Farm income decreased across the Tenth District and the trend of steady deterioration in agricultural credit conditions continued in the first quarter of 2019. With low income weighing on farm finances, the pace of decline in farm loan repayment rates increased slightly. In addition, carry-over debt increased again for many borrowers and bankers continued to restructure debt and deny a modest amount of new loan requests due to cash flow shortages. Major flooding and blizzards across some regions in the District late in the first quarter may also put additional financial pressures on some farm borrowers as damages continue to be assessed.

Data

Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

Farm Income

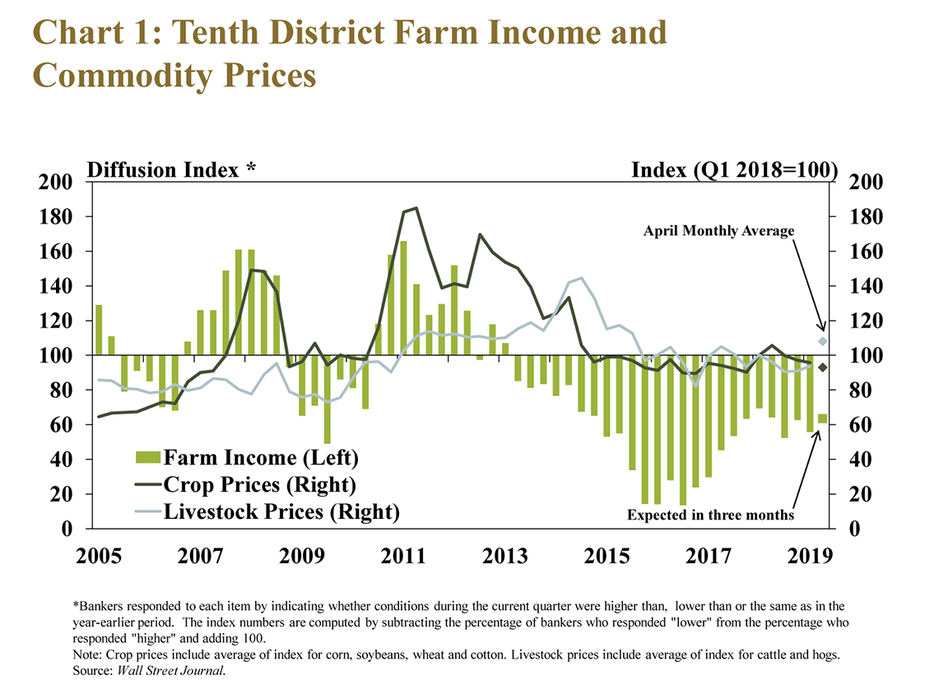

A majority of bankers across the District continued to report decreases in farm income during the first quarter. Despite a slight improvement in livestock prices toward the end of the period, the pace of decline in farm income quickened slightly from a year ago and from the prior quarter (Chart 1). A similar pace of decline also was expected in coming months. However, significant increases in hog prices in the final weeks of the quarter and into April improved revenues for some operations in the livestock sector.

