The Tenth District farm economy remained weak in the second quarter of 2019, but farm income and credit conditions showed some signs of stabilizing. Despite extreme weather and flooding in parts of the Tenth District and continued trade uncertainty, higher corn prices and trade relief payments could have contributed to a slower pace of decline in expectations for farm income and credit conditions. Although farm income was still expected to decrease in the third quarter of 2019, the pace of decline was expected to be the slowest since 2014. In addition, District bankers reported that deposits grew at a faster pace in some states while farmland values remained steady.

Data

Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

Farm Income and Recent Weather Impacts

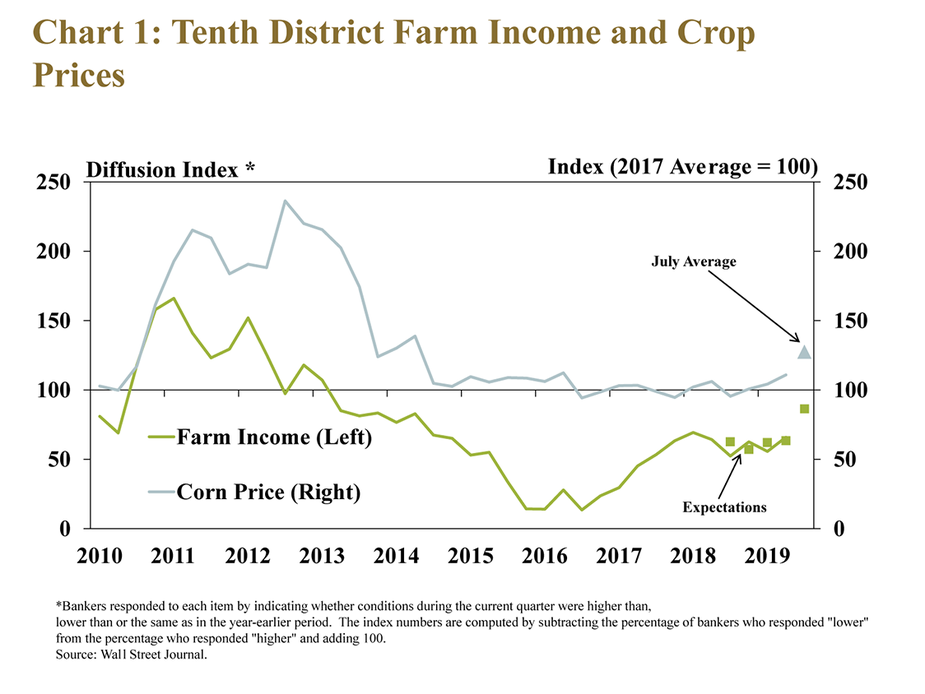

Farm Income in the Tenth District remained weak in the second quarter, but the pace of decline slowed. Slightly more than 40 percent of bankers reported that farm income was lower, compared with almost 75 percent and 60 percent at this time in 2016 and 2017, respectively (Chart 1). Following a nearly 20-year low in 2016, the pace of decrease in farm income has remained relatively stable since the end of 2017. Crop prices increased in the second quarter, and the United States Department of Agriculture announced a continuation of the Market Facilitation Program in 2019. These developments may have led to less pessimistic expectations about farm income in coming months.

