Farm credit conditions in the Federal Reserve’s Tenth District continued to deteriorate steadily in the third quarter of 2019. Despite a slight increase in the price of some agricultural commodities and additional support from government payments, farm income and loan repayment rates declined at a modest pace. According to District bankers, agricultural economic conditions in the quarter were influenced by uncertainty about crop production, agricultural trade and other factors that contributed to commodity price fluctuations. Persistent weaknesses in the sector put further pressure on farm finances and signs of modest increases in credit stress remained. Farmland values, however, remained stable, and provided ongoing support for the sector.

Data

Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

Farm Income and Borrower Finances

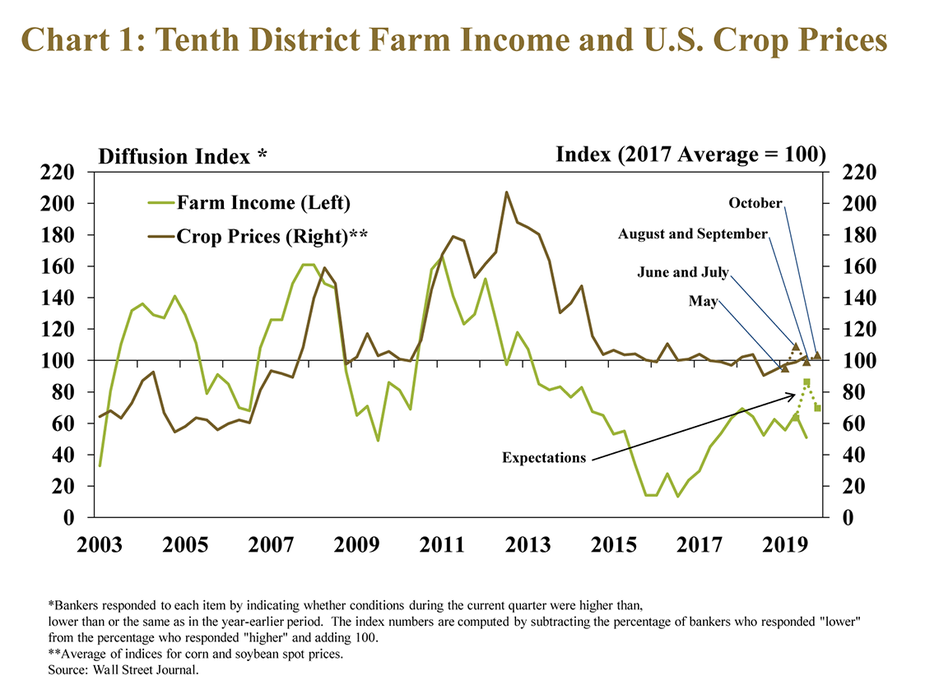

Farm income in the region remained relatively weak and continued to decline, according to the Tenth District Survey of Agricultural Credit Conditions. Despite slightly higher crop prices and support from trade relief payments, farm income decreased compared with a year ago (Chart 1). Recent volatility in crop prices appeared to affect bankers’ perceptions of agricultural conditions in the third quarter, and respondents indicated that farm income declined more than had been expected a quarter earlier. In August, cattle prices dropped sharply in response to substantial disruptions at a major beef processing facility, which weighed on income in the third quarter and affected expectations.