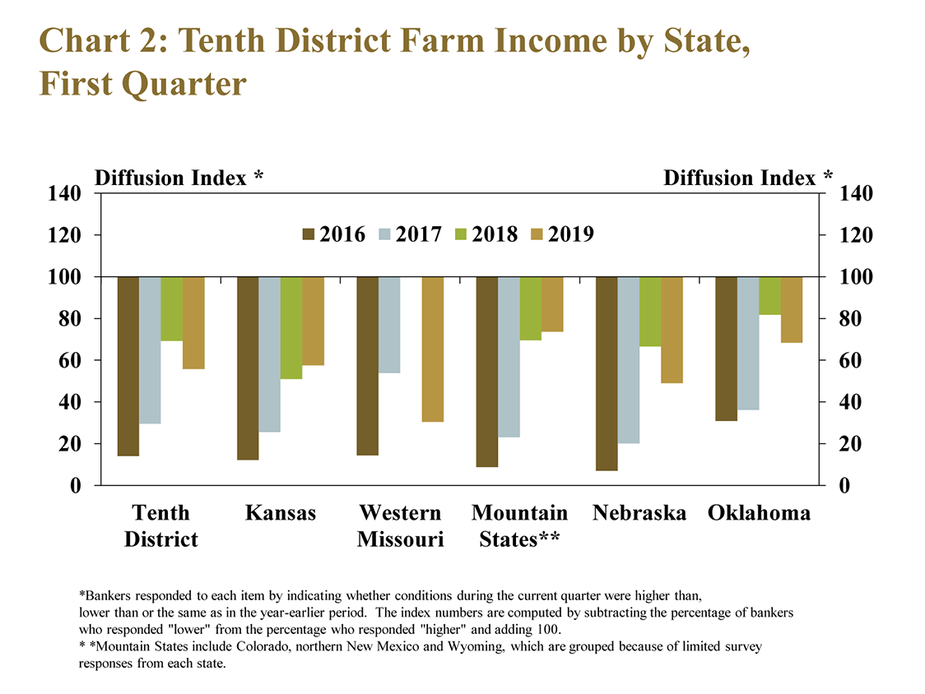

Reductions in farm income were sharpest in Nebraska and Missouri, states heavily concentrated in corn and soybean production. The drop was largest in Missouri, where farm income was steady a year ago (Chart 2). While some areas were heavily affected by spring flooding and blizzards, it may be months before the full impact to farm income is realized as immediate damage and implications for the 2019 operating cycle were being evaluated.

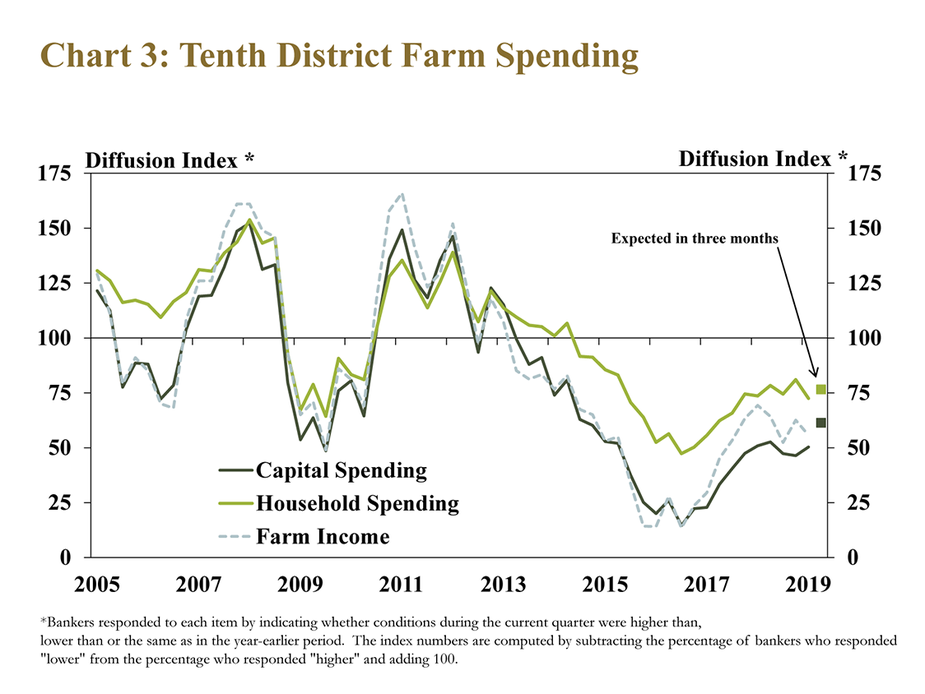

Weakness in farm income continued to weigh on farm household and capital spending across the District. Declines in spending by farm borrowers remained similar to the previous quarters after moderating slightly in 2018 (Chart 3). While following similar trends, decreases in capital spending remained larger than cuts to household spending and that relationship was expected to continue into the next quarter.

