Strength in farm real estate markets provided support to the agricultural sector amid ongoing financial challenges. According to the Tenth District Survey of Agricultural Credit Conditions, nonirrigated cropland values and cash rents increased slightly in the fourth quarter. Credit conditions in the District remained weak, but deteriorated at the slowest pace in more than four years. Despite some signs of stabilization, geographic disparities persisted across the region. Land values were stronger on the eastern side of the District, while farm income and credit conditions were weaker in the west. Bankers commented that trade relief payments provided notable support to farm finances in 2019, but many also indicated that underlying weaknesses in the sector continued to be driven by low agricultural commodity prices.

Data

Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

Farmland Values and Cash Rents

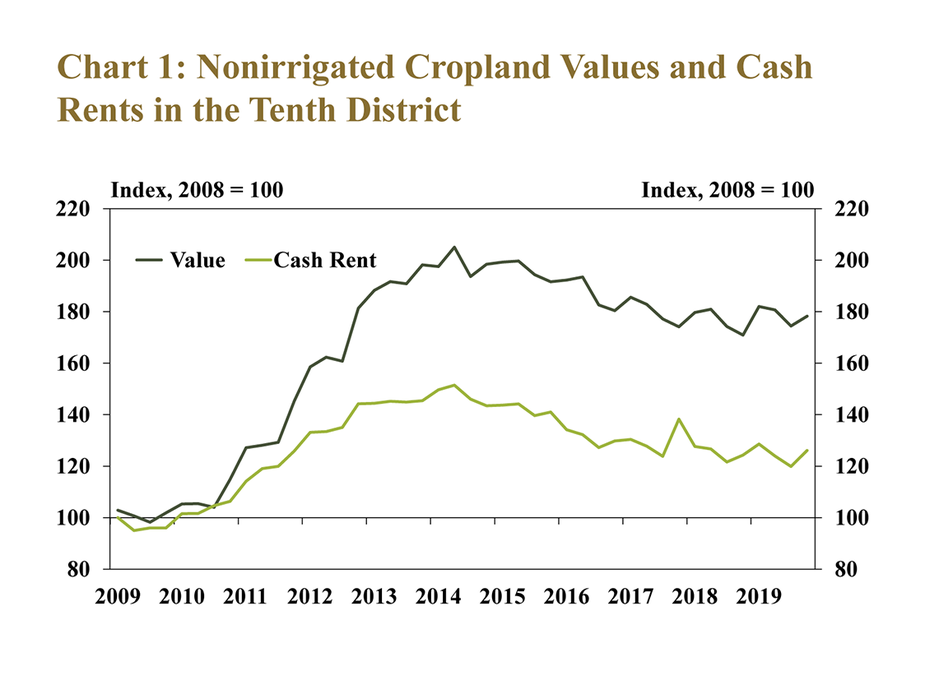

Farmland values increased slightly in the fourth quarter, and cash rents remained stable. Nonirrigated farmland values trended higher at a modest pace in 2019 and increased 4 percent in the fourth quarter (Chart 1). Cash rents have trended lower since 2017 but increased slightly at the end of 2019. In the fourth quarter, cash rents were 2 percent above year-ago levels.

