Farm income in the Tenth District dropped in the third quarter, intensifying concerns about farm sector liquidity and credit conditions in the coming months. Bankers generally expected farmers to continue to cut spending on capital and household purchases as a response to weaker profit margins. Still, loan demand was expected to continue rising while additional declines in repayment rates were expected in the months ahead, creating unease over potential carry-over debt levels. Alongside weaker farm incomes, District bankers also expected farmland markets to cool further throughout the Tenth District.

Farm Income and Spending

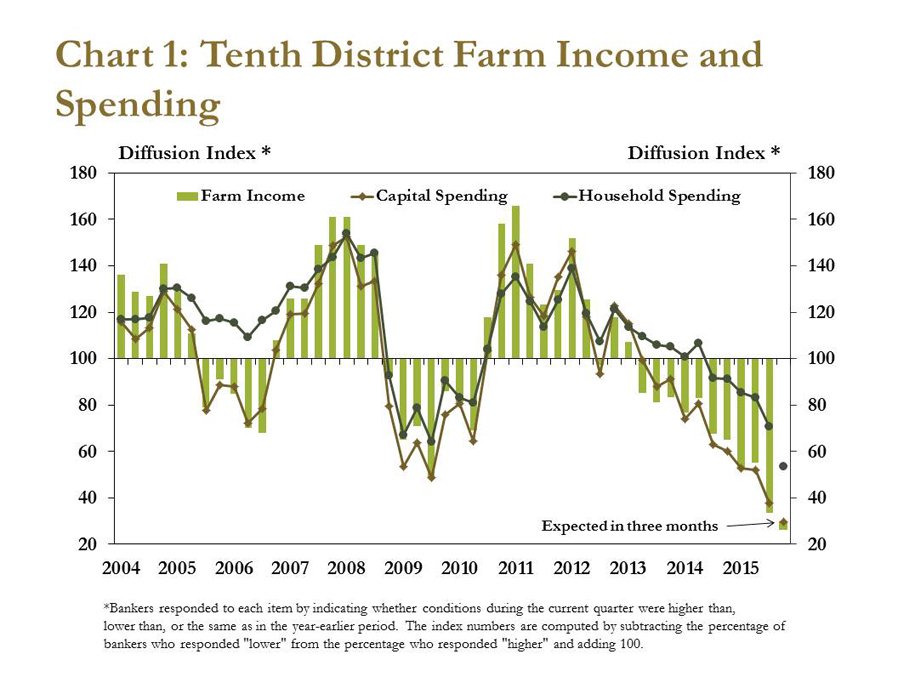

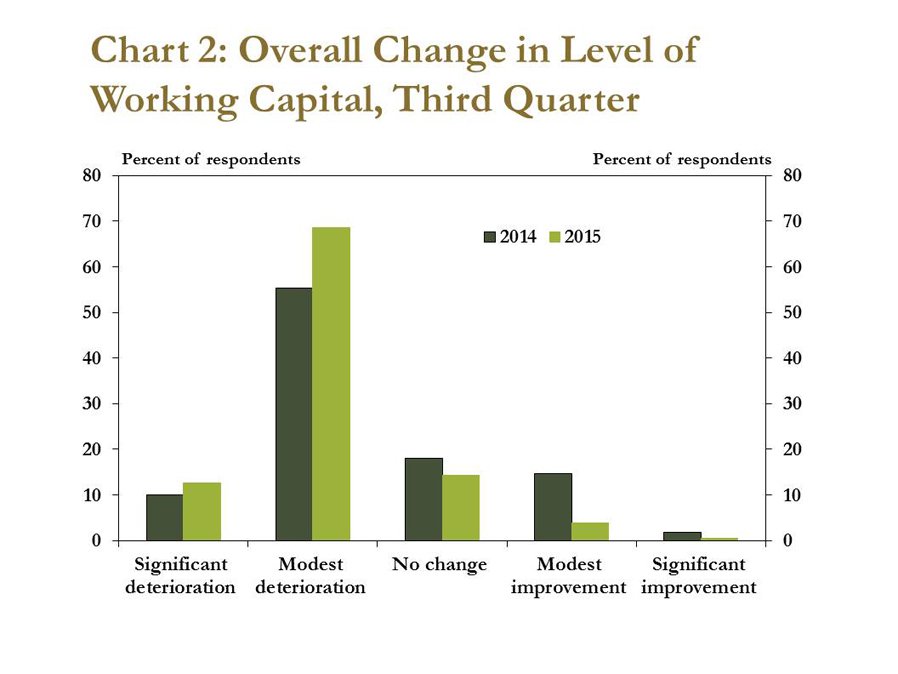

Farm income fell sharply in the third quarter, according to respondents of the Tenth District Survey of Agricultural Credit Conditions. Although the Tenth District survey measure of farm income has declined for several consecutive quarters, the drop in the third quarter was especially severe. In fact, 68 percent of bankers reported lower farm incomes relative to a year ago (Chart 1). The downbeat expectations for farm income in the District were consistent with recent national forecasts. According to third-quarter revisions, the USDA expected farm income to drop 36 percent this year compared to last year. Although the ebb in capital spending was similar to that of farm income, fewer bankers reported a decline in household spending. Compared to the same period last year, 65 percent of survey respondents reported lower capital spending in the third quarter. However, only 35 percent indicated household spending decreased