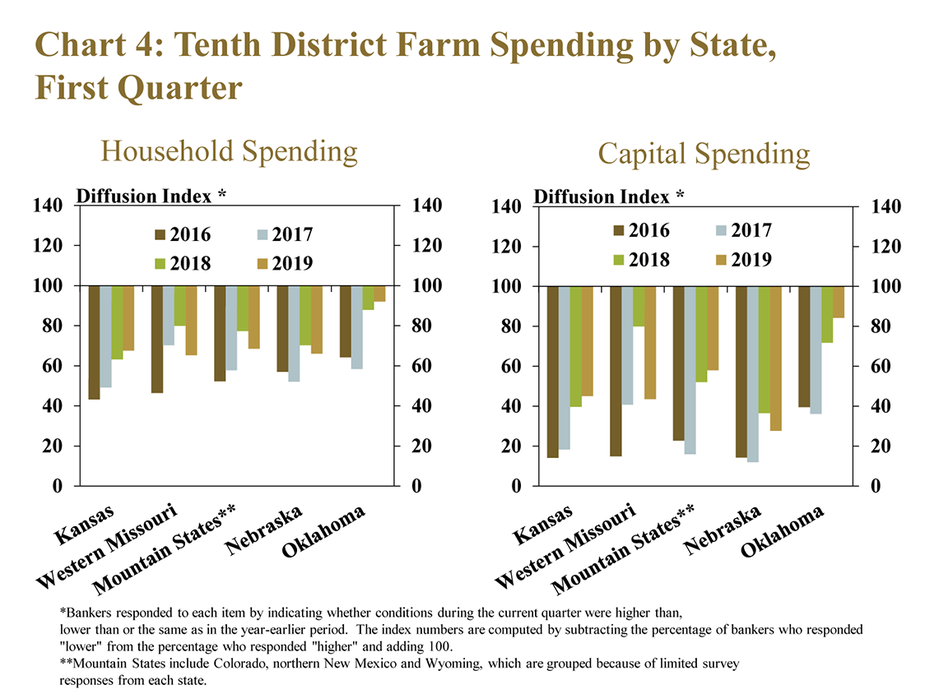

Farm spending declined at a pace similar to the previous year in all District states with the exception of Oklahoma, where bankers were less pessimistic. Similar to changes in farm income, the pace of decline in farm household and capital spending was sharper in Missouri when compared with a year ago (Chart 4, left panel). The decrease in capital spending also was notably smaller in Oklahoma and remained sharpest in Nebraska (Chart 4, right panel).

Credit Conditions

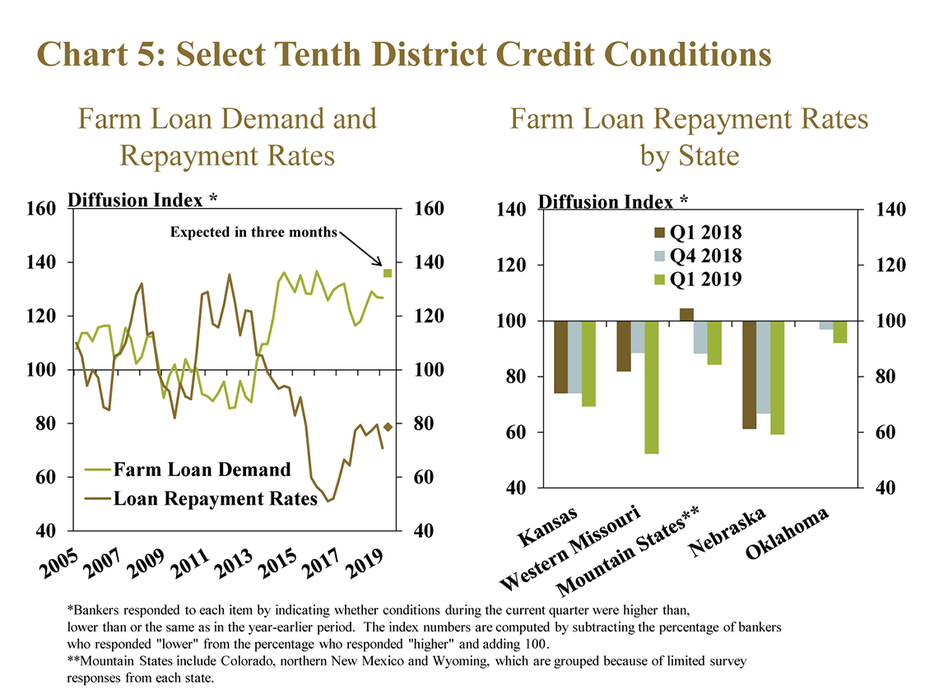

As farm income remained low, demand for farm loans remained high and the ability of farm borrowers to repay loans weakened at a slightly faster pace than in previous quarters. Lower rates of repayment in Missouri and Nebraska were the largest contributors to overall weakness in farm loan repayment rates across the District (Chart 5). Similar to farm income, recent severe weather also may have contributed to slower repayment rates and increased loan demand, but the full impact remains uncertain pending assessment of damages.

