Summary of Quarterly Indicators

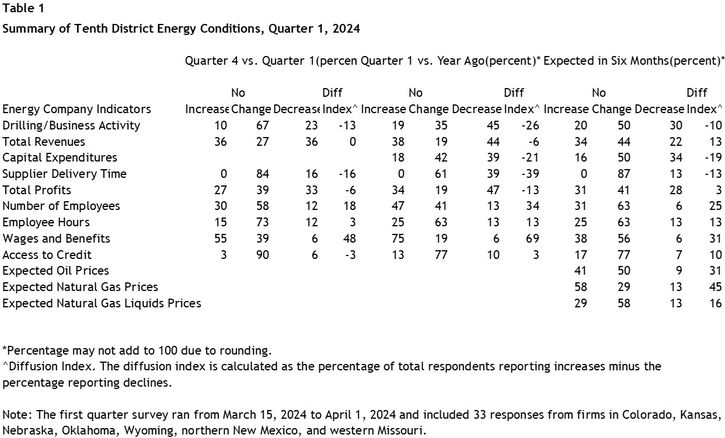

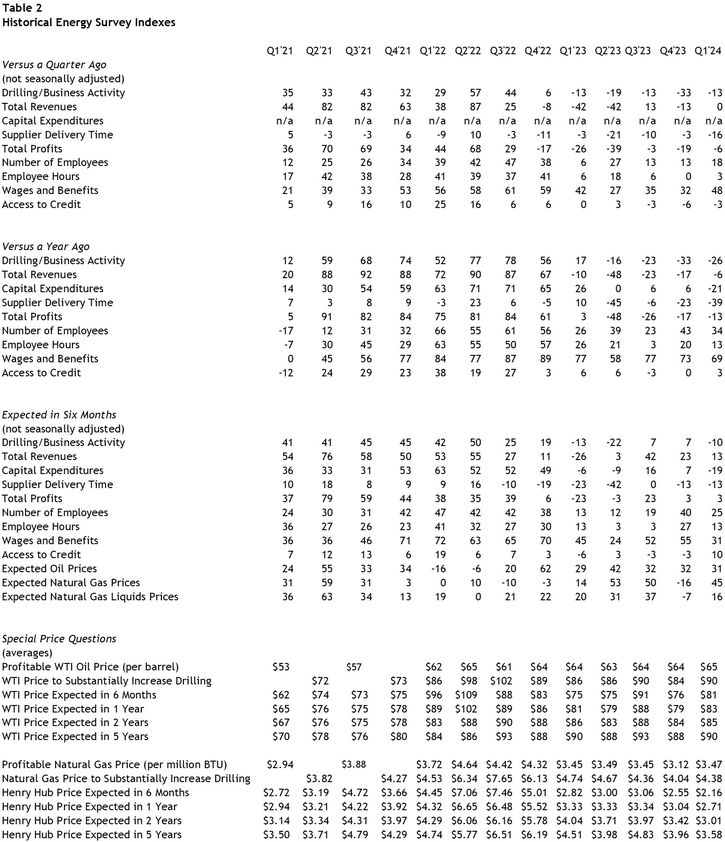

Tenth District energy activity fell again in the first quarter of 2024, as indicated by firms contacted between March 15th, 2024, and April 1st, 2024 (Tables 1 & 2). The drilling and business activity index increased from -33 to -13 (Chart 1). Revenues stayed steady in Q1, while profits declined at a slower pace than in previous quarters. Only the employment-related indexes had positive readings this quarter—namely the number of employees, employee hours, and wages & benefits indexes.

Chart 1. Drilling/Business Activity Indexes

Skip to data visualization table| Quarter | Vs. a Quarter Ago | Vs. a Year Ago |

|---|---|---|

| Q1 20 | -81 | -92 |

| Q2 20 | -62 | -70 |

| Q3 20 | 4 | -71 |

| Q4 20 | 40 | -60 |

| Q1 21 | 35 | 12 |

| Q2 21 | 33 | 59 |

| Q3 21 | 43 | 68 |

| Q4 21 | 32 | 74 |

| Q1 22 | 29 | 52 |

| Q2 22 | 57 | 77 |

| Q3 22 | 44 | 78 |

| Q4 22 | 6 | 56 |

| Q1 23 | -13 | 17 |

| Q2 23 | -19 | -16 |

| Q3 23 | -13 | -23 |

| Q4 23 | -33 | -33 |

| Q1 24 | -13 | -26 |

Drilling activity also fell from this time last year, with the business/drilling activity index changing to -26 from -33 last quarter. Revenues and profits also declined somewhat, and the capital expenditures index was negative for the first time since Q4 2020.

The contraction in drilling activity is expected to continue in the next six months, but firms anticipate revenues and profits will pick up somewhat. Despite this, capital expenditures are expected to continue declining even as the outlook for access to credit is stable.

