Agricultural credit conditions in the Kansas City Fed’s Tenth District deteriorated at a slightly faster pace at the onset of developments related to COVID-19. The survey for the first quarter of 2020, distributed in mid-March, indicated a larger decline in farm income and loan repayment rates than in recent quarters. Looking ahead, bankers indicated their expectations were much more pessimistic. Beyond the survey period, further disruptions at meatpacking and food processing facilities and a substantial slowdown in ethanol production put heavy downward pressure on cattle and corn prices. Through early May, cash prices for both since January had declined more than 20 percent, adding pressure to already stressed farm finances in the seven states of the District.

Data

Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

Farmland Values

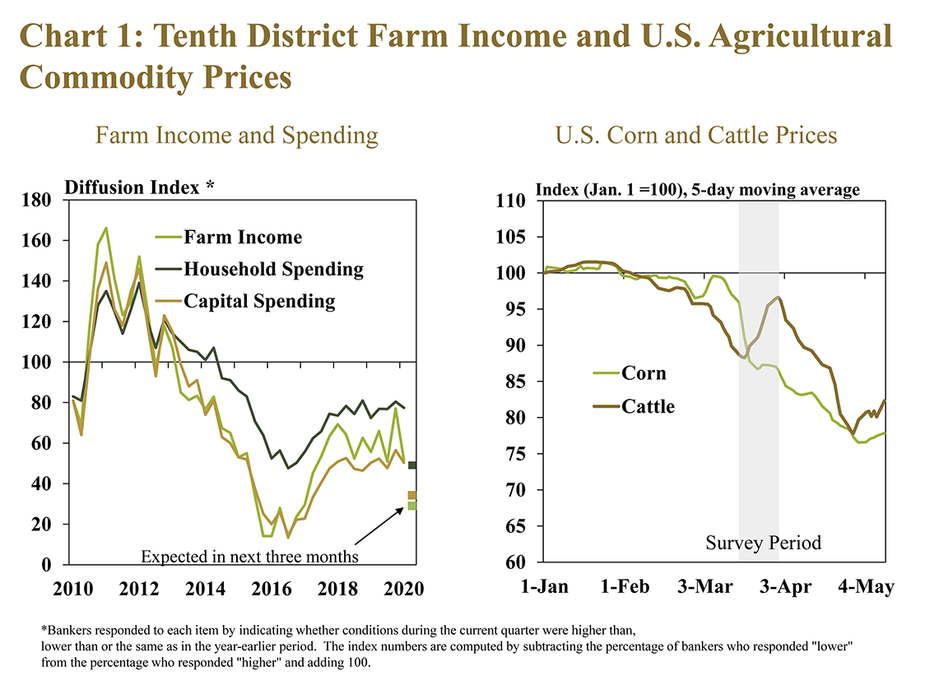

Farm income in the Tenth District weakened alongside a steep drop in agricultural commodity prices that began in March. The pace of decline in income was noticeably faster in the first quarter than in the previous quarter amid intensifying concerns related to COVID-19 (Chart 1). Spending by farm borrowers also weakened slightly, but less abruptly than farm income. Corn and cattle comprise a large share of total revenues in the region and as the survey began in March, prices of both had decreased about 15 percent since January. Even after the first quarter survey, the declines continued through early May, putting added downward pressure on revenues for producers.