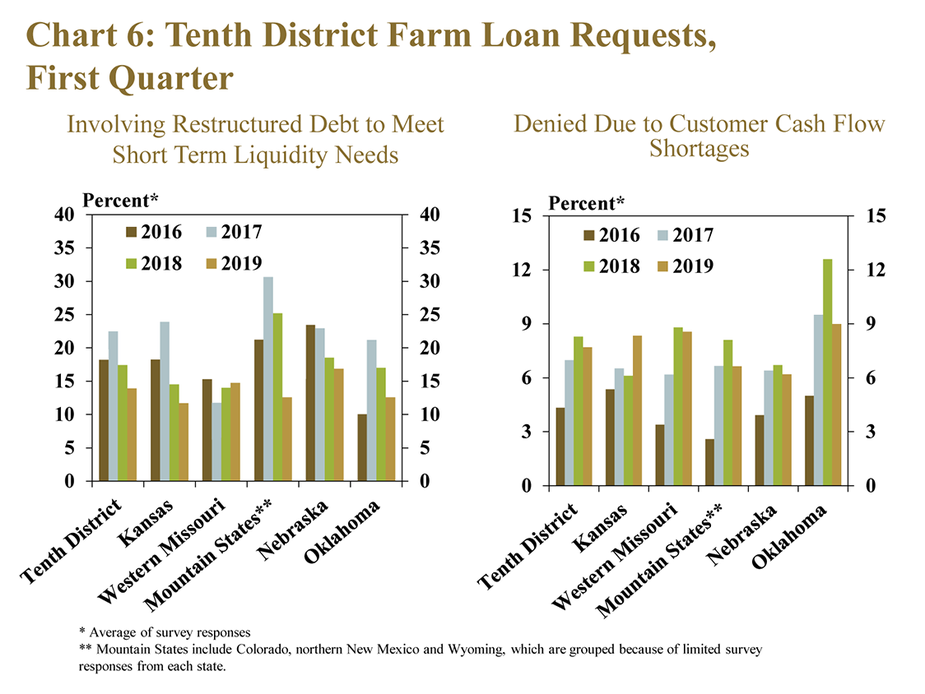

As farm cash flows remained weak, bankers continued to restructure debt and even deny some farm loan requests. Despite moderating from a high of 23 percent in 2017, about 14 percent of new farm loan requests involved restructuring to meet liquidity needs (Chart 6, left panel). New loan requests were denied at a pace of 8 percent because of cash flow shortages, a rate similar to a year ago (Chart 6, right panel). While remaining near the District average, the rate of denial on new loan requests in Kansas increased moderately compared with a year ago.