from a year ago. Prior to 2013, household spending had tracked relatively closely with farm income and capital spending. Since 2013, however, household spending generally has been slower to come down, following multiple years of extraordinary profits. A majority of surveyed bankers expected farm incomes to continue to fall, but some also noted that further reductions in household spending may be needed to maintain adequate working capital and cash flow. Reductions in farm income have continued to raise concerns about the liquidity of some District farm borrowers. In 2015, 81 percent of bankers reported a significant or modest deterioration in the overall level of working capital for crop producers, up from 65 percent in 2014 (Chart 2). Expectations of further slumps in District farm income have caused agricultural lenders to continue to stress the importance of maintaining adequate levels of working capital, especially for highly leveraged producers.

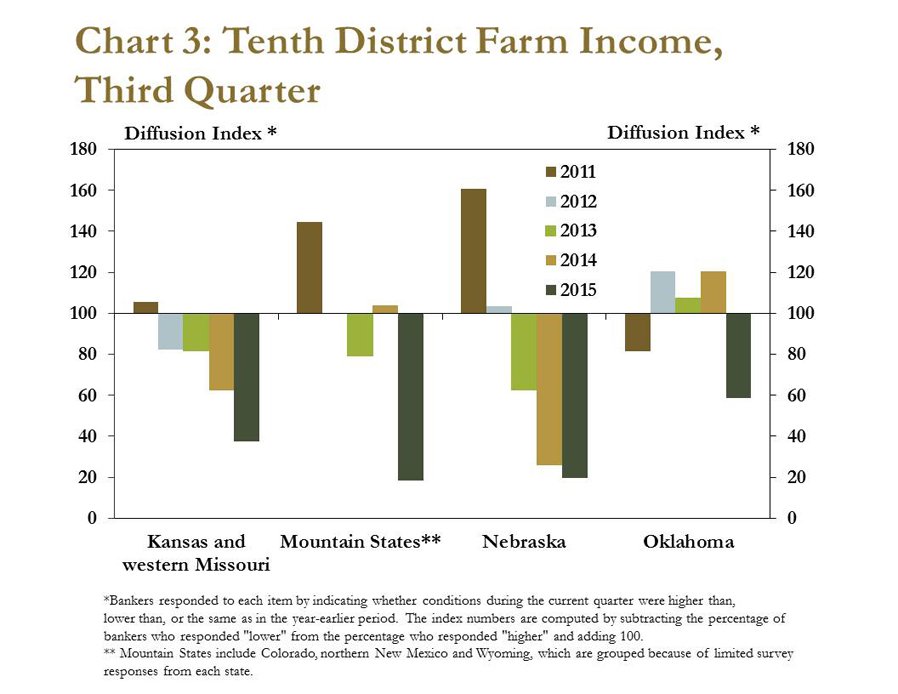

In the Tenth District, third-quarter farm income fell across all states for the first time in several years. Bankers in Oklahoma and the Mountain States reported the largest downward shifts from previous years, possibly due to the timing of the survey (Chart 3). During the survey reporting period, live cattle prices slipped by about 17 percent and feeder cattle prices dropped by 22 percent. A three-month downturn in cattle prices could have contributed to more pessimistic farm income outlooks in cattle-producing states. As in recent years, farm income continued to decline steadily in states more concentrated in crop production.