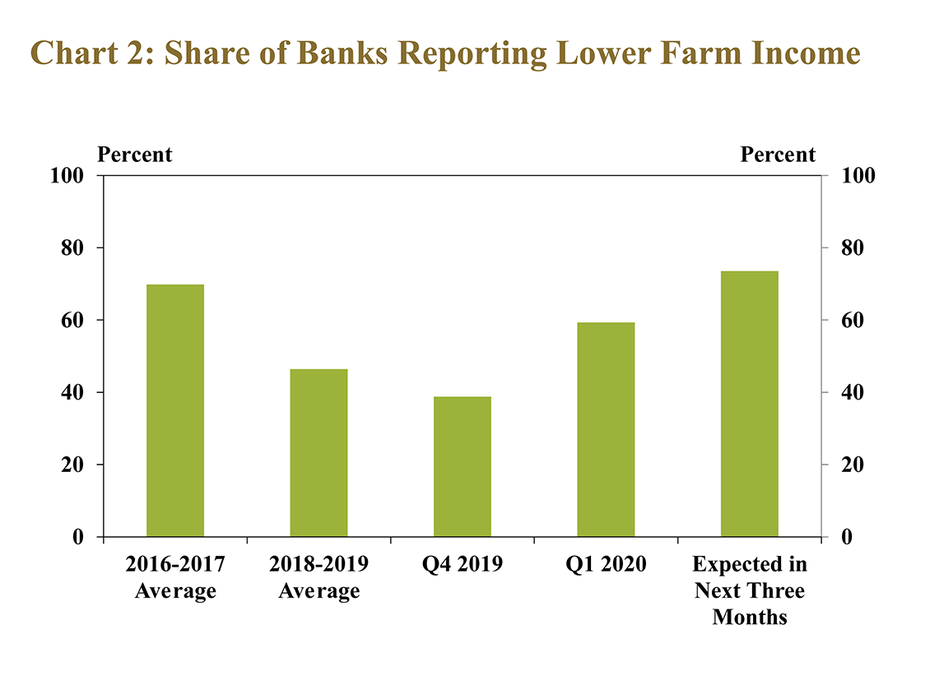

After improving slightly at the end of 2019, the share of bankers reporting lower farm income increased sharply in the first quarter. About 60 percent of respondents across the region indicated that farm income was lower than the same time a year ago, the highest share since early 2017 (Chart 2). The outlook was more pessimistic in every state except the Mountain States of Colorado, Wyoming and New Mexico, with nearly three-fourths of all banks indicating they expect farm income to be less than last year.

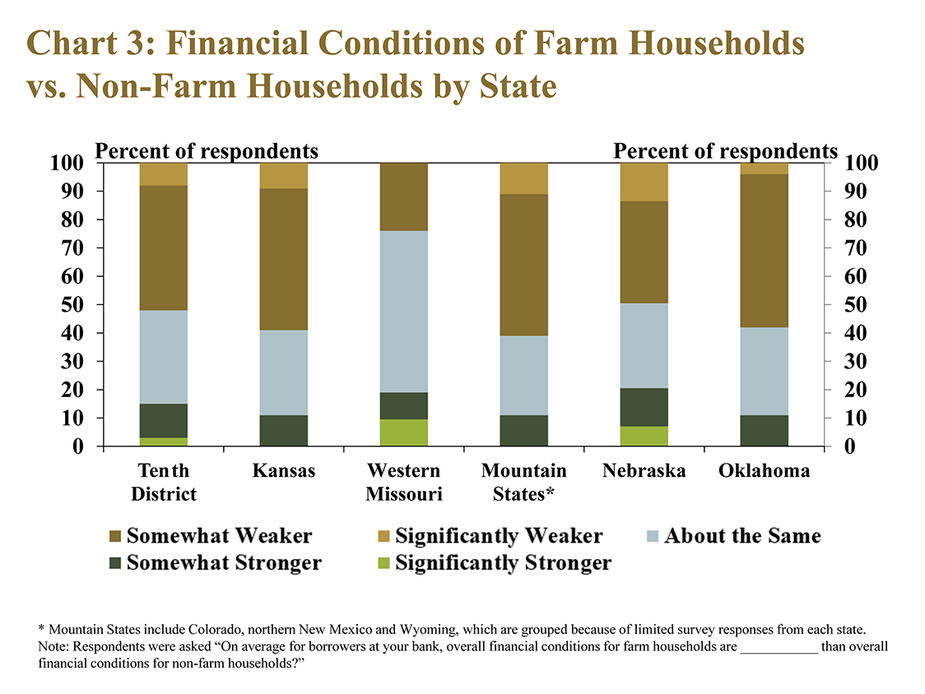

Persistent weaknesses in the agricultural economy in recent years have weighed on many farm households. Only 15 percent of responding banks reported that overall financial conditions for farm households were stronger than non-farm households (Chart 3). Respondents indicated the relative weakness of farm households was felt more strongly in Kansas, Oklahoma and the Mountain States and less so in Missouri. Compared with other states, conditions in Nebraska were more varied.