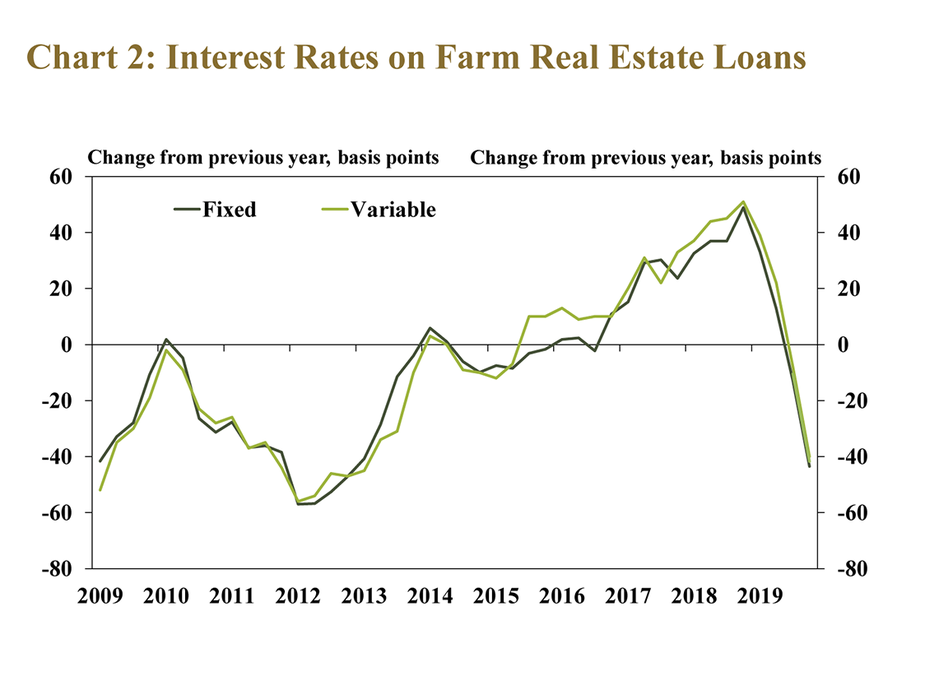

Lower interest rates and reduced borrowing costs may have contributed to recent strength in District farmland values. Interest rates declined 10 basis points in the third quarter of 2019 compared with the previous year (Chart 2). In the fourth quarter, fixed and variable interest rates for loans to finance farmland purchases declined 42 basis points from the previous year.

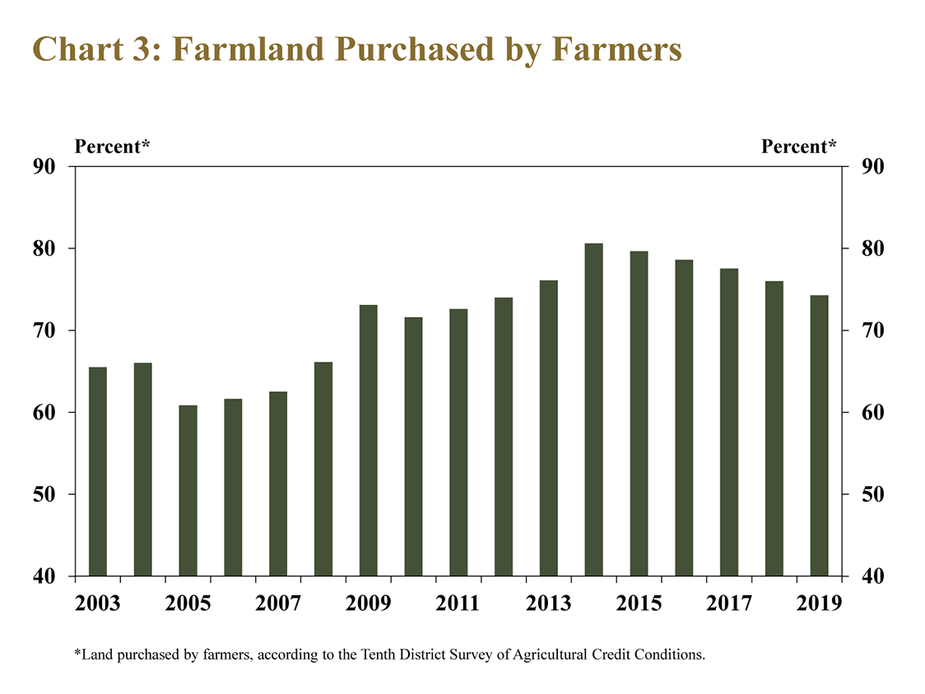

Demand for farmland remained strong in the fourth quarter, which also could have supported farmland values. The share of farmland purchased by farmers since 2014 has declined from 81 percent to 74 percent but remains elevated by historical standards (Chart 3). In addition to the slow pace of decline, farmers have continued to purchase a majority of farmland sold in the District.