Credit Conditions

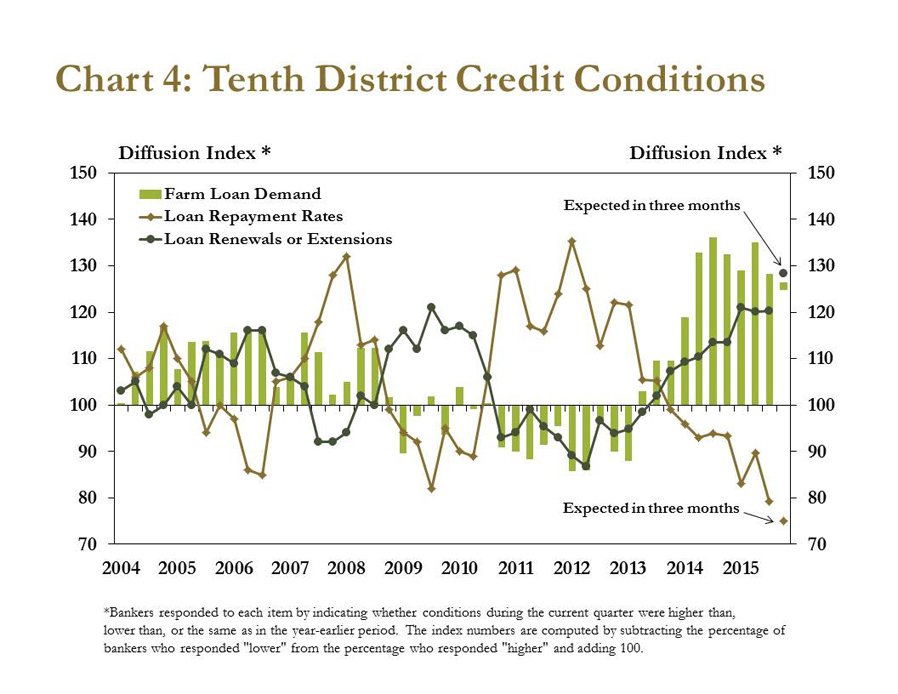

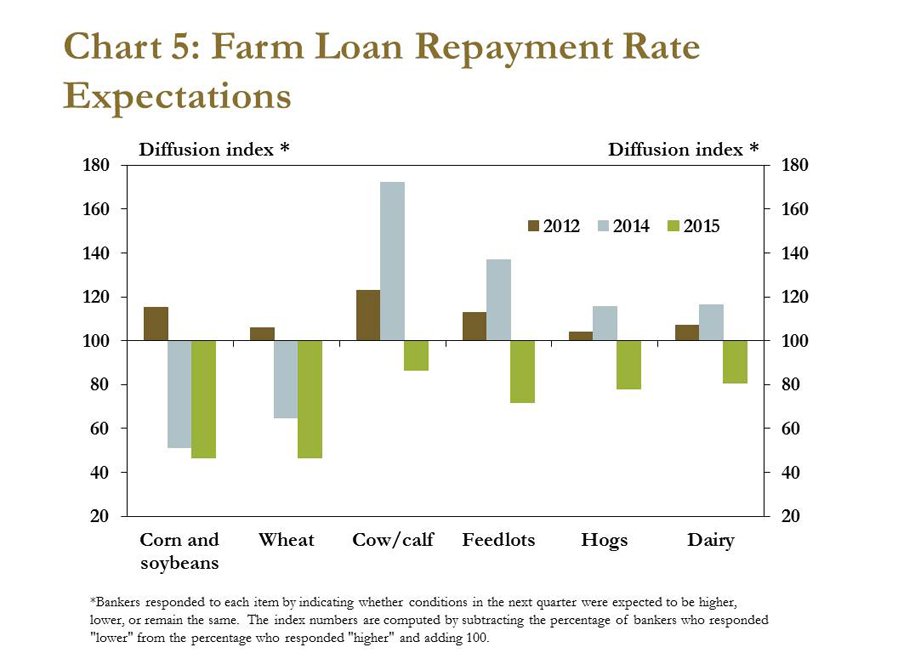

Reduced farm income continued to weaken credit conditions at agricultural banks in the third quarter. District bankers indicated that farm loan repayment rates dropped for an eighth consecutive quarter in the most recent survey (Chart 4). Bankers expected repayment rates to deteriorate further in the fourth quarter and to decline for both crop and livestock producers in that time (Chart 5). The shift in expectations for future repayment rates was particularly notable for livestock producers, however. For example, 33 percent of bankers expected lower repayment rates for feedlot operators in the next three months, up from only 3 percent a year ago. Moreover, bankers in each state in the District expected repayment rates to continue to fall in the fourth quarter.