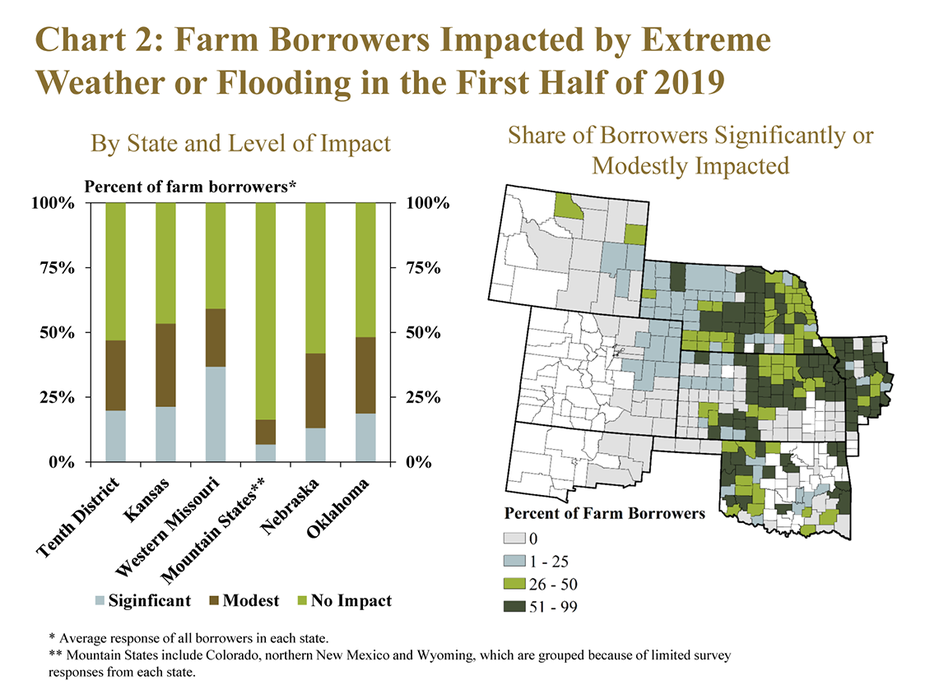

Despite expectations for higher crop prices and farm income, severe weather and flooding could dampen the outlook for some farm borrowers in 2019. In the Tenth District, almost 50 percent of farm borrowers were impacted by extreme weather or flooding (Chart 2, left panel). Although only 20 percent of farm borrowers were impacted significantly by weather, those directly impacted by flooding or extremely wet conditions could be at risk of lower yields and revenues. Areas of the District most severely impacted by weather were central Nebraska, northern and eastern Kansas, western Missouri, and western Oklahoma (Chart 2, right panel). Farm borrowers in the Mountain States, however, were less likely to experience impacts from severe weather.

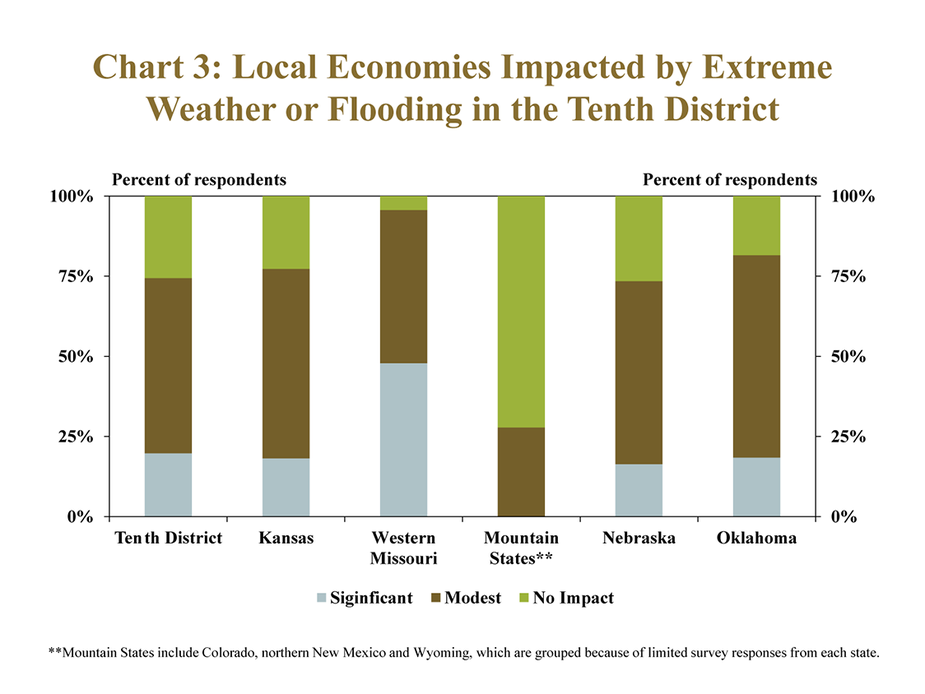

Bankers also reported that local economies were impacted by extreme weather and flooding. Local economies are comprised of local infrastructure, roads, bridges, railways, residential homes, and businesses. About 75 percent of bankers reported that their local economies were impacted, at some level, by adverse weather conditions in Kansas, Nebraska, and Oklahoma (Chart 3). A larger percentage of communities in western Missouri was significantly or modestly impacted by weather, likely due to their proximity to the Missouri River, which was subject to record flooding in the first half of 2019.

