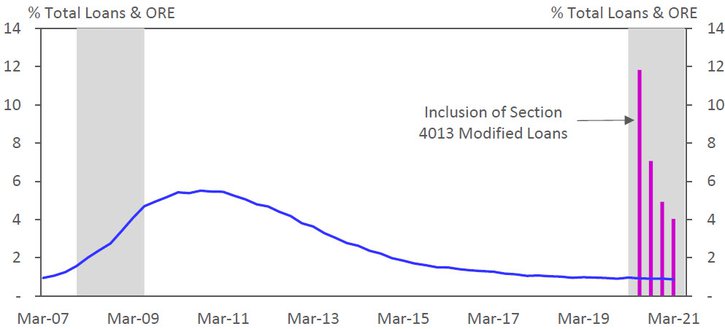

Problem Asset and Modified Loan Levels at Community Banks

Problem assets (loans past-due 90+ days, loans on nonaccrual, and other real estate) as a percentage of total loans and other real estate

Source: Reports of Condition and Income

- Despite extraordinary economic hardship presented by the COVID-19 pandemic, problem asset levels remain muted through March 2021, with the percentage of noncurrent loans and other real estate (ORE) owned representing less than one percent of total loans and ORE. For context, problem assets at community bank organizations (CBOs) peaked at over 5.5 percent in the last financial crisis.

- Consistent with many government-led efforts to provide respite, Section 4013 of the CARES Act granted banks temporary relief from troubled debt restructuring reporting. The volume of these loan modifications continues to fall for CBOs from an initial level of $198 billion in June 2020 to $56 billion, or 3.2 percent of total loans, in March 2021.

- While loan modifications_ provided necessary relief to borrowers adversely affected by the pandemic, the level of loans modified at the onset led to uncertainty around future increases in problem loans. These concerns have lessened as the economic outlook has improved. The level of loan modifications continues to fall, yet some uncertainty remains.

Questions or comments? Please contact KC.SRM.SRA.CommunityBankingBulletin@kc.frb.org.

*Note: Community banking organizations (CBOs) are defined as having $10 billion or less in total assets

Endnotes

-

1

Does not include loans modified under the External LinkInteragency Statement on Loan Modifications and Reporting.