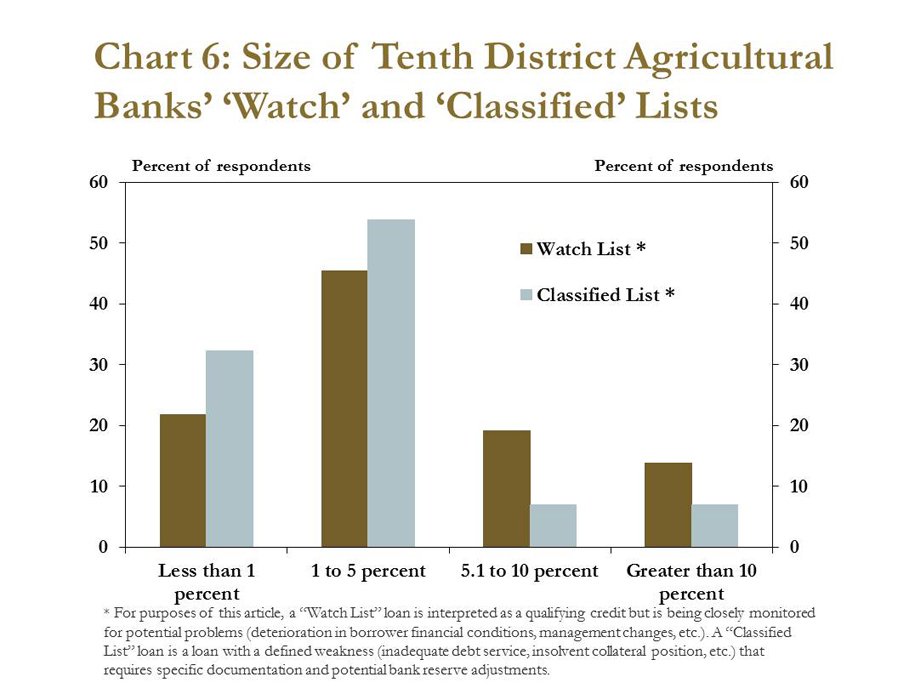

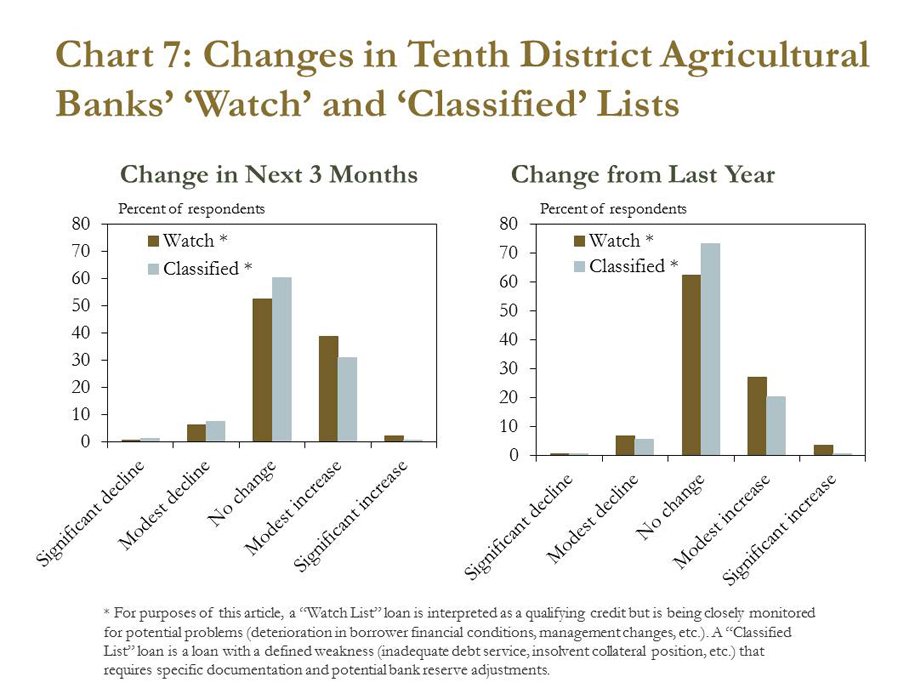

Further declines in farm income continued to boost the demand for financing at the District’s agricultural banks, representing the 10th consecutive quarter of rising demand. Requests for renewals and extensions also continued to grow at a pace similar to the previous two quarters. In the third quarter, for example, renewals and extensions rose 6 percent from a year ago following an average increase of nearly 10 percent in the first half of 2015 from the first half of 2014. Similar to expectations of softening repayment rates, bankers also expected further increases in renewals and extensions in the fourth quarter, in addition to a general increase in farm loan demand. Increasing demand for farm loans and softening repayment rates have raised concerns about future farm loan performance at District agricultural