To continue monitoring the impact of COVID-19 on low- and moderate-income (LMI) communities and the organizations that serve them, the Federal Reserve System conducted the Community Impact Survey in August 2022. Respondents to the survey for the Federal Reserve’s Tenth District_ suggested LMI communities and the organizations that serve them were experiencing much less disruption due to COVID-19 compared to 2021. Price pressures and labor shortages presented the most difficulties for LMI communities. Organizations stated they were facing the most disruption due to difficulties with the recruitment of staff/volunteers and concerns around staff physical and mental health.

About the Survey

The Community Impact Survey (CIS) was a national initiative by the Federal Reserve System to monitor the impact of the COVID-19 pandemic on LMI communities and the organizations serving them. In August 2022, the survey was sent to contacts in non-profit organizations, financial institutions, government agencies and other community organizations. The national report is available External Linkhere. The survey received responses from 190 organizations that represented the seven-state Tenth District._

LMI Communities are Recovering while Facing Fewer Setbacks

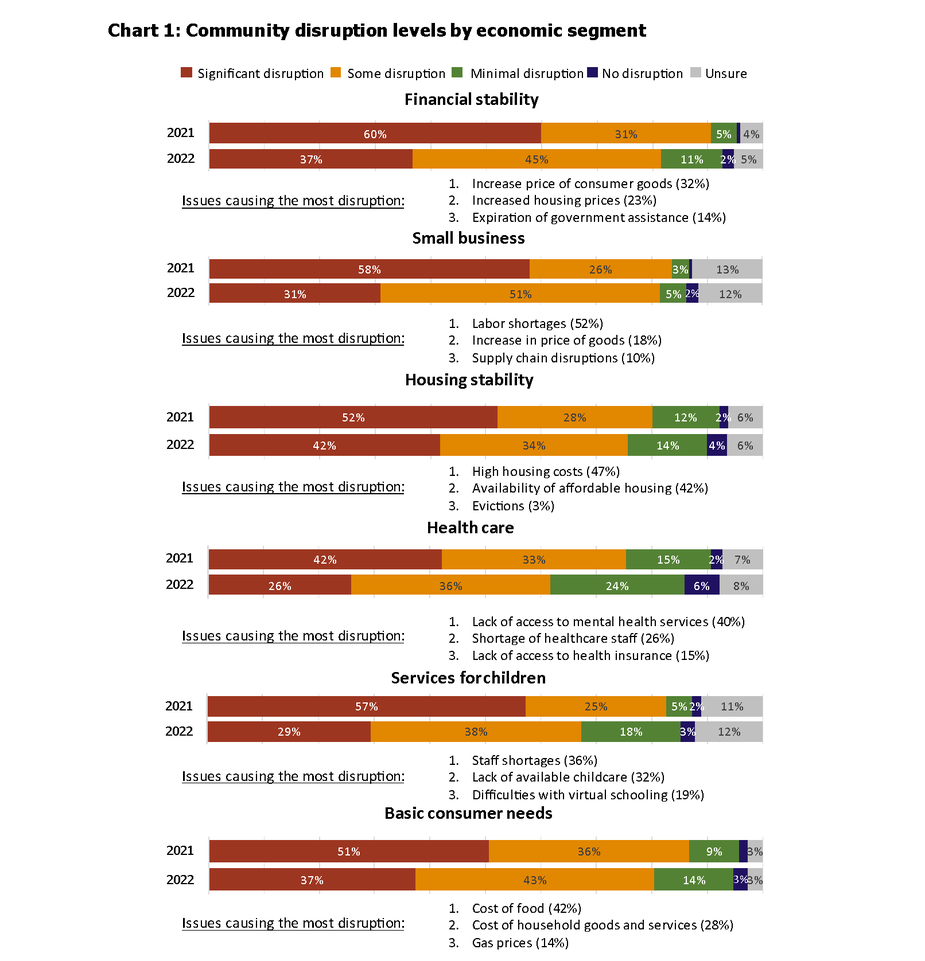

Most communities experienced at least some disruption due to COVID-19 in 2022. Depending on economic sector, the number of organizations stating COVID-19 was causing a “significant disruption” to LMI communities declined between 20-49% from 2021 to 2022 (Chart 1). Housing stability had the least reduction in disruption, largely led by high inflation in the housing market and limited supply of affordable housing units. Inflation was also a leading contributor to disruption in basic consumer goods. While supply chain problems did not appear to be as prevalent, the price increases induced by supply chain problems continued to impact LMI communities. Even with inflation, respondents felt financial stability was in a much better position in 2022 compared to 2021.