Farm Finances and Credit Conditions

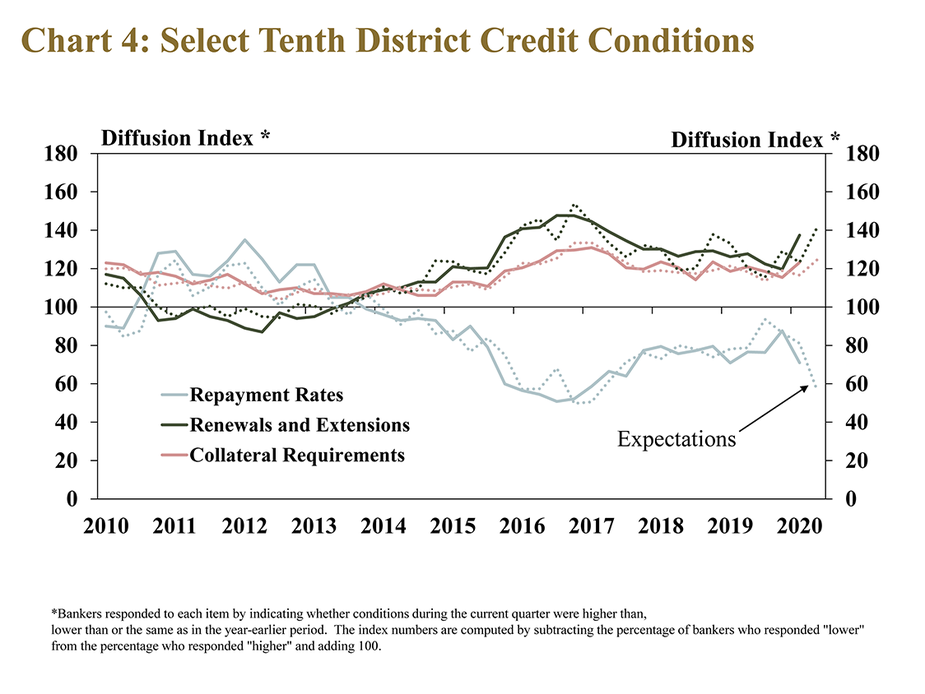

After showing some signs of stabilizing in previous survey periods, credit conditions also deteriorated more quickly in the first quarter. Similar to farm income, farm loan repayments declined at a faster rate than recent quarters (Chart 4). The pace of increase in loan renewals or extensions, as well as collateral requirements, also ticked up from the last survey period. In addition, these credit conditions were expected to turn more negative in the second quarter as banks assessed the likely economic difficulties surrounding COVID-19.