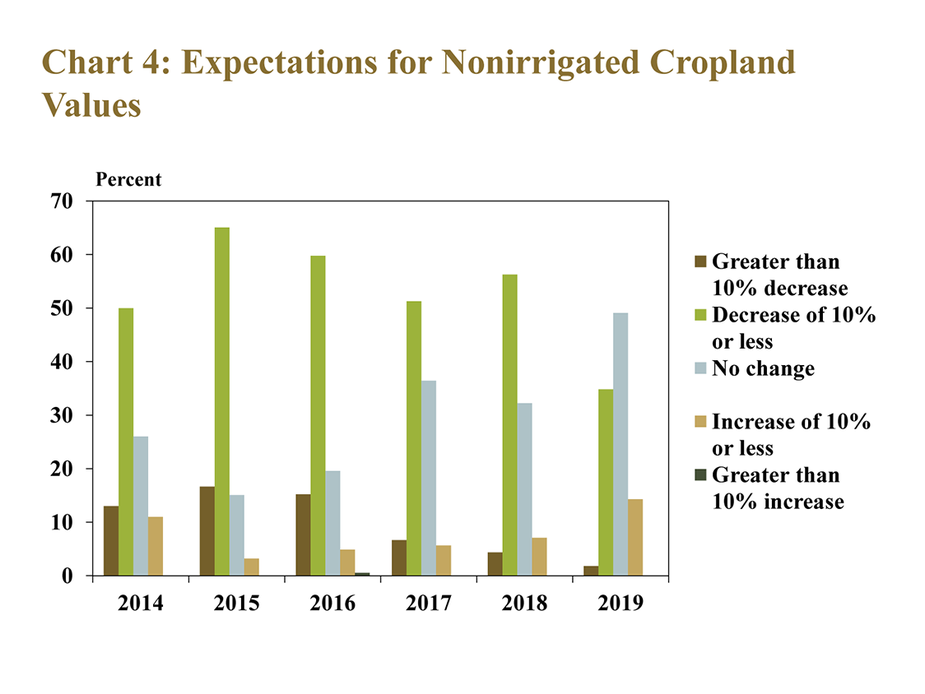

In addition, strong demand and lower interest rates may have contributed to higher expectations for farmland values in 2020. For the first time since 2014, more bankers expected farmland values either to remain steady or increase compared with those that expected farmland values to decline (Chart 4). Although 37 percent of bankers expected farmland values to decline somewhat, half expected no change, and 14 percent expected farmland values to increase moderately in 2020.

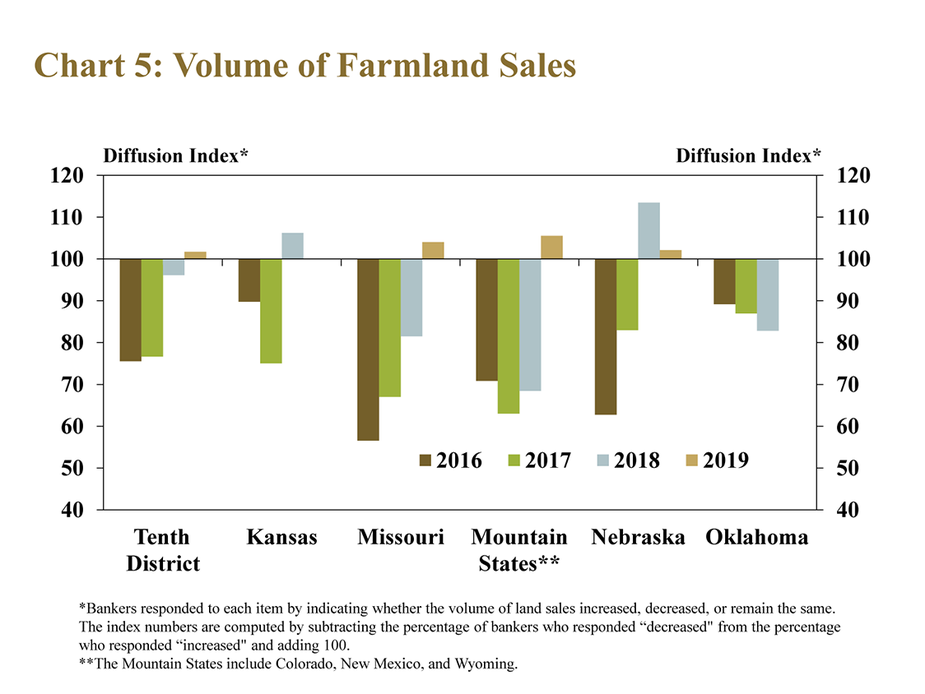

However, some risks remained in the outlook for farmland values, as the volume of farmland sales in the District increased for the first time in several years. The volume of farmland sales increased or remained the same in all states in 2019 (Chart 5). Throughout the downturn in the Tenth District farm economy over the past six years, a persistently low volume of land sales has contributed to the stability of farmland values. However, additional increases in sales could put some downward pressure on values moving forward.