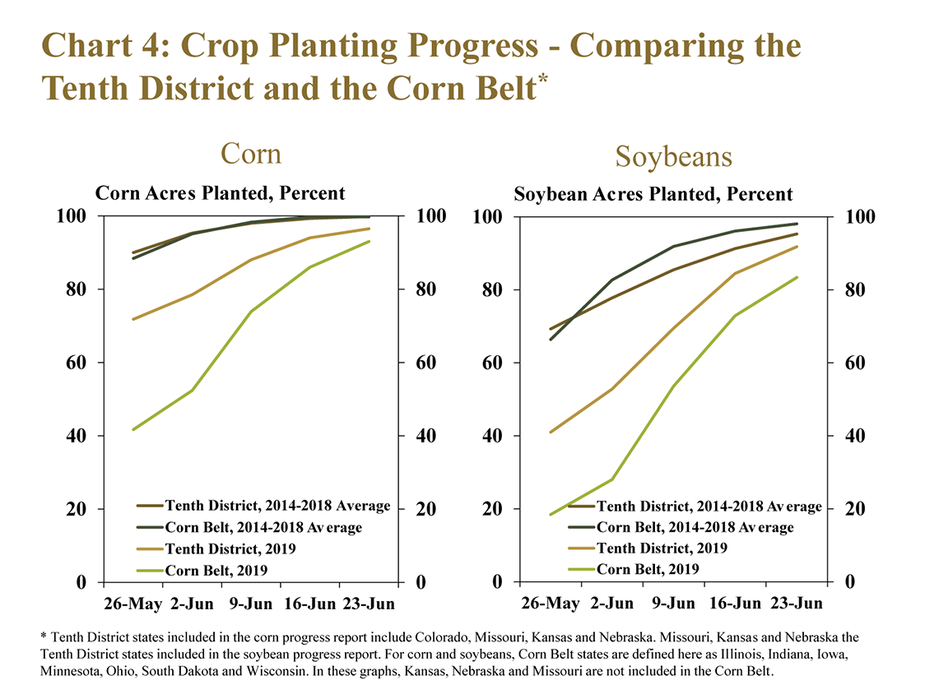

Although some areas of the District were significantly affected by extreme weather and flooding, the outlook for crop production and revenues still could be better than other areas of the United States. For example, weather likely weighed more heavily on planting progress in the Corn Belt than in the Tenth District (Chart 4). In the Corn Belt, corn and soybean plantings were 50 percent and 70 percent, respectively, behind the five-year average in May. Although progress was made during planting season in both regions, the share of corn and soybean acres that were planted in the Corn Belt still lagged both the historical average and planted acres in the Tenth District. Relatively better planting conditions could support higher crop revenues in the Tenth District.