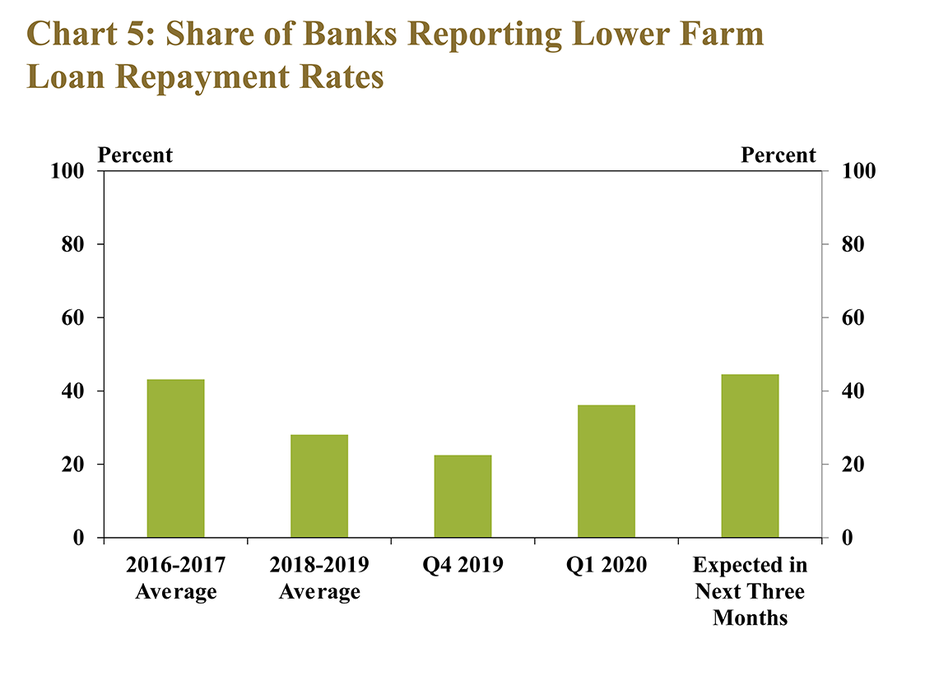

Following a path comparable to farm income, the percent of respondents reporting lower rates of repayment also increased. Over half of all banks continued to report no change in repayment patterns, but about 40 percent reported a decline, the largest share since early 2017 (Chart 5). The outlook also was more pessimistic in every state except the Mountain States.

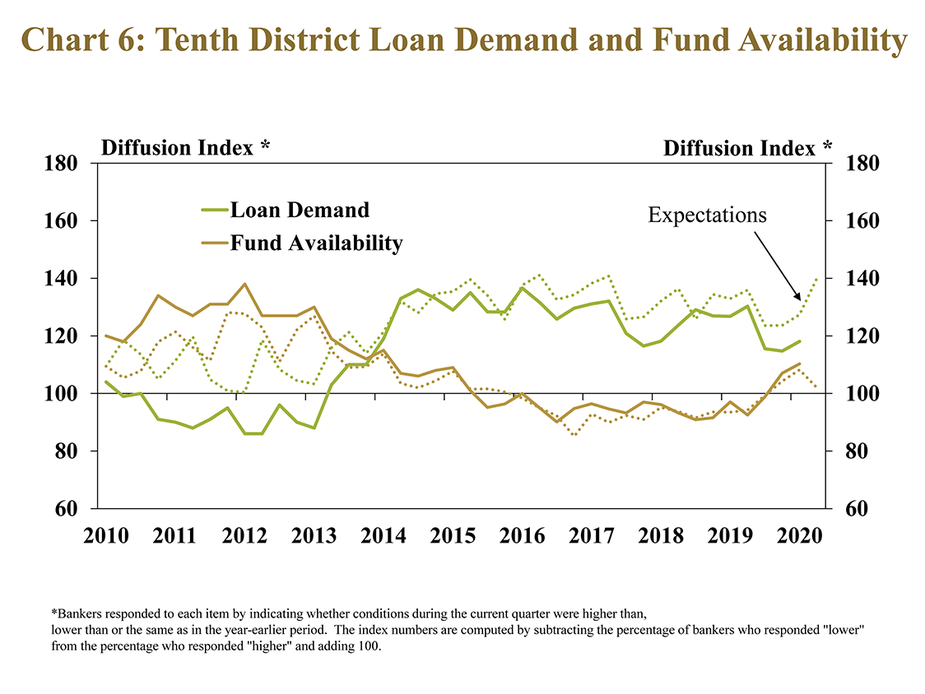

Demand for farm loans remained high, but the scale of the increase was similar to recent quarters. Since mid-2019, farm loan demand in the region has shown some signs of slowing (Chart 6). Also continuing a more recent trend, fund availability increased for the second straight quarter. Likely in anticipation of increased financing needs, both loan demand and availability of funding were expected to diverge from current trends in the next quarter.