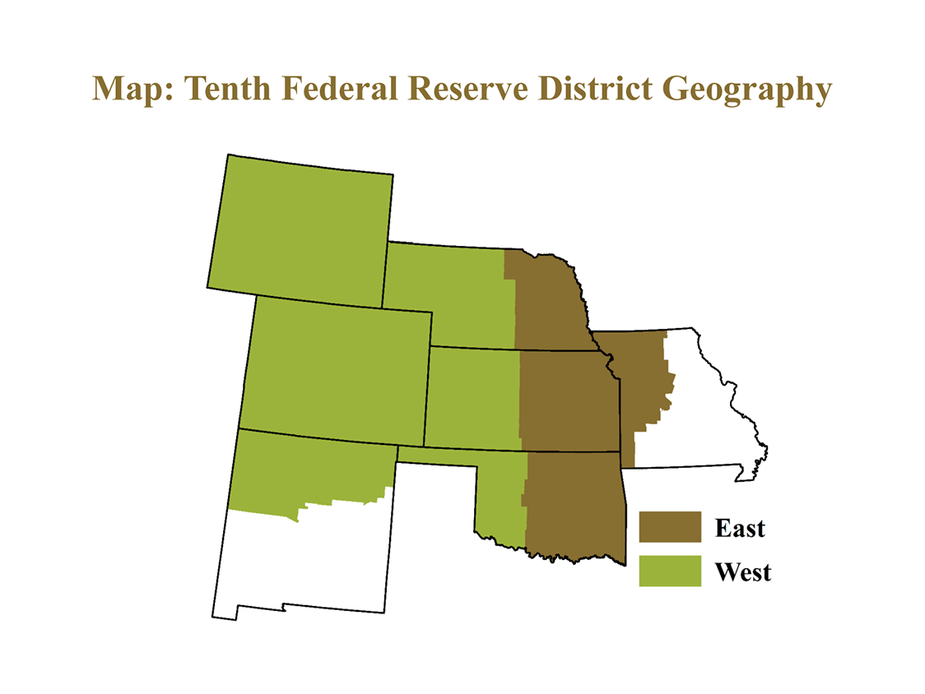

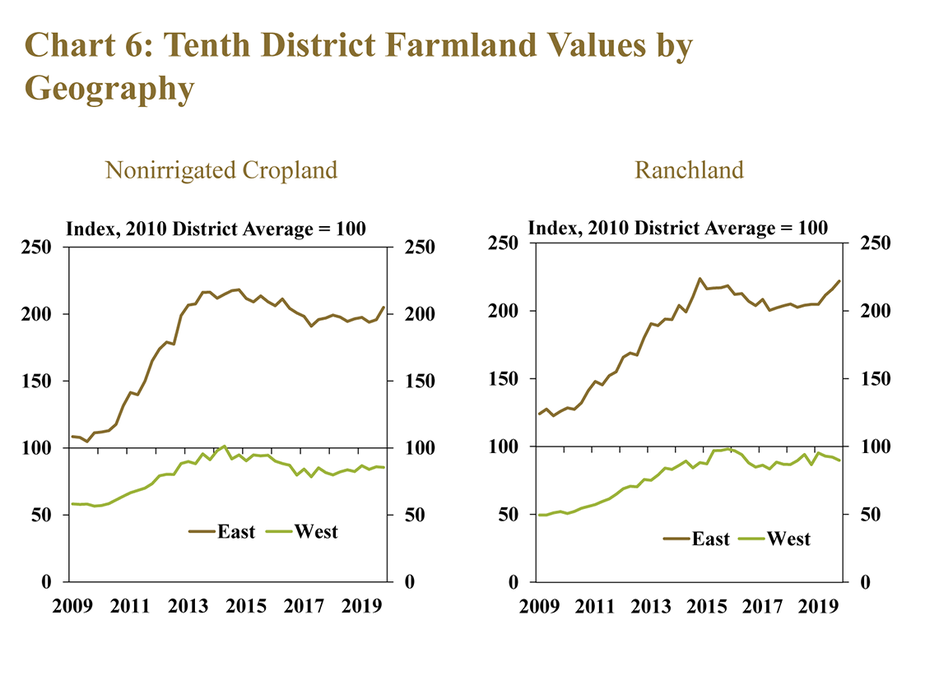

Furthermore, although farmland values have been stable for the District overall, regional disparities have persisted. For example, values for nonirrigated cropland and ranchland grew at a faster pace in the east from 2009 to 2014 (see Map for explanation of geography). In the fourth quarter of 2019, values for nonirrigated cropland and ranchland increased in the eastern portion of the District, while values in the west declined slightly (Chart 6). Several factors, including land quality and proximity to urban areas, could contribute to higher farmland values in the eastern portion of the Tenth District._ However, relative weakness in farmland values in the west could indicate that these areas are more susceptible to financial stress if the agricultural economy weakens further.