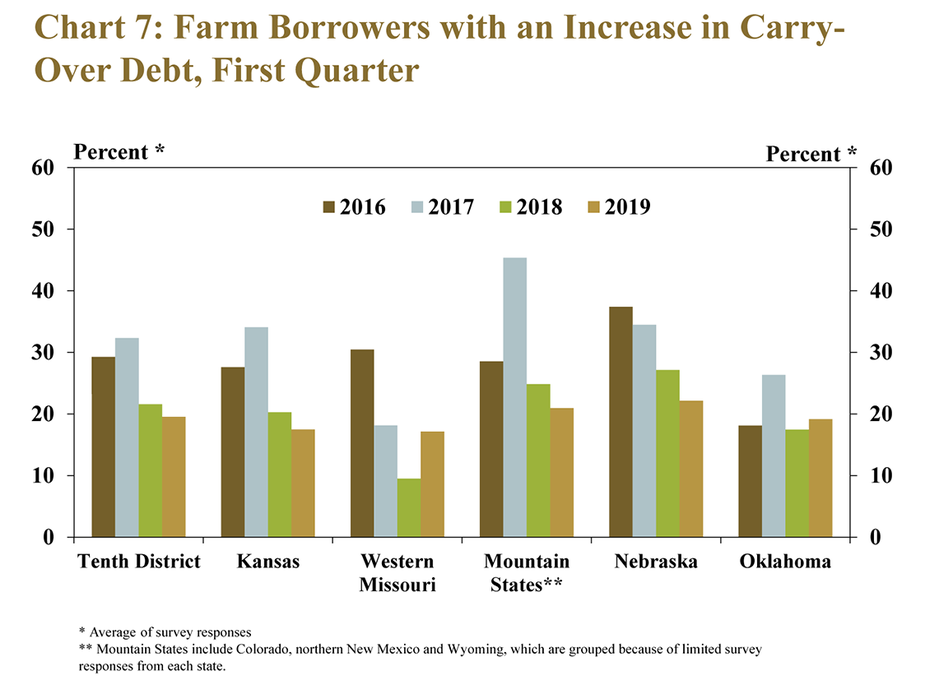

Additionally, further reductions in farm income also led to another year of increases in carry-over debt for some borrowers. On average, about 20 percent of farm borrowers throughout the District had an increase in carry-over debt (Chart 7). Compared with last year, the share of borrowers with an increase in carry-over debt nearly doubled in Missouri and was slightly higher in Oklahoma. In all other states, the share declined slightly.

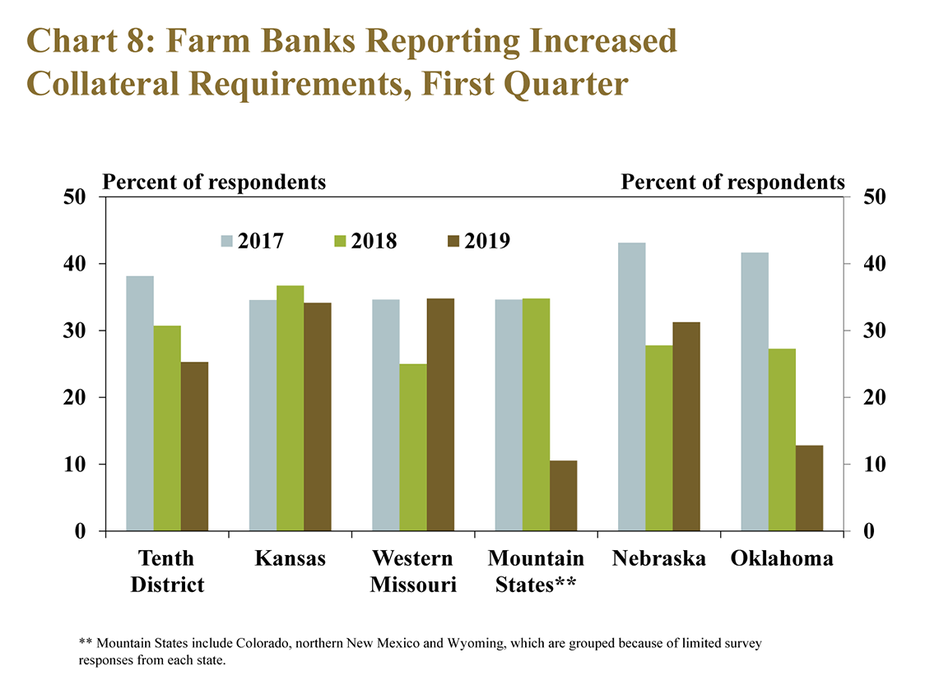

With continued deterioration in agricultural credit conditions, bankers also further tightened credit standards. About 25 percent of all bankers in the District increased collateral requirements relative to last year (Chart 8). Over 30 percent of survey respondents in Kansas, Missouri and Nebraska increased collateral requirements, in contrast to about 10 percent of banks in Oklahoma and the Mountain States.