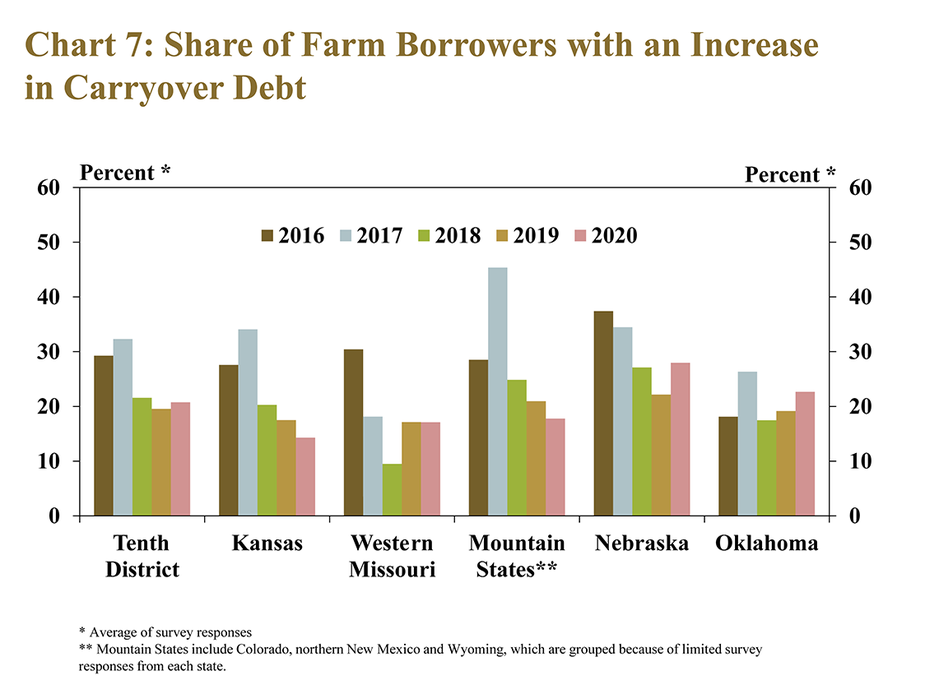

As lending demand remained elevated moving into renewal season, borrowers’ financial conditions continued to deteriorate at a steady, but gradual pace. Revenues remained subdued for many producers in 2019, and the share of borrowers with an increase in carryover debt was similar to the prior two years with some differences across states (Chart 7). Compared with last year, increased carryover debt was slightly more prevalent in Nebraska and Oklahoma, but slightly less so in Kansas and the Mountain States.

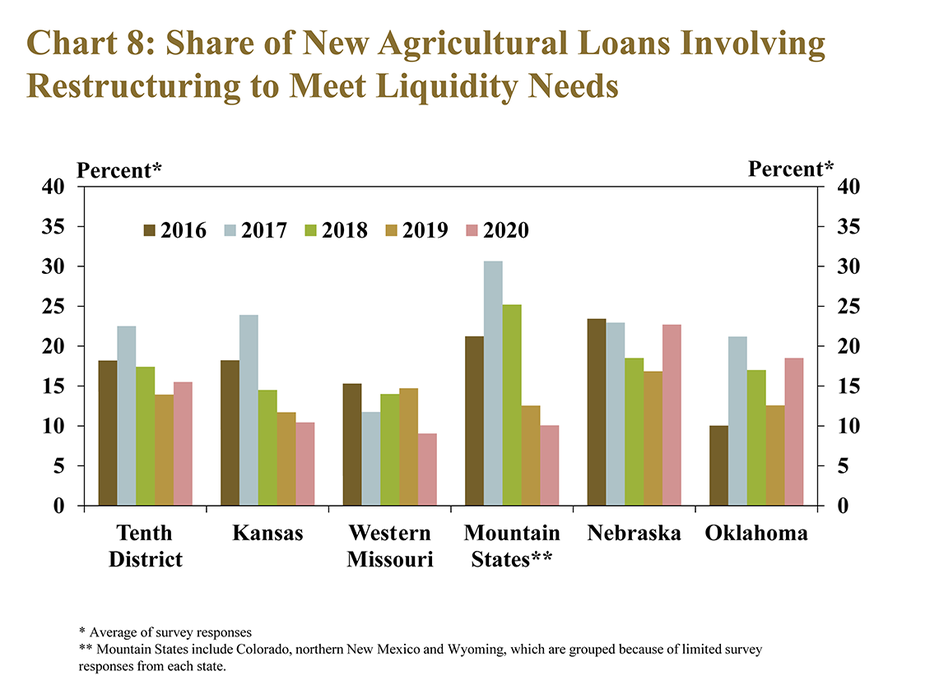

The reduction in farm income and revenue also continued to put steady, but modest pressure on liquidity. About 15 percent of all originated or renewed farm loans throughout the region involved restructuring to meet short-term funding needs, comparable with the past two years (Chart 8). Similar to changes in carryover debt, instances of restructuring also increased slightly in Nebraska and Oklahoma and declined slightly in other states.