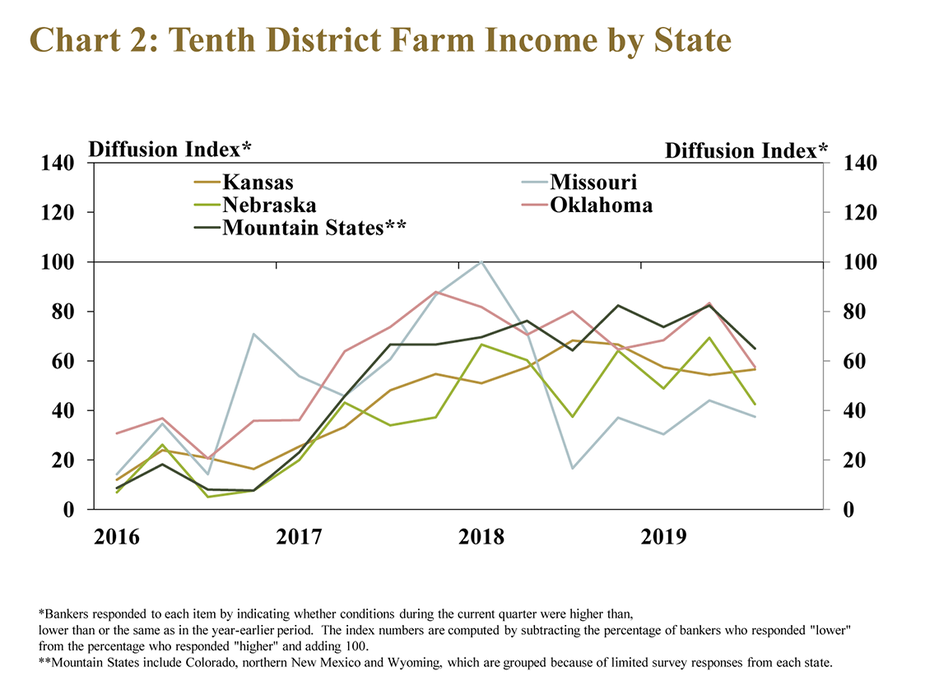

Farm income decreased from a year ago across all states in the region, with some variation in the pace of decline. Compared with other District states, crop conditions through October were slightly worse in Missouri and slightly better in Nebraska. Alongside production variability, income weakened at the fastest pace in Missouri, following sharp declines in 2018 (Chart 2). In addition, a steep decline in cattle prices also contributed to lower farm income across other District states.

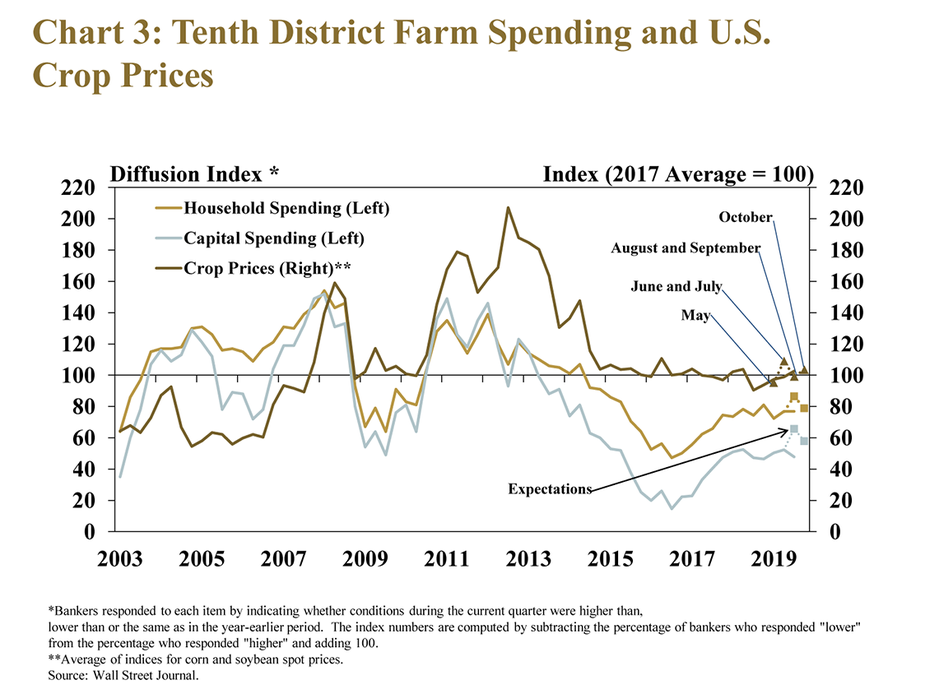

Farm borrowers made additional cuts to spending in response to an ongoing environment of subdued revenue. Similar to farm income, farm household and capital spending continued to decline while the outlook for spending also has been affected by recent volatility in commodity prices (Chart 3). Amid tight profit margins, operators have reduced capital spending at a consistently faster pace than household spending; bankers indicated they expect that trend to continue.