Summary of Special Questions

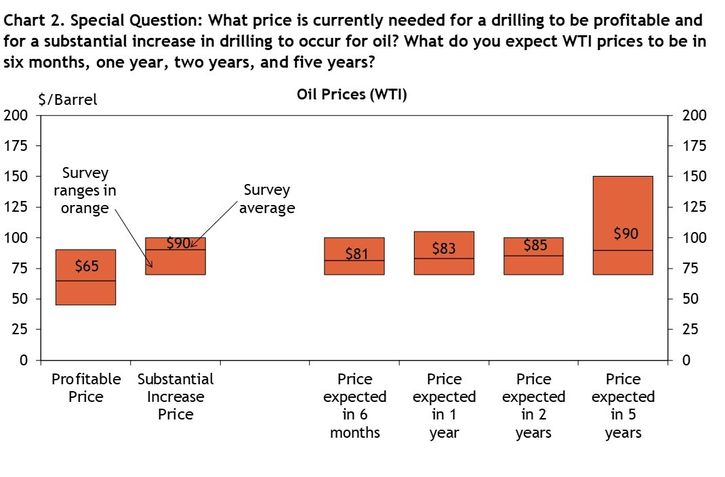

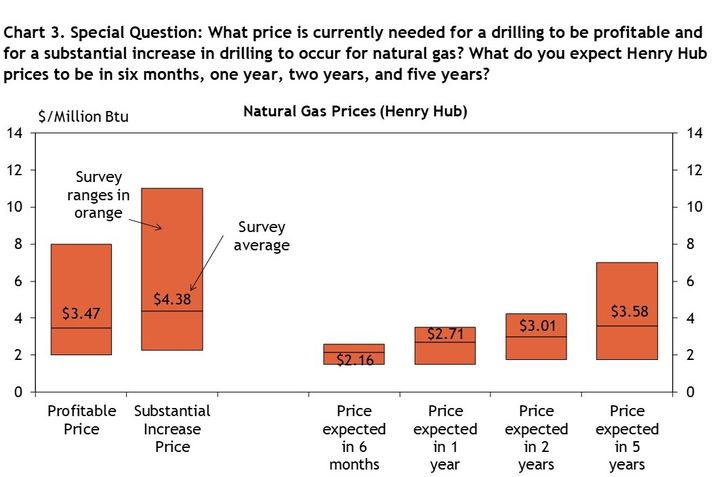

Firms were asked what oil and natural gas prices were needed on average for drilling to be profitable across the fields in which they are active. The average oil price needed was $65 per barrel (Chart 2), while the average natural gas price needed was $3.47 per million Btu (Chart 3). Firms were also asked what prices were needed for a substantial increase in drilling to occur across the fields in which they are active. The average oil price needed was $90 per barrel (Chart 2), and the average natural gas price needed was $4.38 per million Btu (Chart 3).

Firms reported what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices were $81, $83, $85, and $90 per barrel, respectively. The average expected Henry Hub natural gas prices were $2.16, $2.71, $3.01, and $3.58 per million Btu, respectively.

Firms were asked how they anticipate the ongoing consolidation in the oil sector will affect U.S. oil production growth and oil price trajectories (Chart 4). 42% believe the consolidation will likely lead to more cautious U.S. oil production growth and could potentially drive higher oil prices, while 35% believe it will lead to more cautious U.S. oil production growth and contribute to more stable oil prices. The other 23% of firms do not anticipate any significant impact on U.S. oil production or oil prices due to industry consolidation.

Chart 4. Special Question: In light of the ongoing consolidation in the oil sector, how do you anticipate this will affect U.S. oil production growth and oil price trajectories?

Skip to data visualization table| Category | Percent |

|---|---|

| More cautious production growth and more stable prices | 35 |

| More cautious production growth and could drive higher prices | 42 |

| No significant impact on production or prices anticipated | 23 |

Contacts were also asked about how profit margins have changed in the last 3 months given current price pressures (Chart 5). Responses were mixed, with 29% reporting a slight decrease in margins, 25% a significant decrease, and 23% each reporting no change in margins or a slight increase.

Chart 5. Special Question: Given current price pressures, how have profit margins changed for your firm since the last 3 months?

Skip to data visualization table| Category | Percent |

|---|---|

| Significantly Increased | 0.0 |

| Slightly Increased | 23 |

| No Change | 23.0 |

| Slightly Decreased | 29 |

| Significantly Decreased | 25 |

Selected Energy Comments

“We are staying nimble in order to be able to react to major happenings in the world.”

“In the short run, there is very little that can be done to maintain profit margins. In general, we don't think there is a lot that service companies can do to lower their cost and thus pass on savings to exploration and production companies. Capital expenditures must come down to match cash flow.”

“Long term, the cost of gas needs to match the cost to replace the gas reserves. Current low prices do not justify the cost of reserve replacement.”

“Natural gas continues to be plentiful.”

“The USA is way oversupplied in natural gas, hence exports of LNG are critical. As LNG projects for exports are delayed, natural gas will back up in the USA.”

“Working through excess supply currently. Natural gas will be in higher demand as we move forward for electricity generation.”

“Dry gas development will meet increased demand needs. Associated gas constant to rising.”

“Less companies looking for new reserves means we will not be able to replace the reserves needed to cover the demand.”

“At least for publicly traded companies, there is sufficient motivation to place profits and return of capital over growth.”

“The industry remains highly fragmented in the US, and US production is a small component of an efficient global market.”