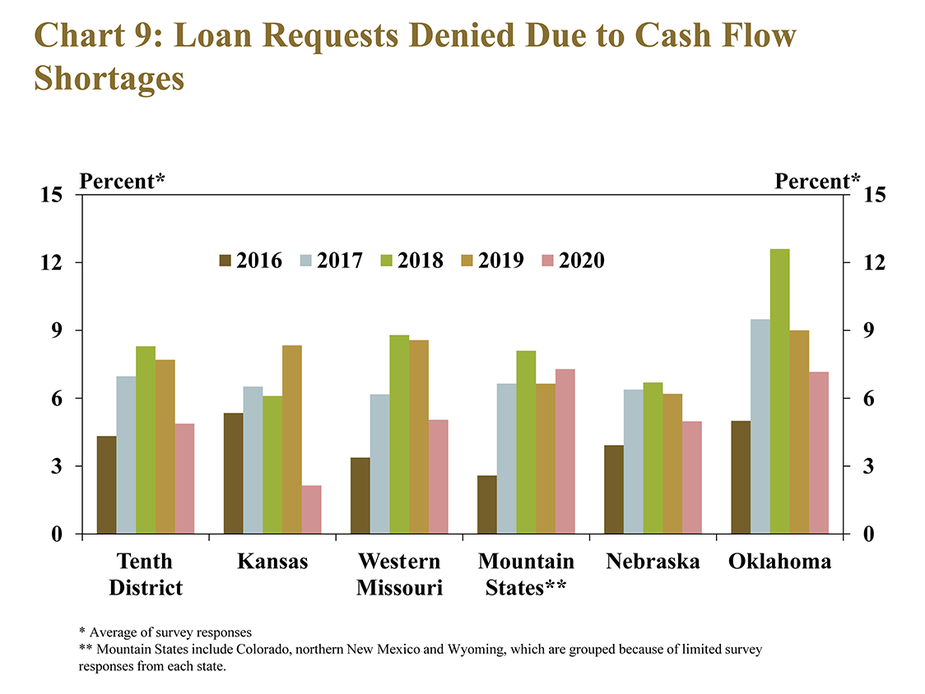

Alongside a deterioration of borrowers’ finances, bankers denied a modest amount of loan requests, but the share was lower than the past few years. In fact, less than 5 percent of all farm loan requests throughout the region were denied due to cash flow shortages, the lowest since 2016 (Chart 9). The rate of loan denial was lower in all states expect the Mountain States, where the share increased modestly.