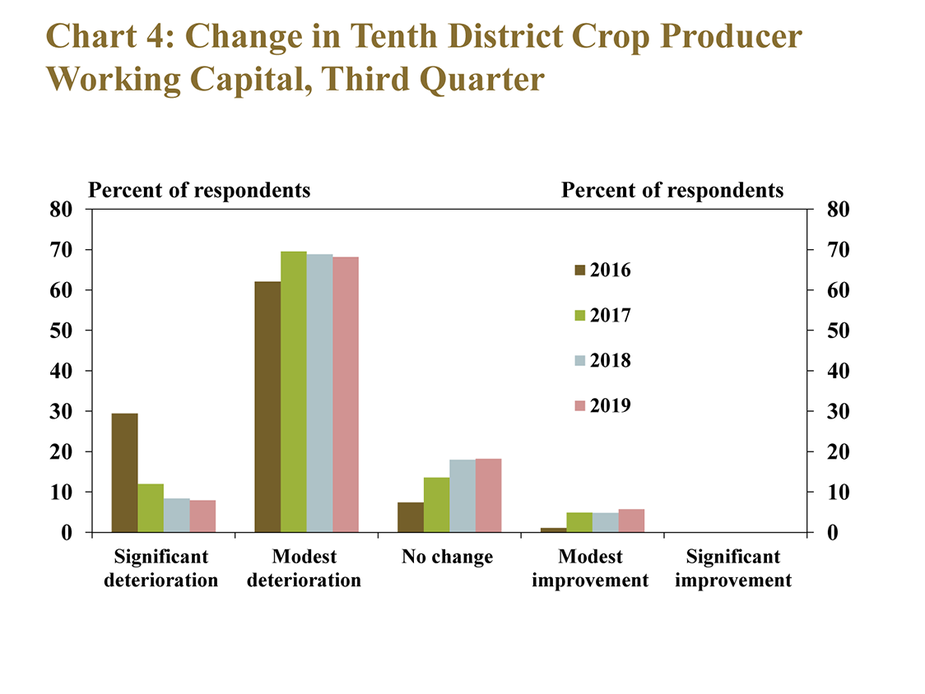

Ongoing reductions in farm income put further downward pressure on liquidity positions of crop producers. Working capital deteriorated at a modest pace throughout the District for the sixth consecutive year, but weaknesses were less severe than in prior years (Chart 4). About 75 percent of bankers reported that working capital of crop farmers deteriorated at least modestly in 2019, compared with over 90 percent in 2016.