banks. The majority of agricultural banks in the third quarter reported less than 5 percent of farm loan volume had been placed on a “classified” list or a “watch” list (Chart 6). However, 30 percent of District bankers reported an increased share of farm loan volume on the watch list from a year ago (Chart 7). Moreover, nearly half of bankers surveyed expected their watch list and classified list to expand over the next three months (Chart 7).

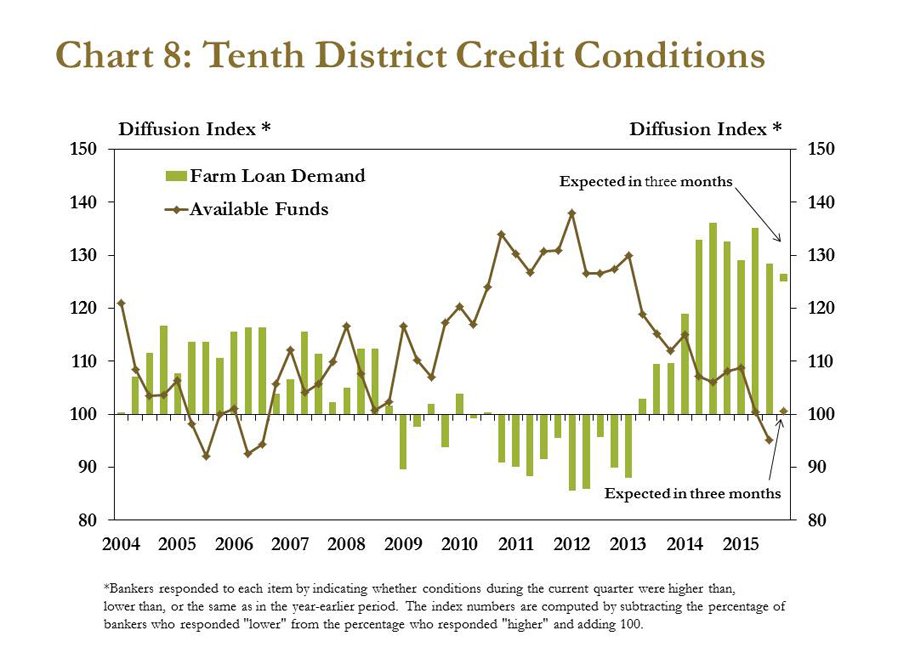

Softening credit conditions and concerns highlighted by expanding watch and classified lists have pinched available funds at District agricultural banks. For the first time since 2006, bankers indicated there were fewer funds available to match farm loan demand (Chart 8). Bankers also generally expected very little change in available funds in the coming quarter despite persistent increases in loan demand.