Farm Finances and Credit Conditions

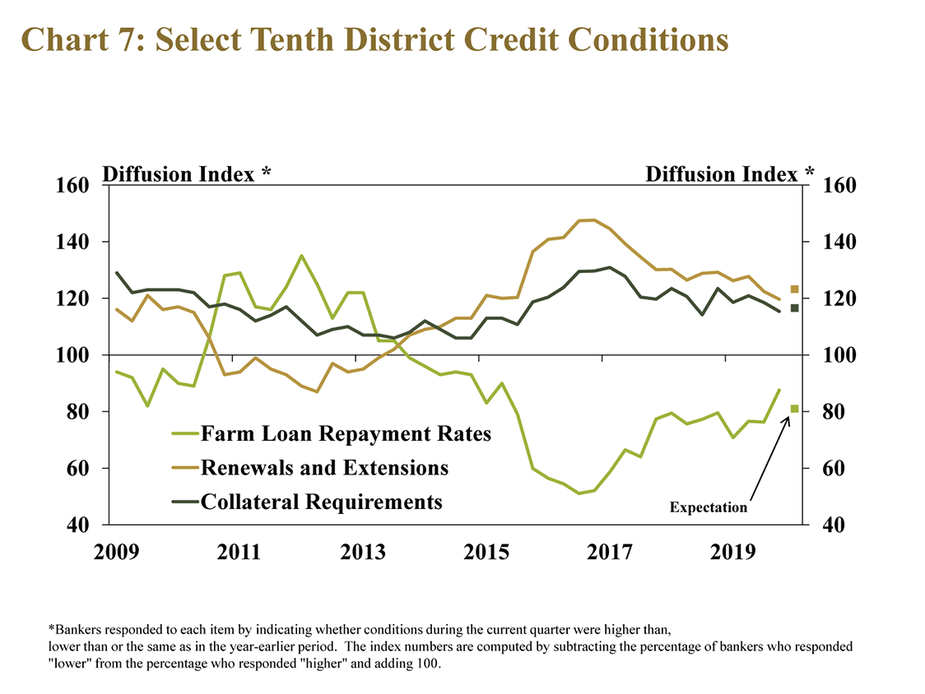

Agricultural credit conditions throughout the District remained relatively weak through year-end, but the pace of deterioration slowed. About a quarter of all bankers continued to report a decline in repayment rates, but it was the lowest share in more than four years (Chart 7). Loan renewals and extensions continued to increase, but also at a slower pace and collateral requirements followed a similar trend. Looking ahead to the coming months, conditions were expected to weaken at a similar rate.