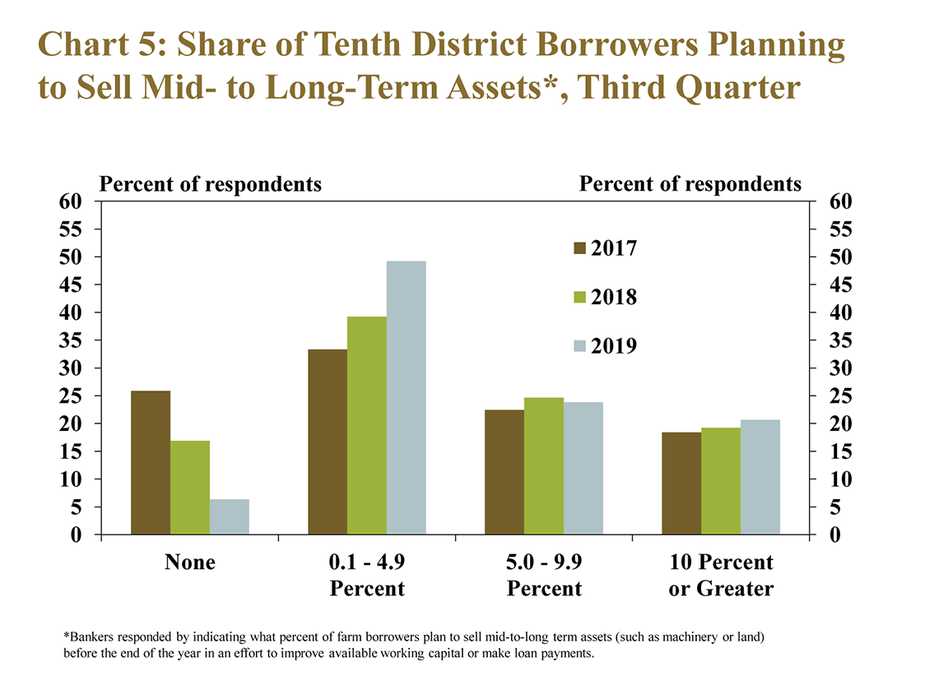

Steady deterioration of farm finances led to a modest amount of borrowers selling assets to improve liquidity. Similar to last year, about half of District bankers indicated they expect at least 5 percent of their borrowers to sell assets before year-end (Chart 5). Almost all survey respondents indicated they expect some borrowers to liquidate assets in coming months, a sign of broad impacts from persistent weaknesses in the sector and long-lasting pressure on farm finances.

Credit Conditions

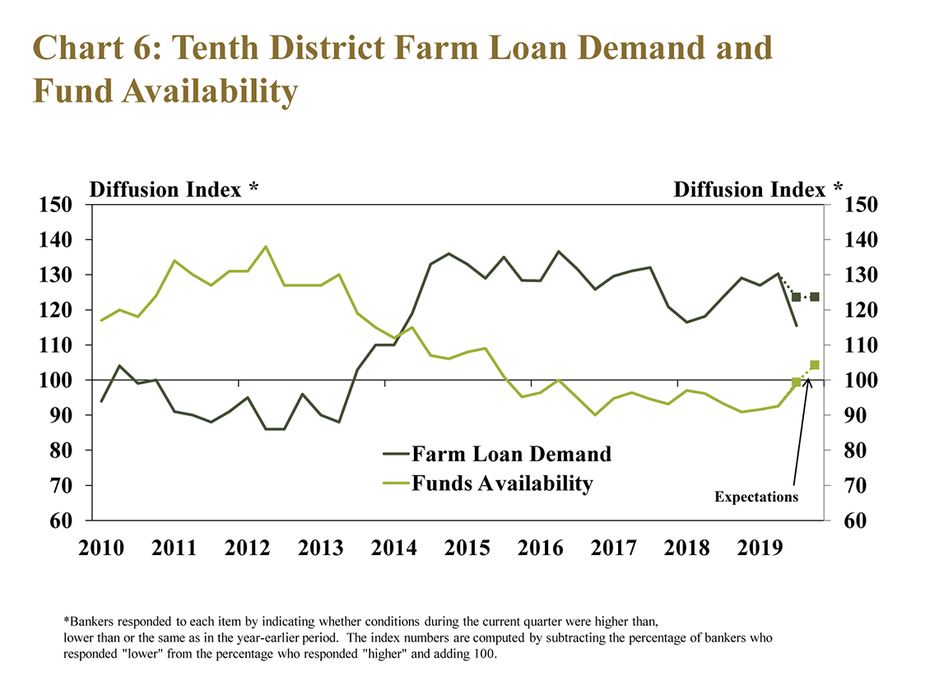

Demand for farm loans remained strong and continued to increase, but the pace of growth slowed from previous quarters. Loan demand, on average, grew across the District for the sixth straight year, but the share of respondents indicating demand was higher reached the lowest level since late 2013 (Chart 6). Despite slightly slower growth, demand was expected to remain high into the next quarter. The availability of funds at agricultural banks was little changed from a year ago. Expectations for the next quarter were for a slight increase in available funds, which would be the first increase in nearly four years.