Credit Conditions

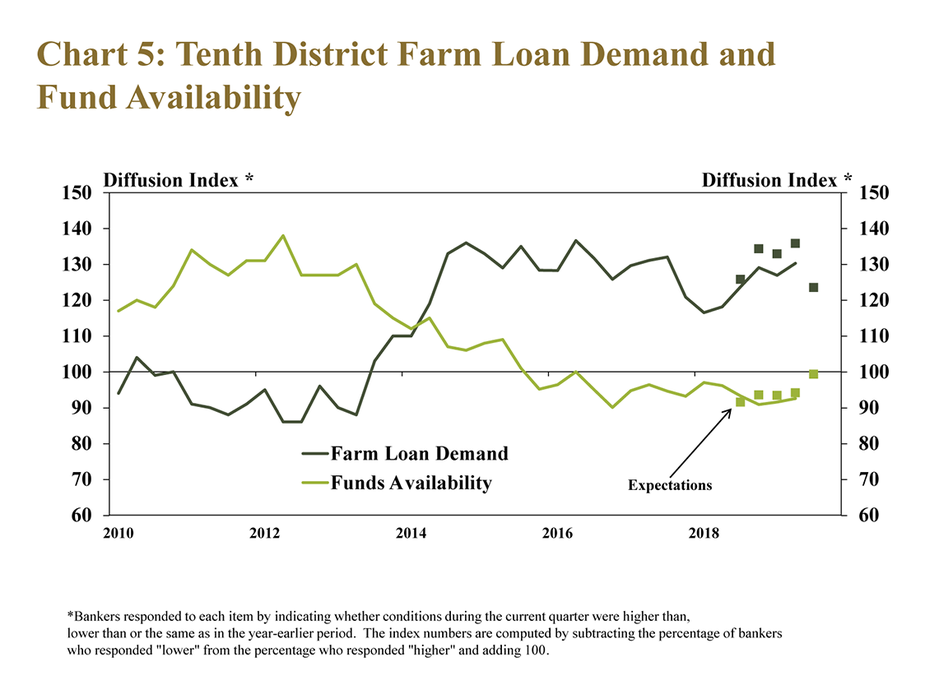

Demand for agricultural lending in the District remained high, but bankers anticipated slower growth in future months. In contrast with expectations in previous quarters, bankers anticipated a slower pace of increase in loan demand than in the current quarter (Chart 5). The extended period of low farm income and strong farm loan demand likely has placed downward pressure on liquidity at some banks. However, over 80 percent of respondents continued to indicate that availability of funds was unchanged from a year ago and looking ahead, nearly no change was expected across the region.

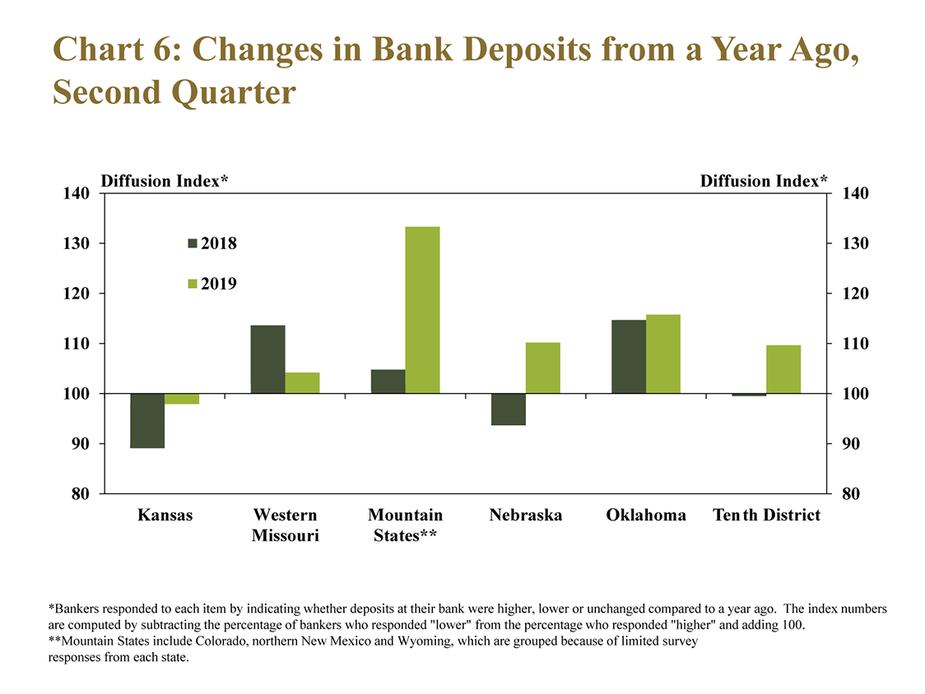

Alongside stable fund availability, deposits at agricultural banks throughout the District were higher than a year ago. Deposits at agricultural banks may have been supported by recent increases in crop prices and payments from the Market Facilitation Program in 2018. Similar to last year, about 35 percent of bankers reported higher deposit levels in the second quarter (Chart 6). However, only 26 percent reported lower deposits, down from over 35 percent in 2018.