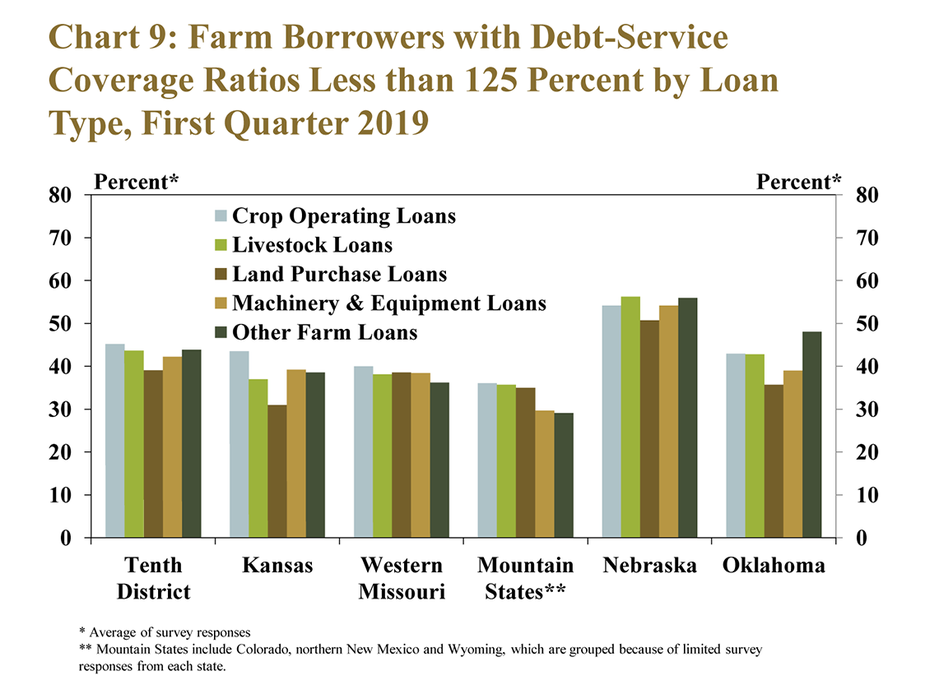

Debt service capacity in the farm sector also has tightened in recent years. Survey respondents indicated annual cash flow was only slightly greater than annual debt obligations for nearly half of borrowers with crop operating loans in the Tenth District. A similar capacity for servicing debt was reported for other types of loans (Chart 9). The coverage of loan payments by cash flow was tighter in Nebraska, where respondents reported that more than half of borrowers, regardless of loan type, had a debt service coverage ratio of less than 125 percent.