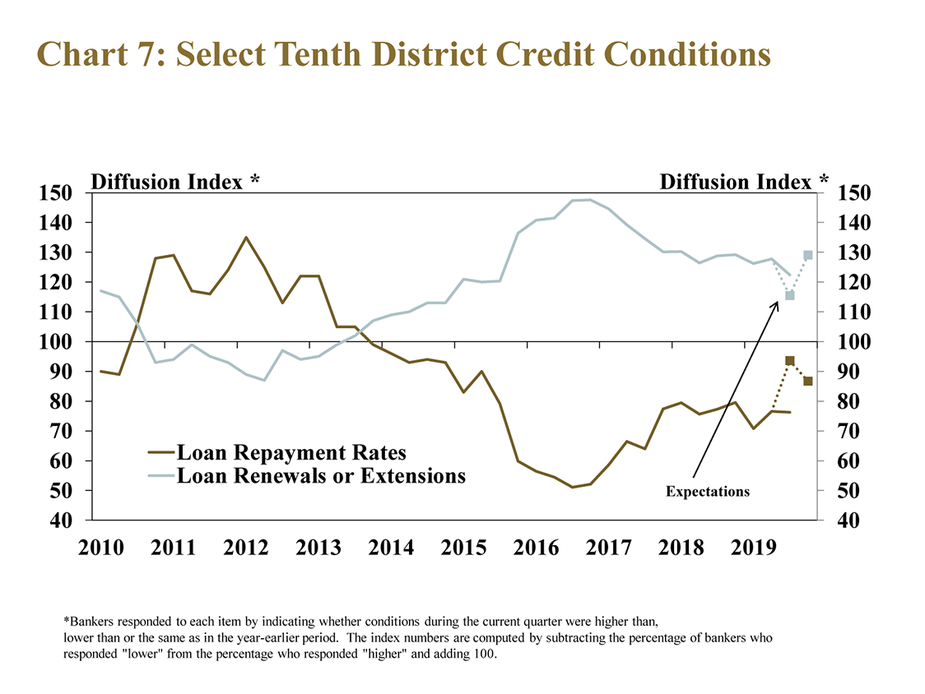

The strain on farm finances in the District has led to steady deterioration of agricultural credit conditions. The rate of farm loan repayments continued to decline, at a pace similar to recent quarters, while the number of renewals and extensions remained high (Chart 7). Similar to farm income, repayment rates in the third quarter were much slower than expected. Looking forward, bankers remained more optimistic than in the current quarter, but indicated they expected the modest deterioration to continue.

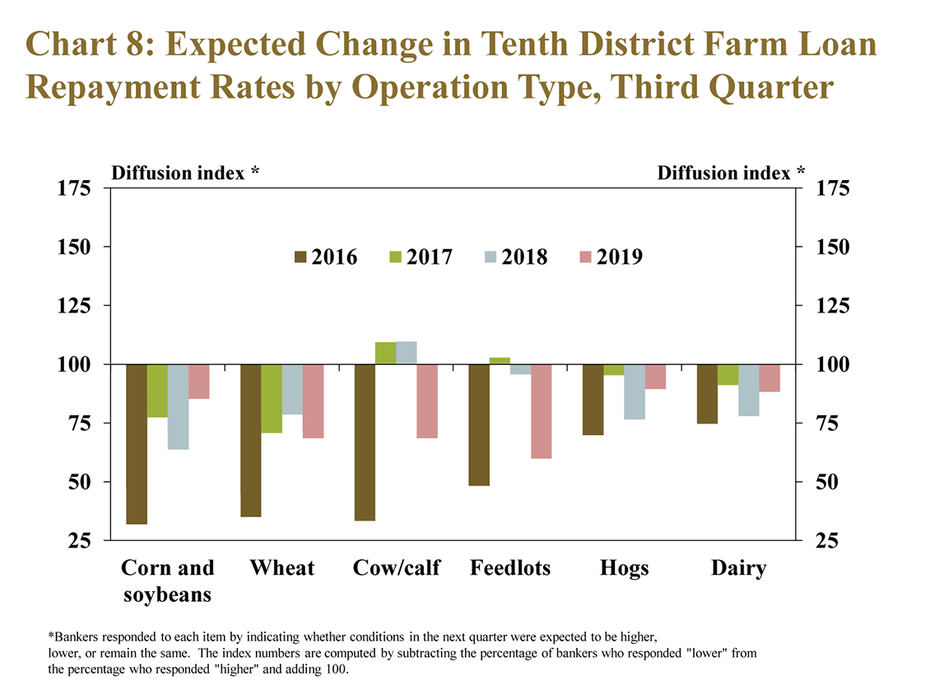

Compared with a year ago, the outlook for repayment rates through year-end varied by the type of operation. Following a sharp drop in cattle prices during the summer and reduced revenues for some producers, bankers expected repayment rates to weaken considerably for cow/calf and feeding operations relative to last year (Chart 8). In contrast, slightly higher prices and improved revenues for most other major commodities led to predictions of a slightly slower pace of decline in repayment rates for those borrowers compared with last year.