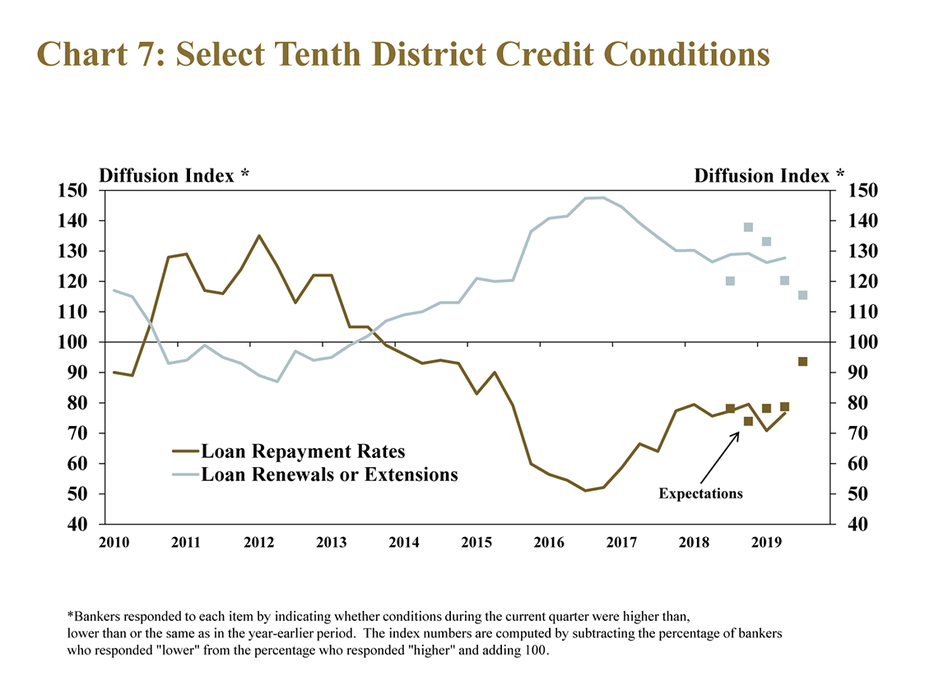

Similar to trends in farm income, the pace of decline in credit conditions also showed signs of stabilizing in the second quarter. Slightly less than 30 percent of bankers reported that farm loan repayment rates were lower, compared with almost 50 percent and 40 percent, respectively, at this same time in 2016 and 2017 (Chart 7). Moreover, bankers expected farm loan repayment rates to decline at the slowest pace since 2014 in the next quarter. The pace of increase loan renewals and extensions remained relatively stable but was expected to slow in the next three months.

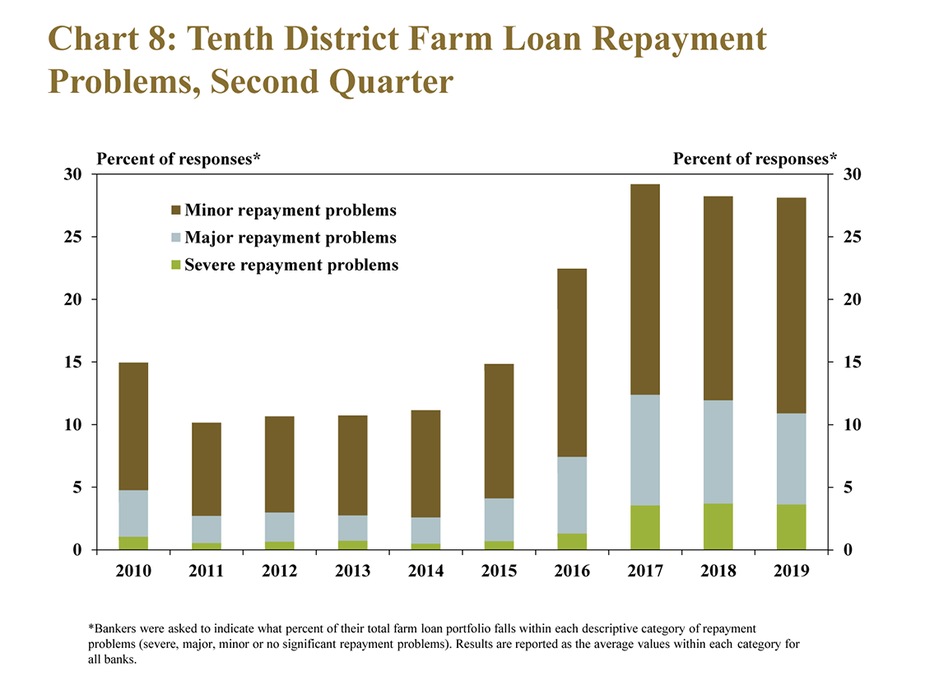

The portion of farm loan portfolios with repayment problems remained steady from a year ago. Since 2017, nearly 30 percent of all loans volumes in the District have experienced issues with repayment (Chart 8). The recent boost to farm revenues from crop prices could improve short-term cash flow and repayment ability. However, another recent survey showed that several years of depleted working capital and carryover debt has increased the need for debt restructuring and weighed on debt-service capacity of some farm borrowers.