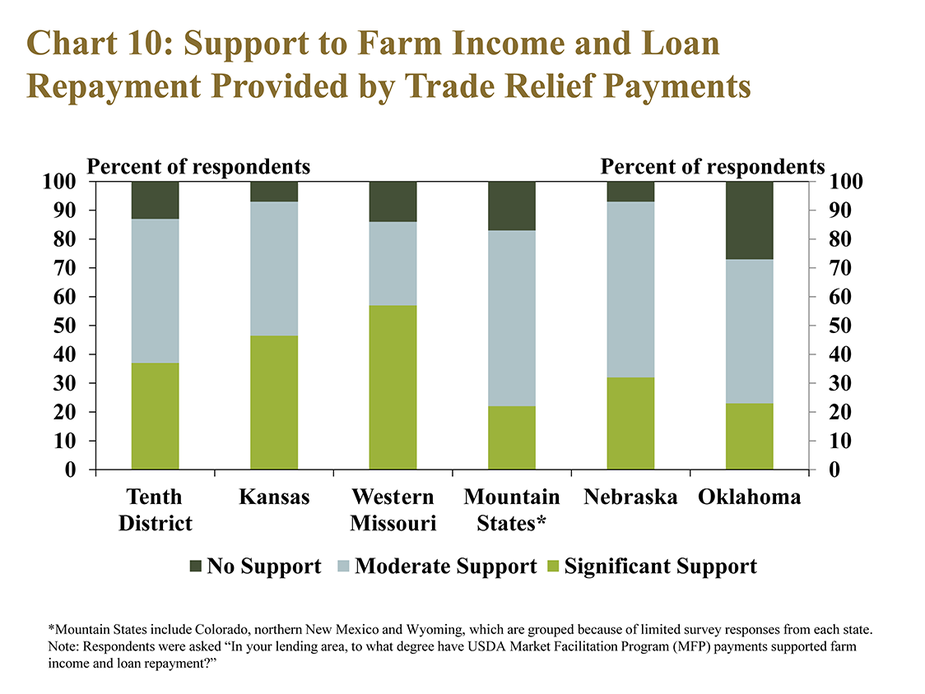

Respondents indicated trade relief payments have provided notable support to their borrowers’ finances. Across the District, nearly 90 percent of banks indicated that payments provided at least moderate support to farm income and loan repayment (Chart 10). Based on bankers’ responses, support from payments was relatively more significant in Kansas, Missouri and Nebraska and less so in Oklahoma and the Mountain States.

Interest Rates and Farmland Values

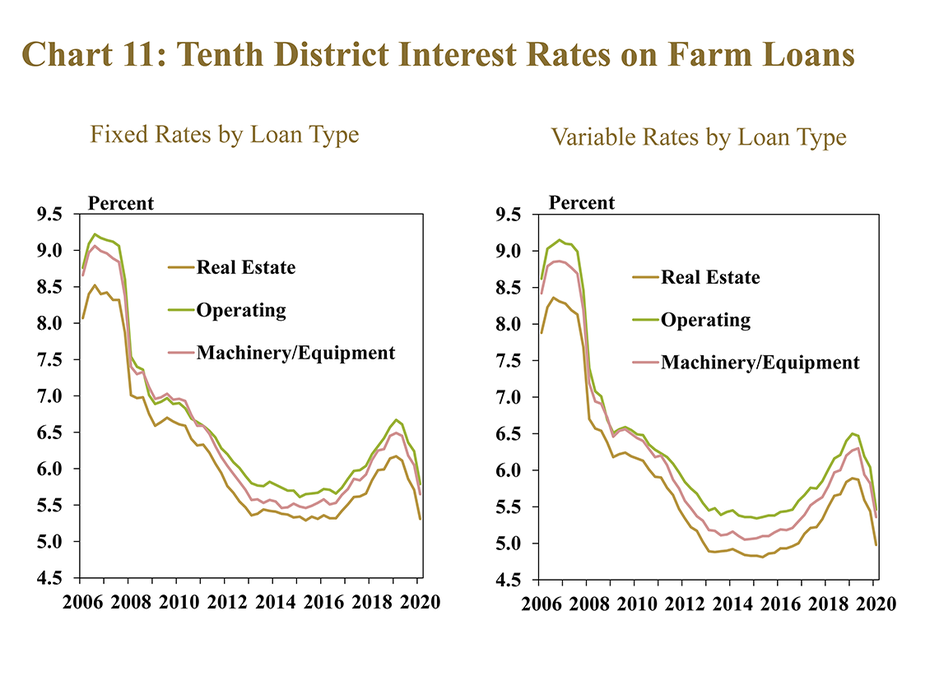

Interest rates on all types of farm loans declined sharply alongside the recent decrease in benchmark interest rates. Variable rates for all types of lending declined at least 90 basis points from a year ago and fixed rates on all loans were at least 80 basis points lower (Chart 11). The fixed rate on farm real estate loans declined to the lowest first-quarter level on record, but all other rates remained between 10 and 30 basis points above historic lows.