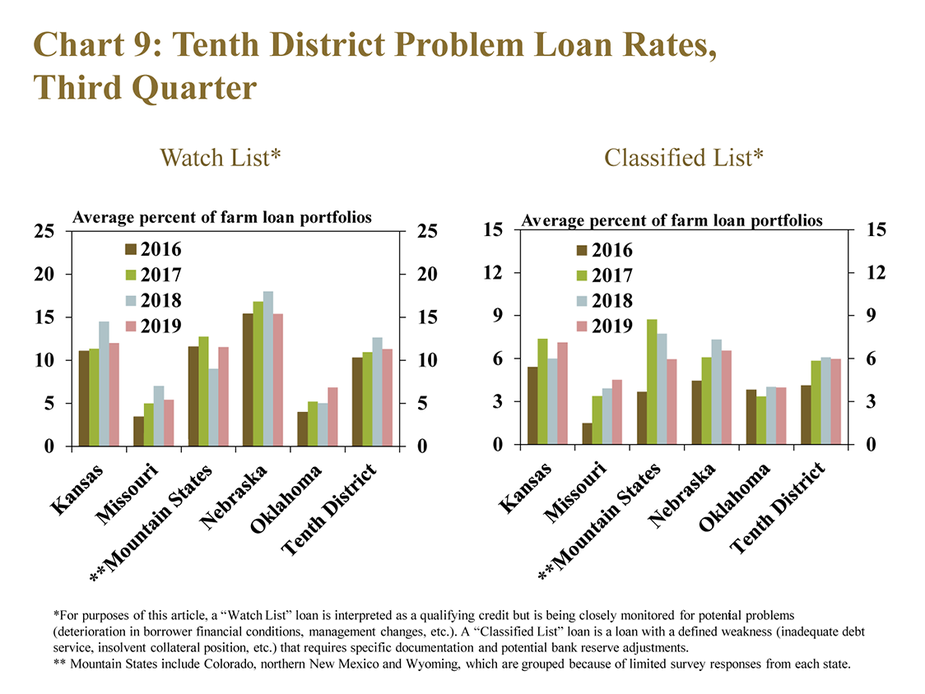

Alongside modest deterioration in borrower finances and slower repayment rates, the share of problem loans was steady and the increase in overall credit risk associated with farm loans remained modest. On average across the District, about 10 percent of farm loan portfolios were on the watch list and about 6 percent were considered classified (Chart 9). The percent of farm borrowers on the bank watch lists was highest in Nebraska, while the classification rate was highest in Kansas.