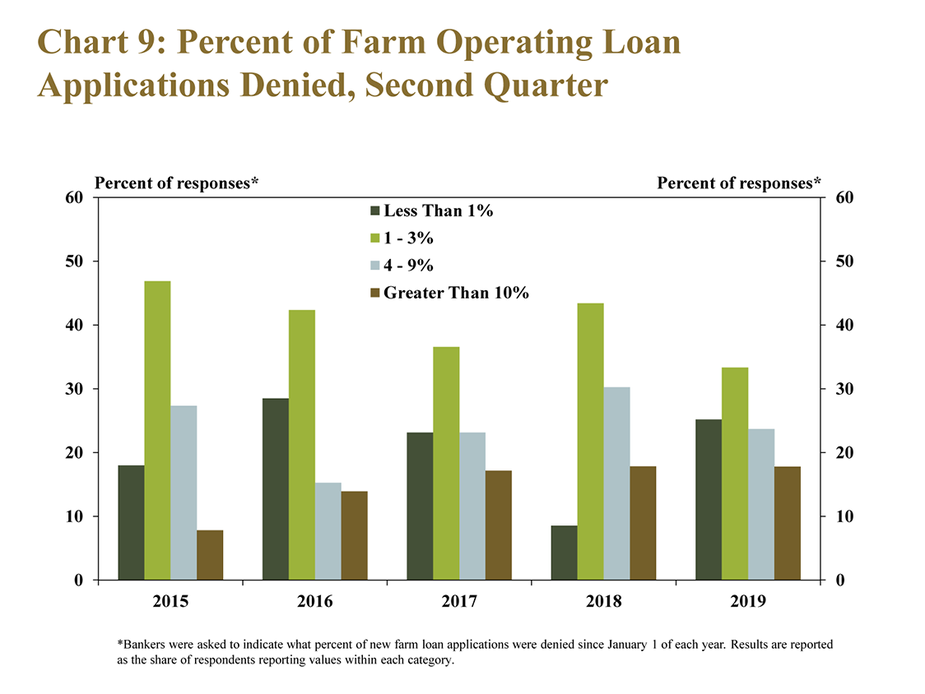

The share of new farm operating loans denied by bankers declined slightly after reaching a five-year high a year ago. About 75 percent of banks in the District denied at least 1 percent of all new farm operating loan applications, down from over 90 percent of banks in 2018 (Chart 9). Nearly 18 percent of respondents continued to report denying more than a tenth of operating loan requests, however, which remained slightly higher than in previous years.

