repayment rates declined and delinquency rates picked up slightly alongside reduced farm income. Banks appeared to be taking proactive measures to reduce risk by increasing the amount of farm real estate used to collateralize large non-real estate loans and raising interest rates slightly. Though farmland values have remained relatively strong, a poor outlook for cash flow could continue to pressure a larger share of farm borrowers in the coming year, particularly those most highly leveraged.