Farmland Values

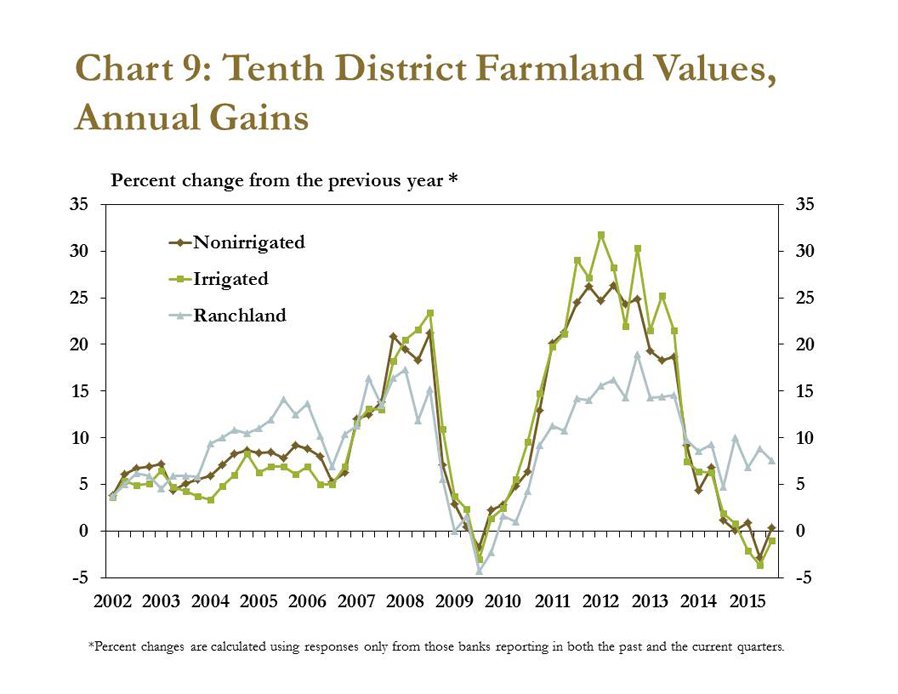

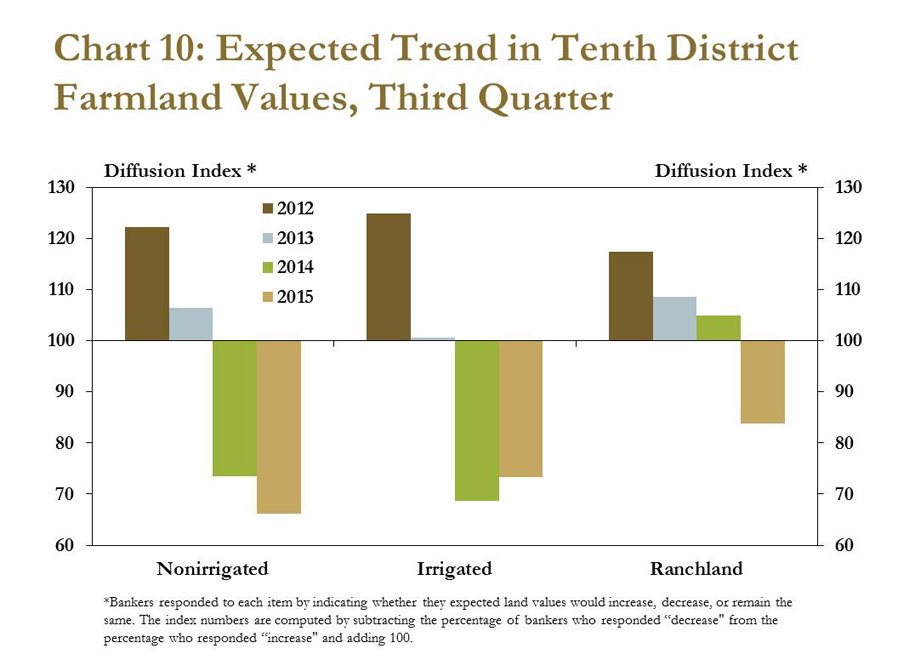

Waning farm income has also stifled growth in farmland values. Although ranchland values continued to increase modestly, there was only minimal change from a year ago in the values of nonirrigated and irrigated cropland (Chart 9). Bankers also reported that they expected nonirrigated cropland, irrigated cropland and ranchland values to decrease in the next quarter (Chart 10). These expectations mark the first time in six years that bankers expected values in each category of farmland to fall in the months ahead.