Interest Rates and Farmland Values

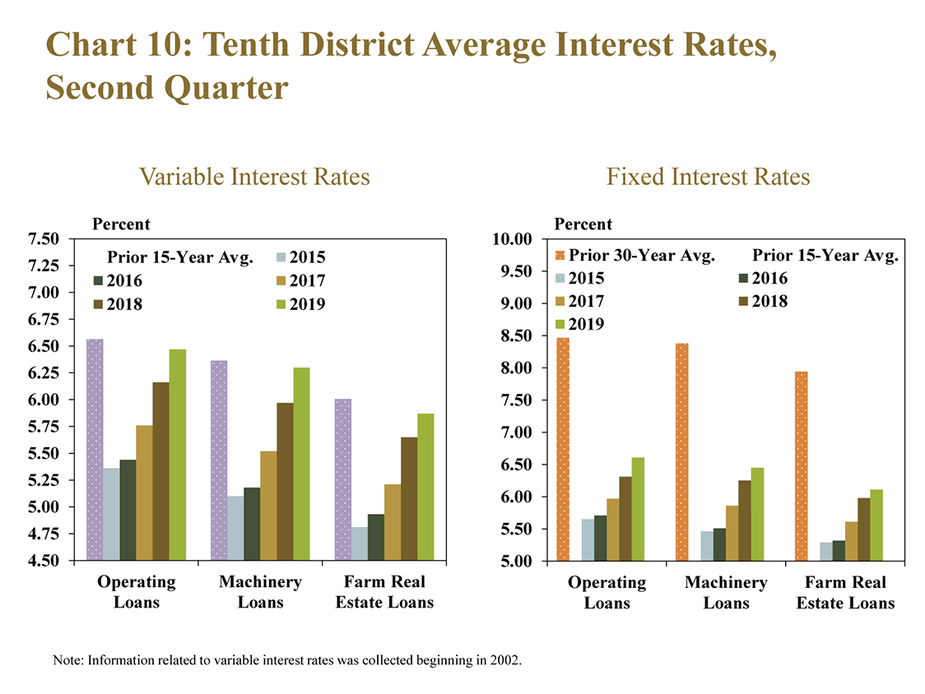

Interest rates on farm loans have increased modestly since 2015 but remain low from a historical perspective. Both fixed and variable rates on all types of farm loans remained slightly below the average from 2003 to 2018 (Chart 10). Fixed rates on operating loans and machinery loans increased slightly more than fixed rates for farm real estate since 2015, but all remained well below the 30-year average.

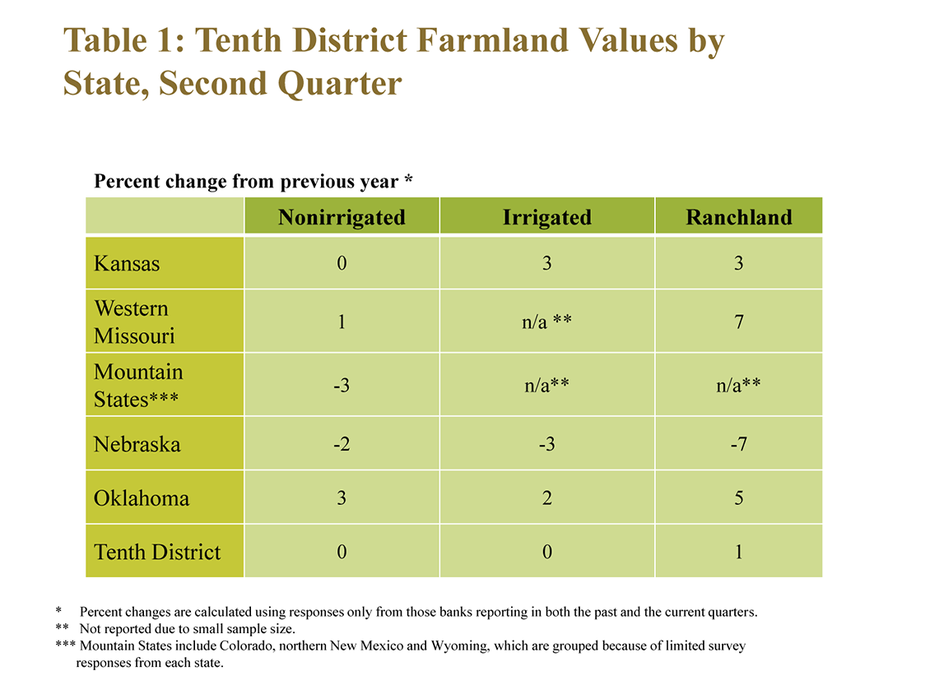

Farm real estate values across the District were nearly unchanged from a year ago in the second quarter. The value of all types of farmland declined modestly in Nebraska and increased slightly in all other states except the Mountain States (Table 1). Ranchland values exhibited the largest changes, declining 7 percent in Nebraska and increasing 7 percent in western Missouri.