Interest Rates and Farmland Values

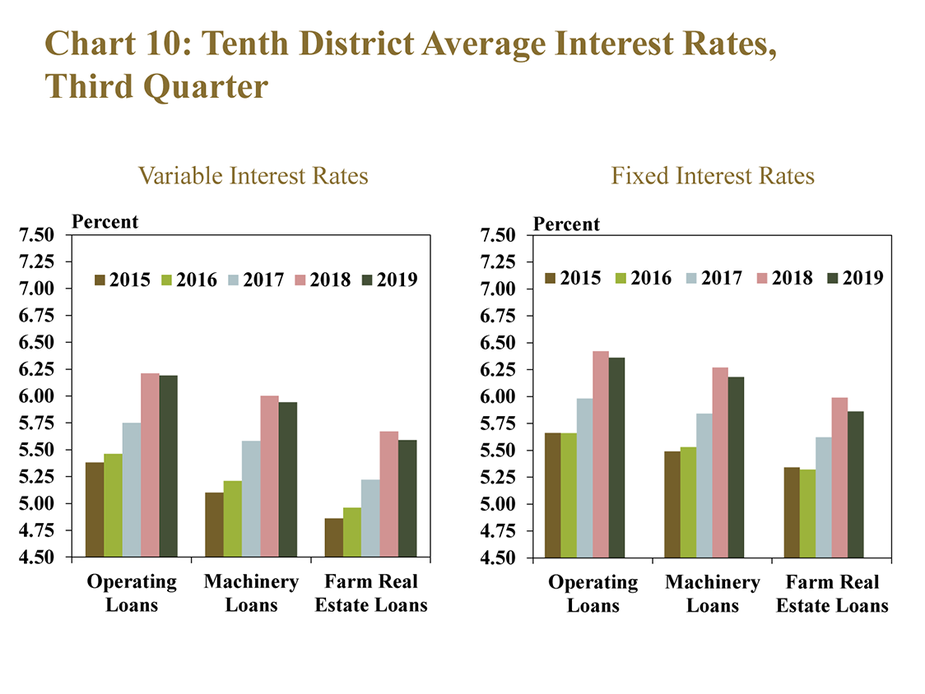

Following nearly five years of steady increases, interest rates on farm loans declined slightly in the third quarter. Both variable and fixed rates for all types of farm loans decreased from a year ago, with fixed rates on farm real estate loans showing the largest decline (Chart 10). Fixed rates decreased slightly more than comparable variable rates and the spread between fixed and variable rates inched slightly higher across all loan types compared with last quarter.

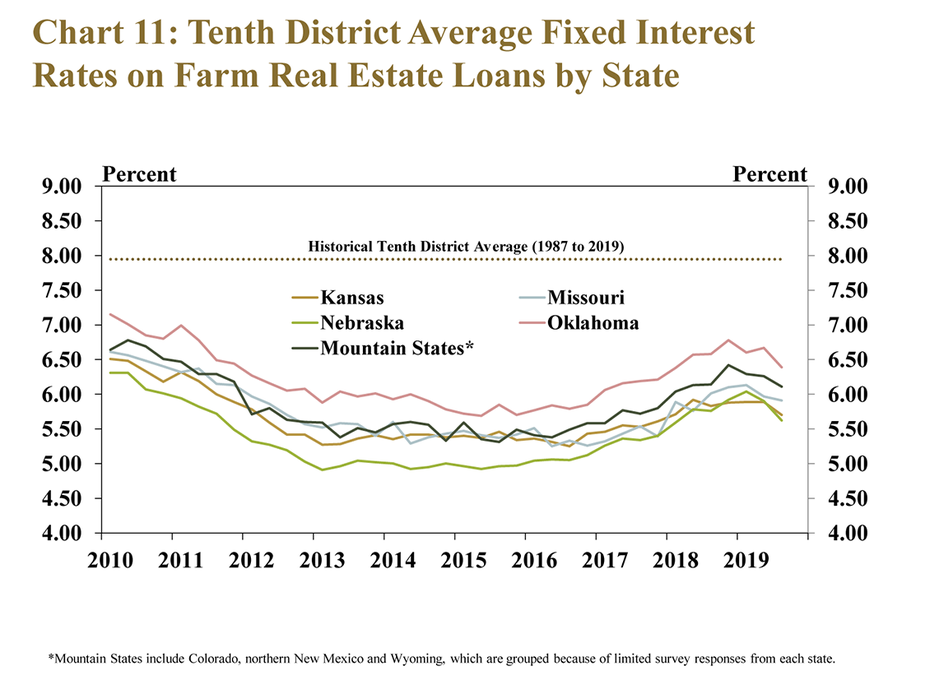

Consistent with the region, on average, fixed interest rates on farm real estate loans declined slightly in all District states. Rates declined slightly more in Oklahoma, Nebraska and Kansas compared with Missouri and the Mountain States (Chart 11). Fixed rates on operating loans also remained highest in Oklahoma, consistent with historical trends.