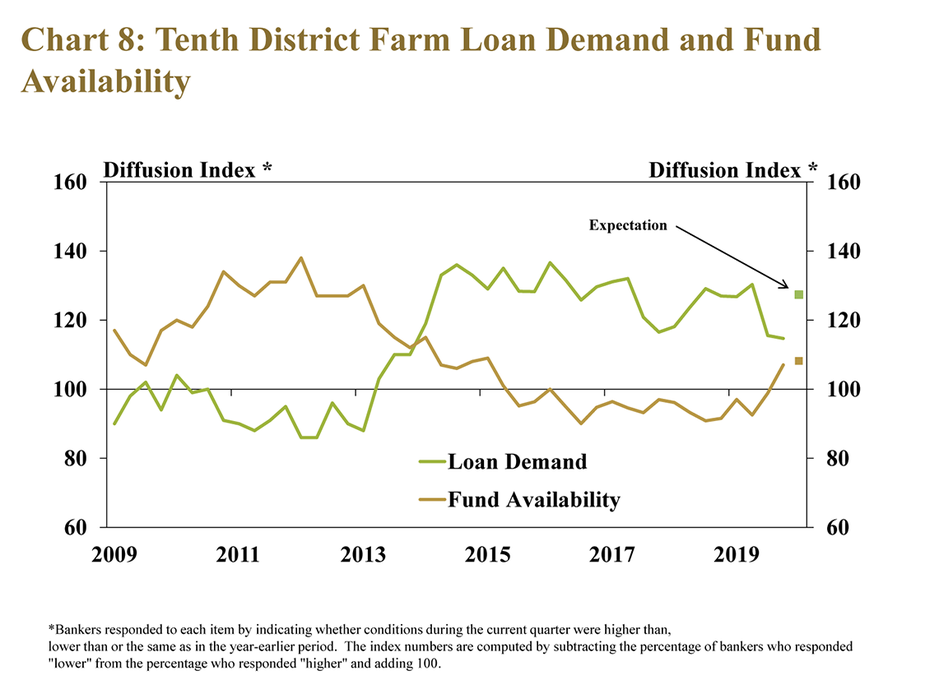

Demand for farm loans remained high across the region, but grew at a slower pace than previous years. Alongside slower growth in loan demand, availability of funds at agricultural banks increased in the fourth quarter (Chart 8). Looking forward, funds at farm banks were expected to increase at a similar pace while loan demand was expected to pick back up to a rate similar to recent years.

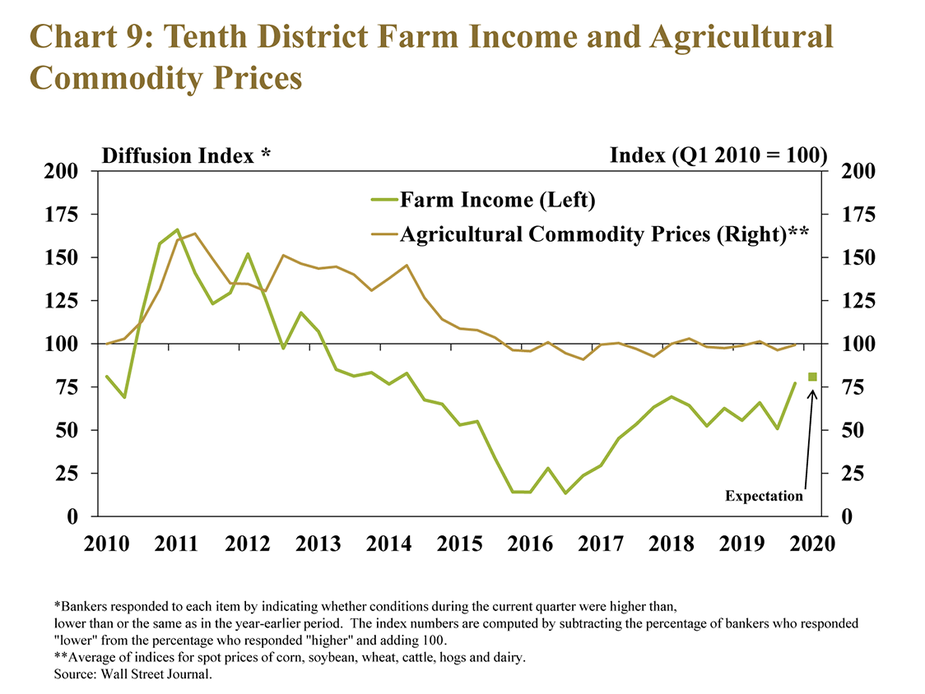

Alongside slower deterioration in other credit indicators, farm income also decreased at a slower pace. About 40 percent of bankers indicated that farm income declined from a year ago, but that was the lowest share since 2014 (Chart 9). Government payments (Market Facilitation Program) connected to trade disputes provided financial support to many producers in 2019. However, farm income in the District remained relatively weak alongside generally low agricultural commodity prices and subdued farm revenues.