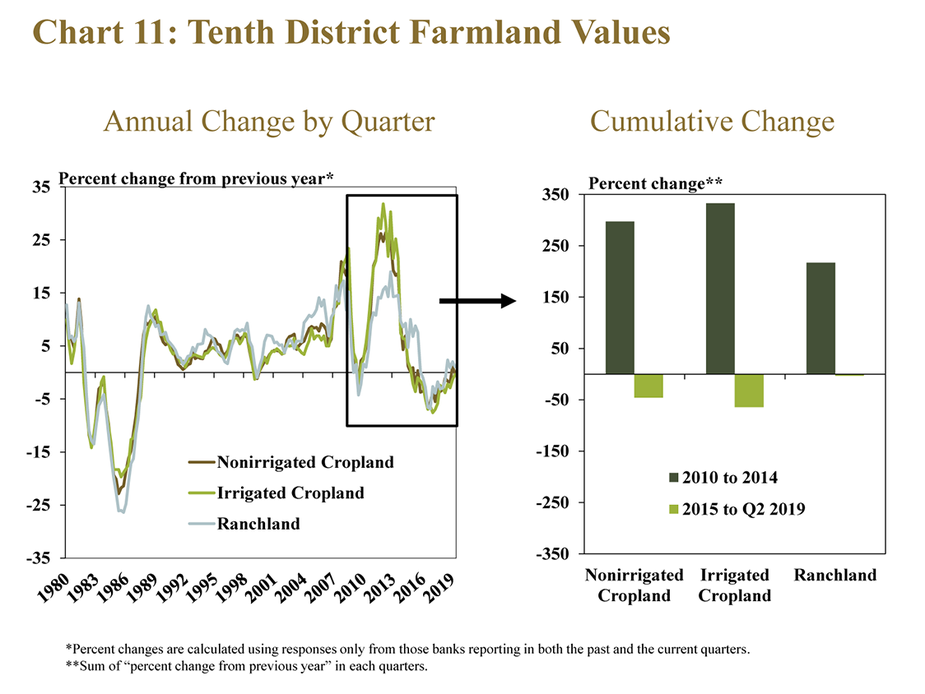

The annual change in farm real estate values was also similar to other recent quarters. The value of all types of farmland in the Tenth District has held relatively steady despite downward pressure from weak farm finances and recent increases in interest rates. Compared with the preceding period of sharp increases in the value of all types farmland, the decline since 2015 has been modest (Chart 11). For example, based on the sum of annual percent changes in each quarter since 2015, nonirrigated cropland values have dropped about 50 percent, a modest change in comparison with the cumulative increase of nearly 300 percent from 2010 to 2014.

Conclusion

Despite some signs of continued stress, the pace of deterioration in the farm economy in the Tenth District was expected to slow in the next three months. Higher corn prices and trade relief payments likely supported less pessimistic expectations for farm income and agricultural credit conditions. Severe weather and flooding slowed planting and may have hindered crop conditions in some areas of the District. However, planting delays were less severe in the Tenth District compared with other regions. Although repayment problems and loan denials remained slightly elevated from previous years, stable farmland values and relatively low interest rates could support stronger credit conditions moving forward, especially if farm borrowers in the District are able to take advantage of higher crop prices in 2019.

_________________________________________________________________________

Banker Comments from the Tenth District

Higher recent commodity prices have spurred producers to liquidate existing grain contracts at break-even prices for 2018. – Central Nebraska

Extreme weather conditions and commodity prices continue to adversely affect the financial condition of producers. These conditions are potentially setting up a difficult renewal season this fall. – Central Nebraska

Weather is still the biggest factor in the farm sector. The lack of signed trade agreements still loom like a black cloud on the horizon. – Central Kansas

Good moisture in winter and spring have supported excellent wheat yields and increasing prices for both corn and wheat are a positive for those in the area not impacted by flooding. – Southwestern Kansas

The excessively wet spring weather delayed crop planting and the harsh winter resulted in cattle not putting on weight as normal, both of which are a negative impact to ag borrowers’ income and cash flow. – Northcentral Kansas

Flooding and excessive rain caused delays to wheat harvest and summer crop planting. On the other hand, land prices have increased based on sales in the past three months. – Northern Oklahoma

Some cattle ranchers are choosing to hold on to their herd in anticipation of increased prices which has led to extension of some single pay cattle loans. – Southeastern Oklahoma

Overall the 2019 spring planting season has been a disaster. The weather has prevented farmers from planting corn and what is planted doesn't look very good. – Southwestern Oklahoma

Planting went well and crop conditions also look good. Subsoil moisture is excellent and long range irrigation water availability is the best in years. – Northern Colorado

Farmers had a tough time getting all of their crops in because the fields were too wet and cooler days have also delayed the growth of what was planted. – Northeastern Colorado

Our bank noticed a sharp increase in new loan applications from non-customers looking for new lender relationships and none qualified. All had very high financial stress in their operations and will probably require debt and expense reduction in order to continue operating. – Northeastern Kansas

There was major flooding in our area and ag producers in the direct path of flooding may face struggles this year. Indirectly, there were also delays in crop and livestock sales due to transportation constraints and postponed sales at local salebarns. – Eastern Nebraska

A total of 181 banks responded to the Second Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to External LinkCortney Cowley, economist or External LinkTy Kreitman, assistant economist, at 1-800-333-1040.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.