Interest Rates and Farmland Values

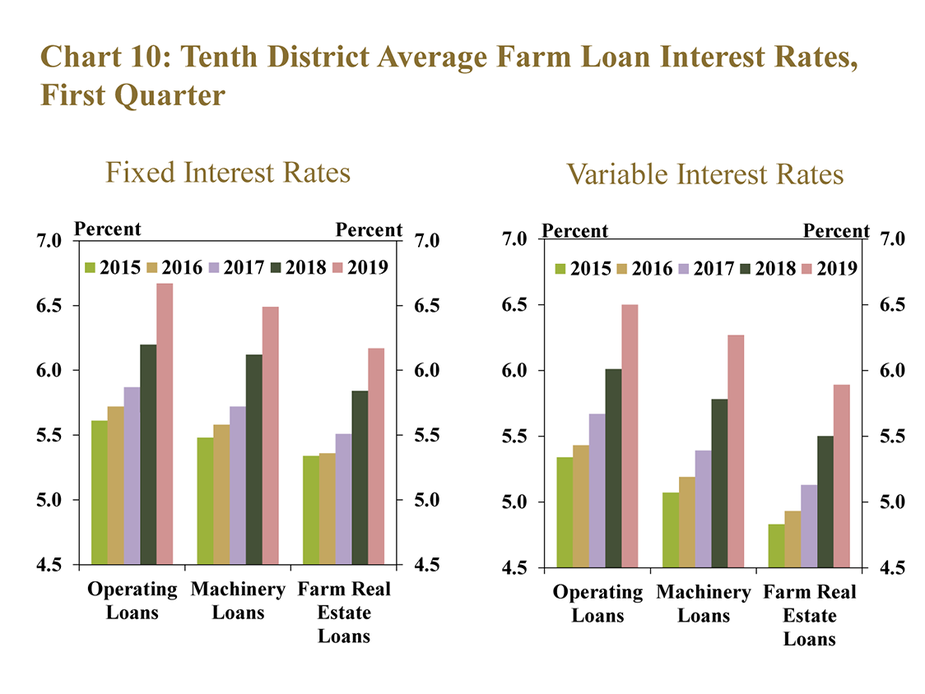

Interest rates on all types of agricultural loans in the first quarter increased at a moderate pace. Compared with the first quarter of 2015,variable interest rates have increased slightly more than fixed rates for the same types of loans (Chart 10). For example, fixed rates on operating loans have increased about 110 basis points over that time compared with an increase of about 120 basis points on variable rates. Similarly, fixed and variable rates on farm real estate loans over that same period increased by 80 and 110 basis points, respectively.