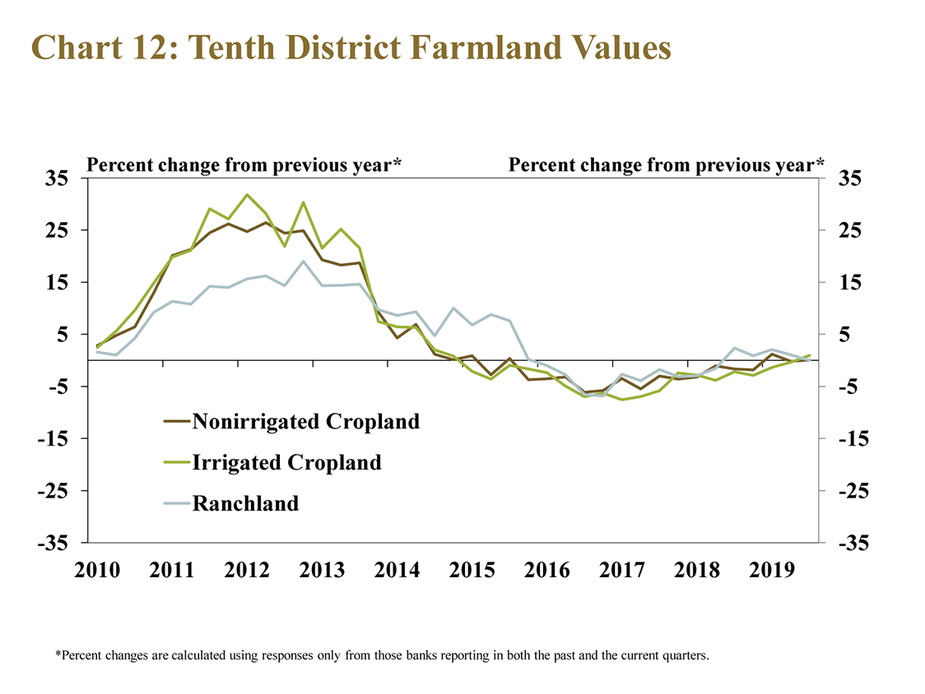

Steady farmland values continued to provide support to farm finances amid an ongoing environment of weaker agricultural economic conditions. The values of all types of farmland (nonirrigated cropland, irrigated cropland and ranchland) remained similar to values a year ago (Chart 12). Although land values, on average, have declined since 2015, the decrease has been modest relative to the sharp increases in preceding years. Moreover, farmland values have shown some signs of stabilizing since 2018.

Conclusion

Bankers in the Kansas City Fed region expected agricultural credit conditions and farm income to continue to decline in coming months. Although numerous contacts indicated that government payments connected to ongoing trade disputes provided some support, most bankers pointed to an ongoing environment of low agricultural commodity prices and elevated costs as the primary factors contributing to the weakness. As profit opportunities have remained limited, borrower liquidity has continued to decline and most bankers expected a modest increase in asset liquidation. The stability of farm real estate values has continued to provide support to farm finances, and likely will be a key determinant of credit conditions in the year ahead.

____________________________________________________________

Banker Comments from the Tenth District

Late planted crops made it especially hard to project farm income before harvest is complete. – Southwestern Missouri

MFP payments and plentiful rainfall have generally improved our farm loan conditions. – Central Kansas

Commodity prices are still low, but increased production is offsetting some of the effect of low prices. – Southeastern Colorado

The MFP has helped alleviate some stress in our area and nearly all in our area expect to meet their obligations. – Central Missouri

Some producers have indicated the need to upgrade equipment but are trying to wait for better prices and a better outlook. – Central Missouri

Extreme weather conditions and commodity prices continue to adversely effect the financial condition of our producers. These conditions are potentially setting up a difficult renewal season this fall. – Central Nebraska

In addition to weather issues, our area suffered a collapse in a large irrigation tunnel that resulted in over 100,000 acres not receiving water during the heart of the summer. It will likely have a significant impact of borrower finances and the extent of production losses is still unclear. – Western Nebraska

Since farm commodity prices are so down and we don't know when the trade war with China will end, there is uncertainty in the farm sector. – Southwestern Oklahoma

Cattle prices are below breakeven for some producers and that is an issue. – Southeastern Oklahoma

Cash flow will decline this year but our operators are well collateralized. – Southern Wyoming

Long term depressed commodity prices continue to erode liquidity and equity in operations. We continue to see reluctance from most borrowers to replace equipment or expand their operations and expect further deterioration in customer financial positions as we begin renewal season. – Eastern Wyoming

Government MFP payments helped producer cash flows this year. – Southwestern Kansas

The MFP payment was a saving grace for a lot of farm operations and was used to pay down line of credit balances. – Eastern Nebraska

A total of 182 banks responded to the Third Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.