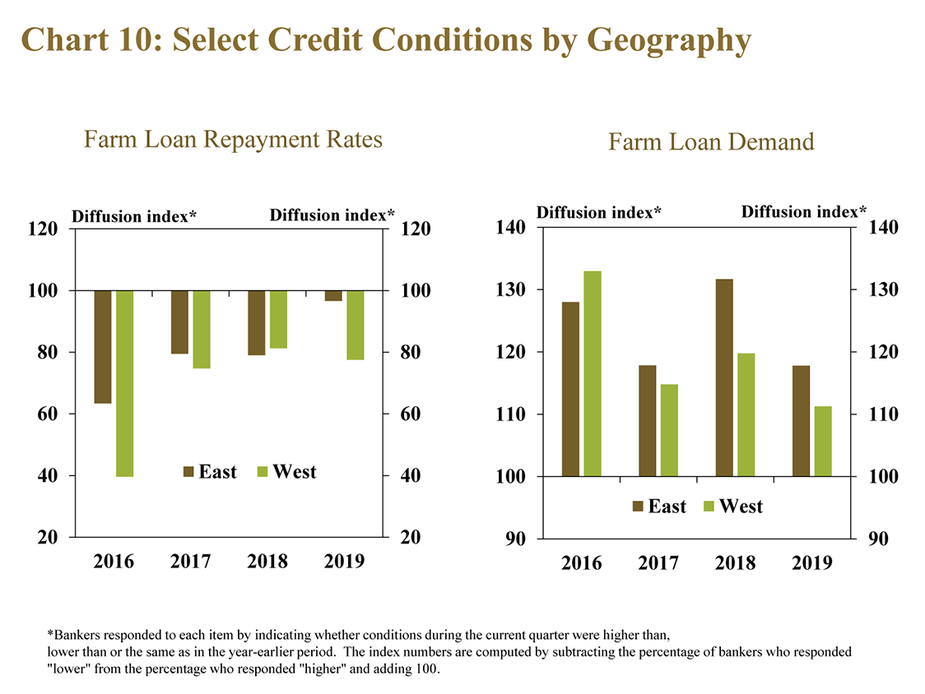

Similar to farm real estate values in the District, some measures of credit conditions varied across geographic area. Farm loan repayment rates decreased at a pace similar to previous years in the west, but appeared to stabilize in the east (Chart 10). The pace of growth in demand for lending slowed slightly in both regions, but similar to previous years, remained slightly lower in the west.

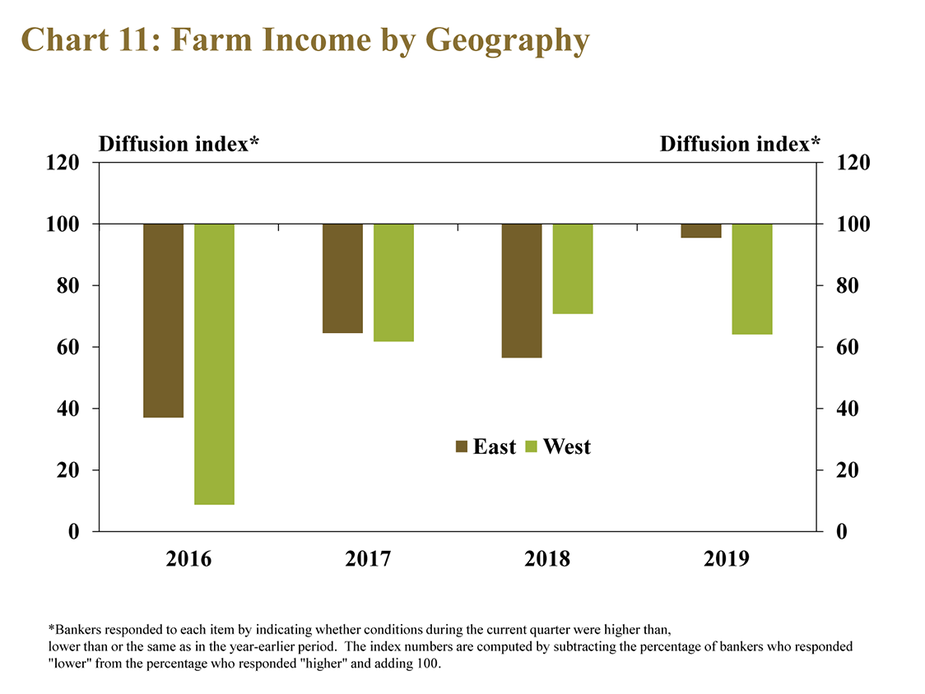

A slower decline in farm income across the District on average was driven by a notably slower pace of decline in the eastern portion of the region. Similar to farm loan repayment rates, farm income was comparably weaker in the west during the fourth quarter (Chart 11). Farm income declined at a pace similar to previous years in the west, but appeared to strengthen slightly in the east.