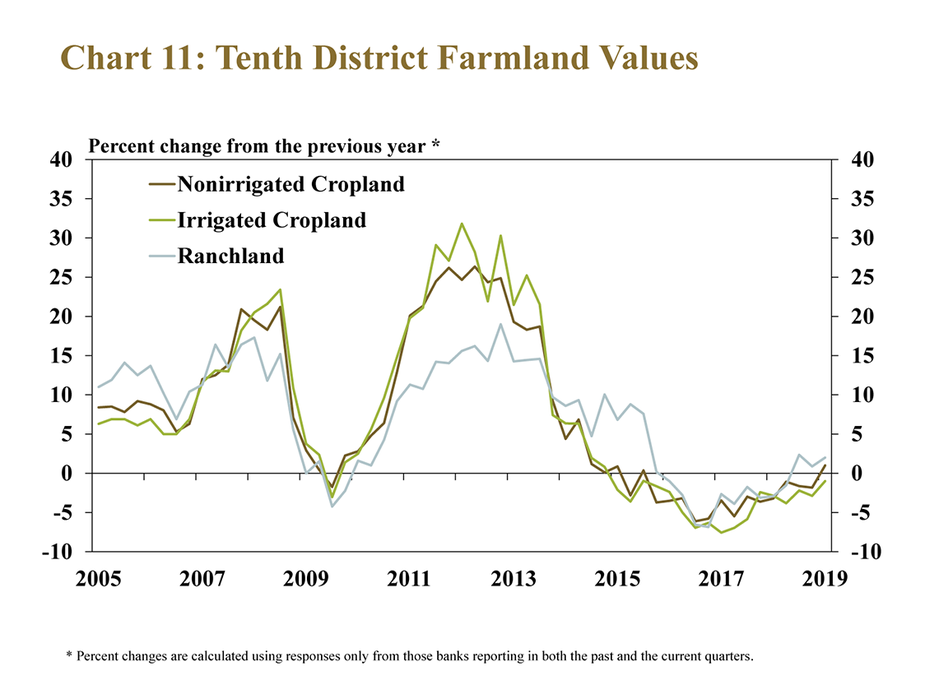

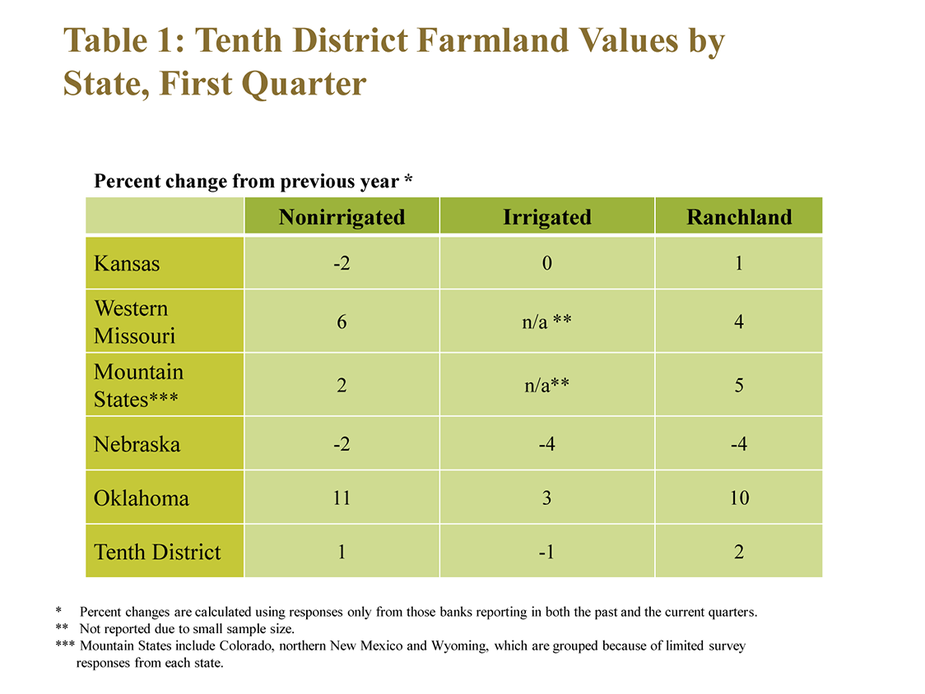

Farm real estate values in the Tenth District were relatively steady compared with a year ago despite pressure from weaknesses in the farm sector and higher interest rates. In fact, the value of nonirrigated cropland increased slightly for the first time since 2015 (Chart 11). The value of ranchland across the District also increased slightly for the third straight quarter while irrigated cropland declined slightly, but at the slowest rate since 2015.

In contrast to the change in farm real estate values across the District, the value of nonirrigated cropland declined slightly in Nebraska and Kansas. The decline in the value of nonirrigated farmland was largest in Kansas while there was a moderate increase in Missouri and Oklahoma (Table 1). Even as values have appeared to stabilize in recent quarters, slightly higher interest rates as well as supply and demand factors of farm real estate markets are likely to remain key risks to the outlook for farmland.

Conclusion

Alongside ongoing weakness in the Tenth District farm economy, agricultural credit conditions deteriorated slightly in the first quarter. Demand for farm loans remained strong and weaknesses in farm finances also put added downward pressure on farm loan repayment rates and farm spending. Despite higher interest rates and added deterioration in farm income and credit conditions, however, farmland markets remained relatively steady as an important source of support for Tenth District agriculture.

________________________________________________________________________

Banker Comments from the Tenth District

The flooding conditions will have a significant bearing on replacements costs for infrastructure, livestock and possibly machinery and equipment and will lead to further deterioration of credit quality. – Northeast Nebraska

The March blizzard resulted in significant cattle losses, particularly newborn calves. – Western Nebraska

Severity of winter and spring weather is hindering marketing efforts and excess precipitation during spring has put crop producers well behind schedule in field preparation. – Northwest Missouri

Commodity prices continue to have a drag on farm income and tough winter weather conditions have led to significant calving losses which will compound lower income numbers. – Central Nebraska

With high expenses and low grain prices, cash flow for row crop farmers is weak and carryover debt increased this year. However, cattle producers have been profitable. - Northern Oklahoma

Lower commodity prices continue to put a strain on working capital for all producers regardless of the size of their operation. Cotton is the only commodity in our area that cash flows with a decent return. – Southcentral Kansas

Livestock producers were able to maintain better returns through the end of 2018. – Southeastern Colorado

Farm income in our area is not good, but not as bad as we had expected. – Central Missouri

With record yields in 2018, many customers that marketed well were able to sell at a level that exceeded their break-even– Central Nebraska

With steady cattle prices, farmers are looking for a price increase before selling calves. – Southeast Oklahoma

Low commodity prices have been the determining factor between profit or loss. – Northeastern Colorado

Most farmers are struggling and it’s becoming hard to keep working with many of them. – Northwest Kansas

There have been concerns about low commodity prices and trade uncertainty, particularly for cotton. – Southwestern Oklahoma

Many full time farmers and ranchers have taken off farm jobs to supplement income. Fortunately, there are plenty of jobs available. – Northeast Kansas

More customers are realizing that their current financial position may not allow them to continue in the future. – Southeast Nebraska

High quality farm real estate appears to be maintaining its value while average to below average quality has been declining. – Central Nebraska

A total of 176 banks responded to the First Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to External LinkNathan Kauffman, Omaha Branch executive or External LinkTy Kreitman, assistant economist, at 1-800-333-1040.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.