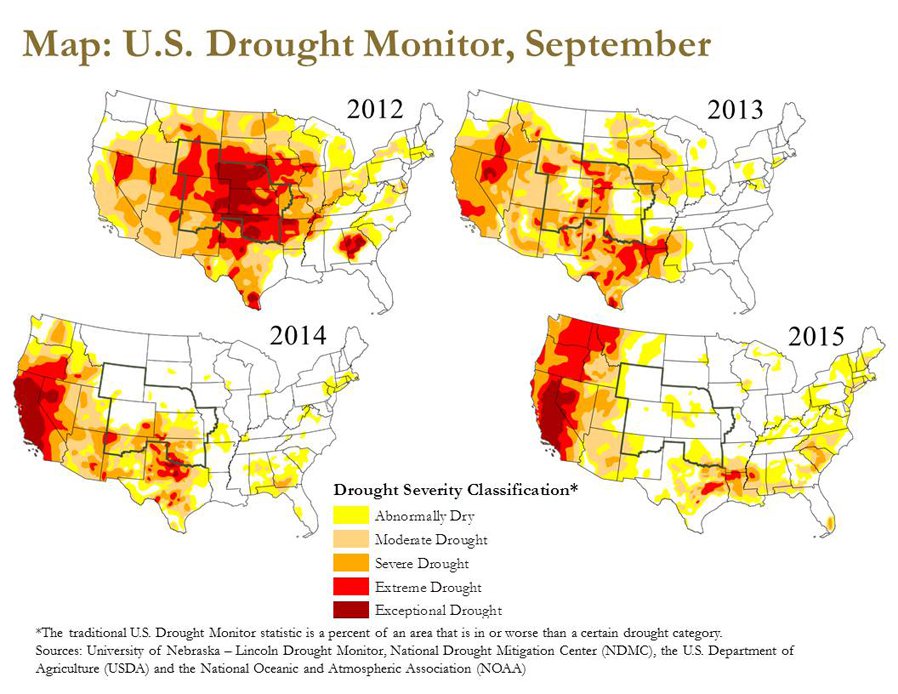

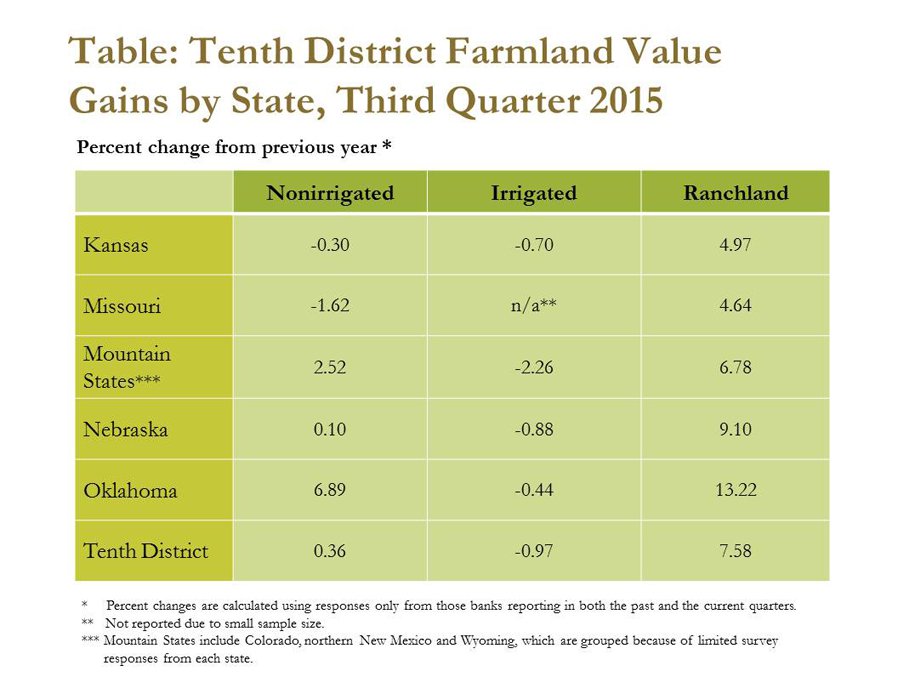

Changes in land values remained largely consistent across District states. Irrigated cropland values dipped slightly in all District states as drought conditions improved from recent years through the summer growing season (Map). Nonirrigated cropland values remained relatively steady throughout the District, except in Oklahoma, where values continued to rise at a modest pace (Table). Similar to recent quarters, ranchland values also increased more notably in Oklahoma relative to other District states.

Conclusion

Diminishing farm income cut agricultural producers’ spending levels, and credit conditions deteriorated further in the third quarter. Following increased demand for renewals and extensions, and weaker repayment rates, many bankers expected the downturn to put more pressure on agricultural loan portfolios in the months ahead. Amid the downturn, credit availability also appeared to decline slightly despite the increased loan demand, raising some concern for producers seeking additional financing or debt restructuring toward year’s end.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.