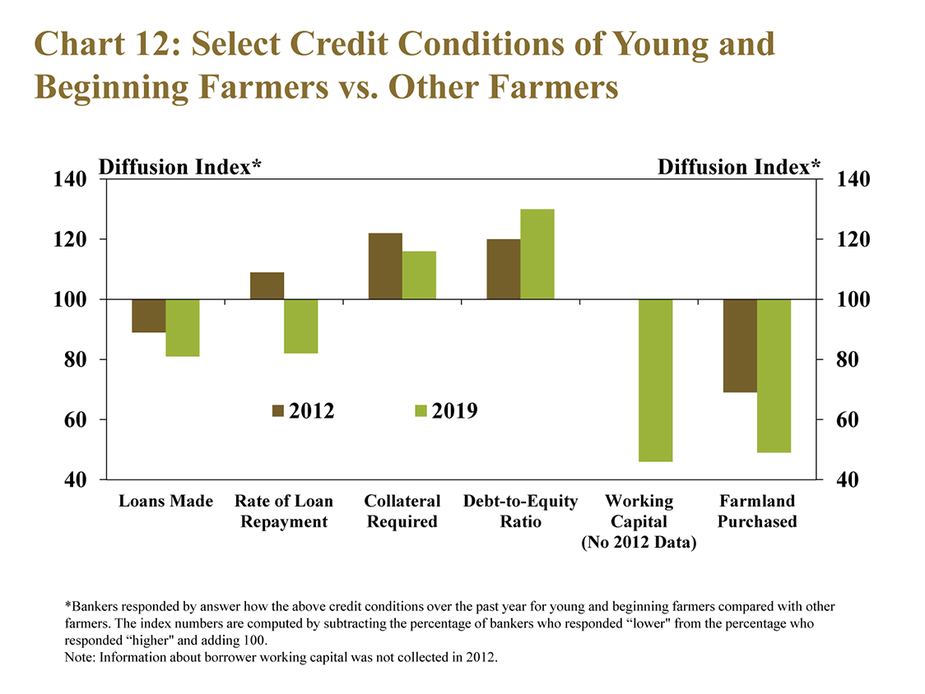

In addition to differences across geography, credit conditions of young and beginning operators were relatively weaker than other farmers in 2019. Less-established producers continued to face a comparatively higher degree of financial stress, and the disparities have increased slightly in recent years (Chart 12). Loan demand among those borrowers was slightly higher, while loan repayment was slower and lenders required higher amounts of collateral. Those producers also were more highly leveraged, had weaker cash flow and purchased less farmland.

Conclusion

In the fourth quarter, farmland values strengthened, providing some stability for the Tenth District farm economy. Reduced borrowing costs and strong demand may have contributed to recent strength in land values. Although farm income and credit conditions remained weak, most indicators appeared to stabilize. Some bankers commented on the positive support from trade relief payments, but a larger share of bankers expressed concerns about persistently low commodity prices. In addition to the future path of agricultural prices, the outlook for agricultural credit conditions through 2020 also may depend on prospects of additional support from government payments.

_________________________________________________________________

Banker Comments from the Tenth District

Grain and cattle prices were down this year causing a loss for some farmers. We will have to term out more losses this year than what we have had to in the past. – Northeastern Colorado

Government payments have made a big impact on the profitability of farm operations. – Southwestern Kansas

Commodity markets are too low. Good farm management practices and marketing are essential to our farm customers. – Northwestern Kansas

If it wasn't for the MFP payments, we would have carryover debt issues on all operating lines of credit. – Central Kansas

Government payments represented the largest share of positive net income and the majority of operations would likely have negative margins in their absence. – Northwestern Missouri

The wet weather is still affecting the farmers getting finished with harvest into December. Farmers are working hard on lowering their input costs with prices not looking too promising in the future. - Southwestern Missouri

The MFP kept the balance sheets in check in 2019. - Southeastern Nebraska

In addition to low commodity markets negatively impacting local producers, continued weather concerns are also still affecting our cattle producers (ex. low preg rates, lower hay production). – Central Nebraska

The outlook in our area all depends on commodity prices and oil and gas income. – Central Oklahoma

The overall decrease in cattle prices during 2019 is probably the number one concern in this area for our customer base. – Southeastern Oklahoma

Late planting this spring and cold, wet weather this fall led to pretty significant crop losses for a lot of local farmers. Sugar beet producers have suffered another huge setback, with as much as 70 percent of the crop left in the ground. – Northern Wyoming

Young and beginning producers continue to lack capital needed to enter ag production and returns are not sufficient to support debt repayment and family living expenses without off farm income. – Central Wyoming

Endnotes

-

1

For more information on farmland values in the Tenth District, see this article.

A total of 174 banks responded to the Fourth Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to Cortney Cowley, economist or Ty Kreitman, assistant economist at 1-800-333-1040.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.