While the impact from COVID-19 was lessening, a recovery to pre-pandemic conditions was expected to take a while. When asked how far along their communities were in their recovery from the COVID-19 shock, respondents said they were over halfway recovered (57% recovered) to pre-pandemic conditions. By the end of 2023 they expect to be about 69% recovered. Twenty percent of respondents said their communities were almost or fully recovered (greater than 80% recovered), and 42% expect as such by the end of 2023.

Organizations are Experiencing Less Disruption, but Challenges Remain

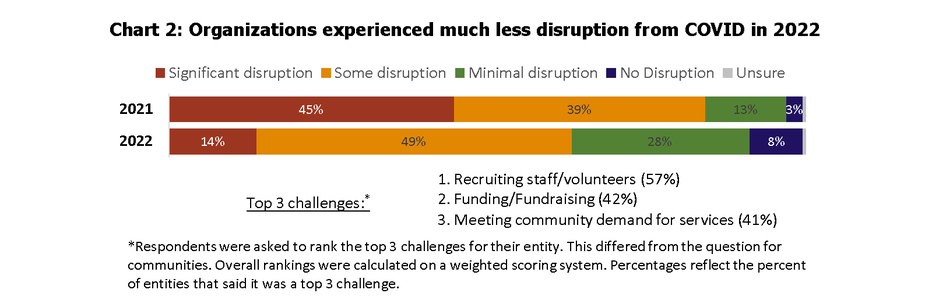

Responding organizations noted a substantial decrease in the level of disruption from COVID-19 (Chart 2). As they adapt to the challenges presented by COVID-19 and recover their operations, they are still facing difficulties from staffing, funding, and meeting the demand for their services.

In 2022, nearly all organizations felt they were able to adapt to at least some disruptions. Only 11% said they struggled to adapt or were unable to adapt at all. However, there was a considerable amount of uncertainty for the future with 62% saying they were only somewhat prepared to face additional disruptions in 2023.

Staffing challenges

When expanding upon their stated staffing challenges, organizations said their biggest staffing challenges were in hiring and retaining staff (25%), inability to offer competitive wages (20%), and not being able to find qualified candidates for skilled positions (15%).

Expenses challenges

One-third of organizations said their top challenge for expenses was paying higher wages. Nearly a quarter said their non-labor overhead expenses were their top challenge and another 19% said their biggest challenge was higher costs associated with increased demand for their services.

Funding challenges

About one-third of organizations said they experienced declines in individual and corporate donations. Of those who experienced declines in donations, over half received more funds from foundations and 42% received more government funds. However, 30% of those organizations did not experience increases in other funds.

Even though more respondents said funding from foundations, government sources, and fees for service increased rather than declined, funding was still inadequate for meeting demand and maintaining operations.

Demand challenges

While about 60% of organizations said they were able to meet 80% or more of the demand for their services in 2019, only 41% stated they met that threshold in 2022. They expect marginal improvements in 2023 with 46% expecting to be able to service 80% or more of their demand. The biggest challenges they were facing in meeting demand were lack of staff and/or volunteers (31%), lack of funding (21%), or experiencing a very large increase in demand (16%).

LMI Communities and Organizations that Serve Them are Still Recovering

While the survey data showed the impact of COVID-19 was waning, LMI communities and the organizations that serve them were still struggling in many areas. This was constraining the pace of their recovery. Organizations appeared to be more recovered than communities which may mean they are more able to respond to community needs than reacting in emergency mode. However, funding and staff levels of organizations are a substantial hurdle to their ability to respond to the continued needs of LMI communities. As inflation lessens, the demand pressure may also ease. Barring an economic recession, LMI communities and the organizations that serve them appear to be on track for recovering to at least pre-pandemic conditions.

Endnotes

-

1

The Tenth District of the Federal Reserve System headquartered by the Federal Reserve Bank of Kansas City covers Colorado, Kansas, western Missouri, Nebraska, northern New Mexico, Oklahoma and Wyoming.

-

2

An organization was considered as “reliably representing” the Tenth District if they stated they served a state of the District, they were not a nationwide serving organization, Tenth District states constituted at least 25% of the states they served, and the states they served need to be contiguous. This was mostly used to determine edge cases for organizations that served multiple states. Over 90% of the respondents for the Tenth District only served one state.