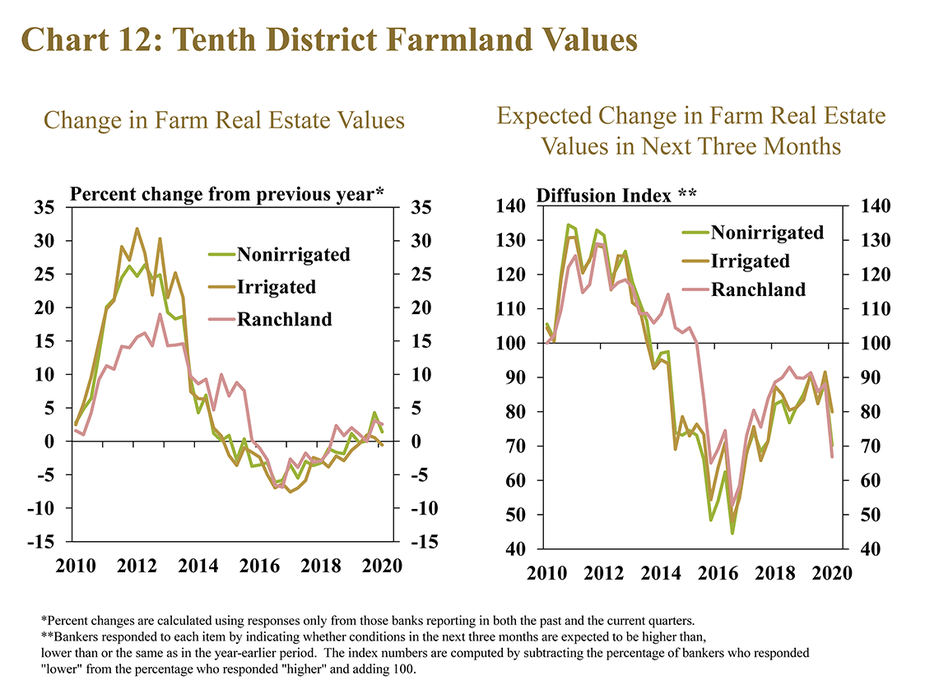

Despite a more pessimistic environment for farm income and credit conditions, farmland values remained relatively steady. Both nonirrigated cropland and ranchland values increased slightly for the second consecutive period (Chart 12). Looking to the next quarter, slightly less than 70 percent of bankers indicated they expect nonirrigated farmland values to remain unchanged compared with a year ago; about 30 percent anticipated a decline.

Conclusion

The initial effect of developments surrounding the COVID-19 pandemic weakened the outlook for the agricultural economy considerably and weighed on farm finances. The share of bankers reporting lower farm income and loan repayment rates increased sharply and expectations for coming months also turned more pessimistic. Providing some support to farm finances, interest rates on agricultural loans declined and farm real estate values remained relatively stable. Weaknesses in some agricultural commodity markets continued to intensify in recent weeks and further weighed on already subdued farm revenues. However, government payments appear likely to provide notable relief to segments of the farm sector again in 2020.

________________________________________________________________________

Banker Comments from the Tenth District

“Cattle futures have collapsed in the last two weeks due to the coronavirus scare and will have major implications on working capital in the coming months.” - Southwest Kansas

“Farmer finances were stable for the 2019 production year, but would have not maintained that position without the MFP program.” - Northeast Kansas

“It was going to be a tough year ahead even before the coronavirus.” – Eastern Kansas

“The effects of coronavirus are just starting to come into play, but I can't determine how severe that will be.” – Central Missouri

“Our main concern right now is the pandemic sweeping the nation and wrecking the markets.” - Northwest Missouri

"Economic conditions could drastically change as a result of the coronavirus, especially crop and livestock markets. However, there could be positive impacts as second quarter approaches if the virus impact diminishes and markets correct."- Northeast Nebraska

“In general, farm income is lower this quarter due primarily to a weaker cattle market and higher operating expenses and the pandemic will add further pressure in the next quarter.” - Southeast Oklahoma

“With the large drop in cattle prices, some operators were forced to hold stocker cattle longer than projected and some customers don’t want to sell because of low prices.” – Northern Oklahoma

“Deterioration was continuing with our borrowers due to adverse conditions in recent years, but COVID-19 will add further complications.” - Central Nebraska

“We are anticipating stress due to decreases in all commodity prices across the board. The price of oil will decrease input prices for farmers and ranchers, but that will also have an impact on the overall economy in our area.” - Eastern Wyoming

“The issues surrounding sugar beets has greatly hindered the cash flow and repayment ability of some of our borrowers. The rest of our farmers cash flowed well in 2019 with the ability to sell corn silage and alfalfa hay at above average prices.” - Northern Colorado

“Commodity prices have remained low and farm income has been on the decline. However, farm real estate has benefited from strong demand.” - Northern Wyoming

A total of 159 banks responded to the First Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to Nathan Kauffman, economist or Ty Kreitman, assistant economist at 1-800-333-1040.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.